Lloyds Soars on Dividend Bump as Bank Signals End for PPI

This article by Richard Partington for Bloomberg may be of interest to subscribers. Here is a section:

Chief Executive Officer Antonio Horta-Osorio, 52, is making a virtue of the bank’s focus on lending to U.K. consumers and businesses, as other major European lenders are pruning investment banking operations amid concern over global economic growth and market volatility. He increased the dividend to 2.25 pence a share from 0.75 pence, added a 0.5 pence special payment, and set a higher target for the bank’s lending margins this year.

“This is real, it’s a clean story,” said Joseph Dickerson, an analyst at Jefferies International Ltd. in London with a buy rating on shares. “We don’t see any earnings downgrades which are going to be a theme for western-world banks globally. One of the major headwinds for this company has been PPI. That drag is now removed in our opinion.”

Horta-Osorio is eliminating jobs, closing branches and investing in technology as he says the firm can respond to persistently low interest rates and a potential slowdown in the British economy. The bank’s cost ratio improved in 2015, and the company forecast its loan impairments will remain muted this year.

“Our low risk, U.K.-focused business model continues to be a source of competitive advantage,” he said on a call with reporters. “The future of Lloyds and the future of the U.K. economy are inextricably linked.”

Payment Protection fines have been a major headwind for UK banks and the removal of this issue represents a powerful bullish factor. The contraction of Lloyd’s valuation from an historic P/E of 45 to an Estimated P/E of 9.42 brings it in line with that of some of the better capitalised US banks such as JPMorgan, Bank of America and Citigroup.

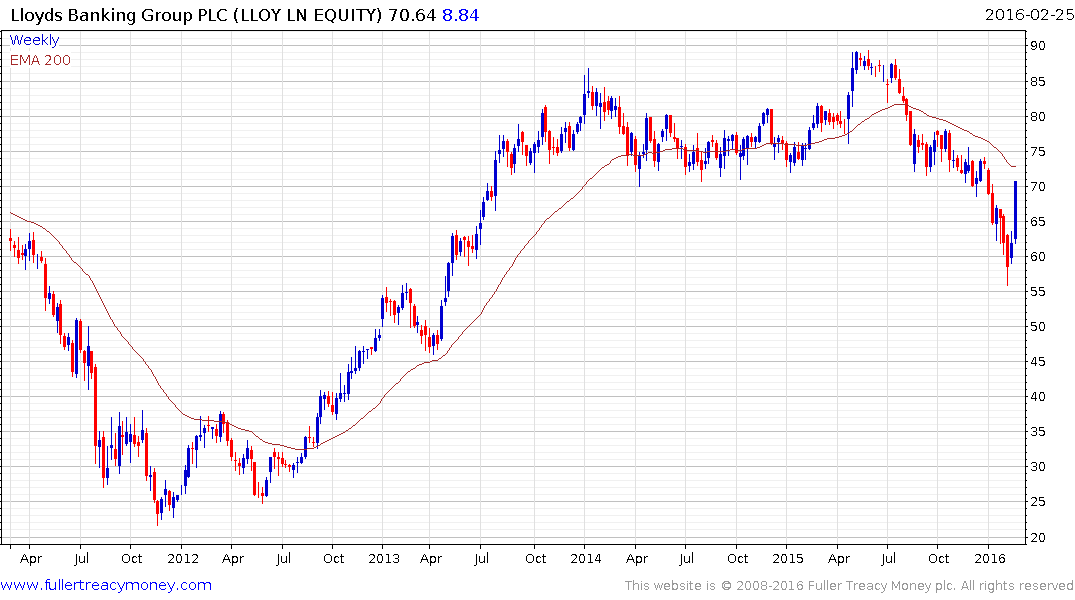

The share rebounded emphatically today to unwind the vast majority of its overextension relative to the trend mean. It will need to sustain a move above it and find support above $60 on the first significant pullback to confirm a return to medium-term demand dominance.

The contrast with HSBC is acute with the large global bank announcing a 4th quarter loss earlier this week It is also being investigated by the SEC for hiring people with government ties in Asia. HSBC has also been dealing with PPI fines and if Lloyds has overcome that issue perhaps HSBC is close to resolving it as well.

The share is still quite oversold relative to the trend mean and has paused in the region of 440p. Potential for a reversionary rally has improved but the share has a lot of work to do before investors can conclude the medium-term downtrend has ended. The company’s exposure to China in particular is likely focusing the attention of investors at present.