Lira Plunges as Turkey's New Economy Team Pulls Back Defense

This article from Bloomberg may be of interest. Here is a section:

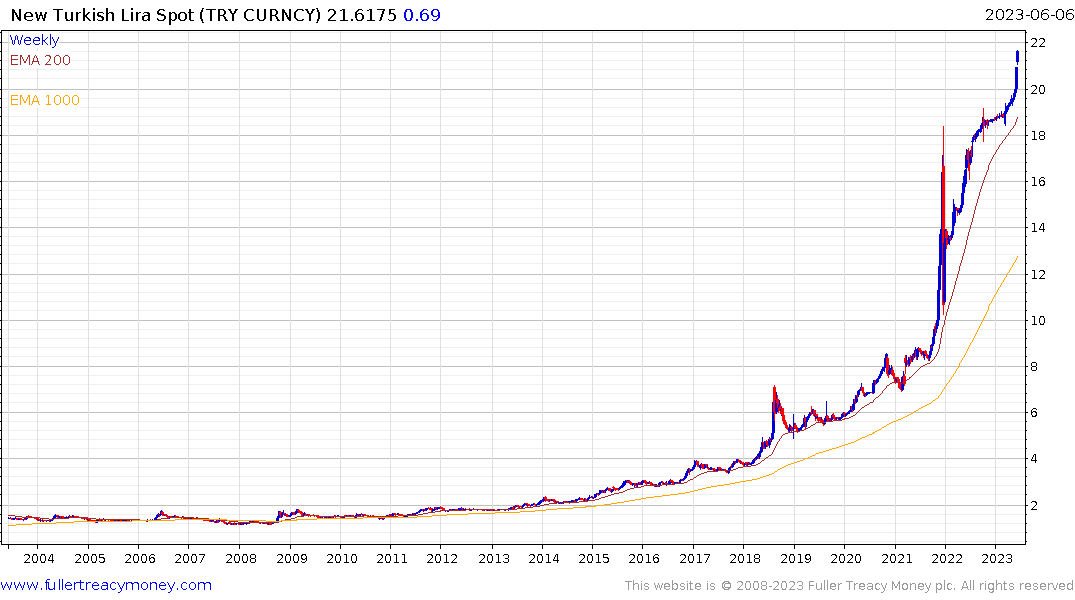

President Recep Tayyip Erdogan, who won reelection to a five-year term, has long championed an unorthodox economic policy based on ultra-low interest rates. The costs of that policy piled up in the form of depleted foreign-currency reserves, an inflationary spike, and an exodus of foreign capital, leading markets to price in a large depreciation after the vote as investors bet that it was unsustainable.

Minister Simsek

Erdogan’s appointment of Simsek, a former Merrill Lynch strategist, has intensified expectations of a return to orthodoxy and abandonment of state intervention in favor of allowing the market to determine fair value for Turkish assets. Since the election on May 28, the lira has weakened more than 13% against the dollar.Investors are betting that more weakness is coming. The options market is currently pricing about an 80% chance that the lira will hit 25 per dollar within the next three months, and a more than 60% chance that it could hit 27 per dollar, according to data compiled by Bloomberg.

Turkey’s state banks don’t comment on their interventions in the foreign-exchange market. A former governor of the central bank said in 2020 that state-owned lenders carry out transactions in line with regulatory limits and could continue to be active in the currency market.

We have some great examples of what works and does not work on the international stage. Brazil and Mexico have successfully overcome inflationary pressures by taking aggressive measures and expressing a willingness to tolerate economic weakness. Many other countries have raised rates but are curtailed from being overly aggressive by high debt loads and interest rate sensitive asset markets. They have not yet overcome their inflationary threats. Then we have Turkey which has insisted on keeping rates low and ignored inflation. That is leading to a significant additional currency devaluation.

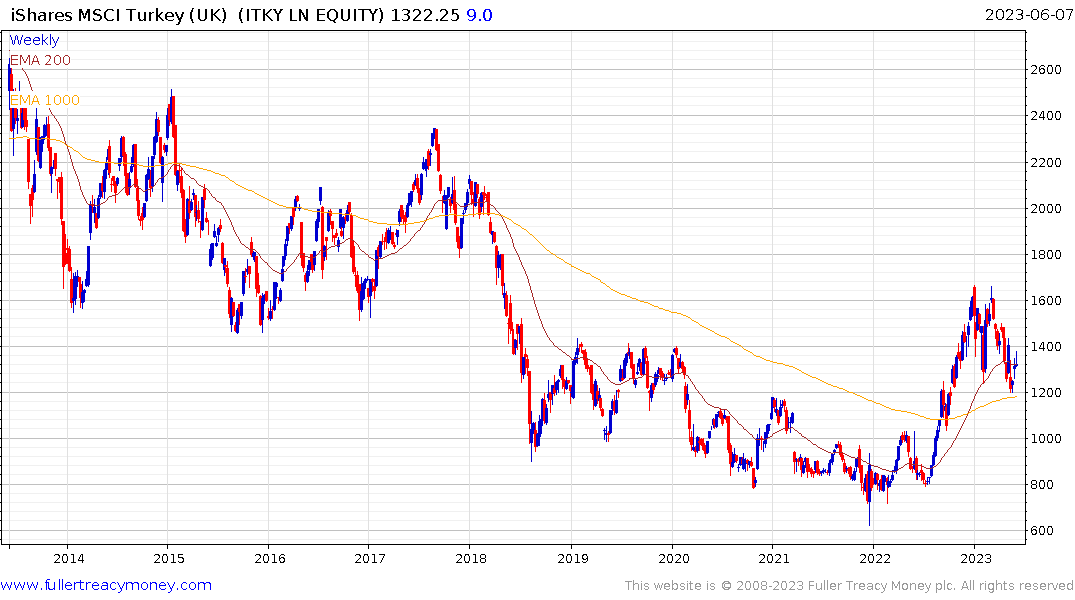

Once the devaluation has run its course, the economy will be in a much better competitive position as an exporter. That should support the outlook for the internationally oriented portion of the market and will make Turkey and even more attractive tourist destination. The only missing ingredient for a recovery would be improving standards of governance.

The iShares MSCI Turkey ETF has held a sequence of lower rally highs since March and pulled back from the region of the 200-day MA this week. That suggests some scope for additional weakness before recovery takes hold. That implies currency stability is likely to be a future bullish catalyst.

The iShares MSCI Turkey ETF has held a sequence of lower rally highs since March and pulled back from the region of the 200-day MA this week. That suggests some scope for additional weakness before recovery takes hold. That implies currency stability is likely to be a future bullish catalyst.