Licence for value hunting

Thanks to a subscriber for this note from Amundi Asset Management which may be of interest. Here is a section:

Here is a link to the full note and here is a section from it:

We strongly believe that focusing on fundamentals will prevent investors from falling into the pessimism (and/ or excess of optimism) trap that a noisy news flow could trigger (trade disputes still in the radar screen and CBs communications). Following this sort of focus will also help in identifying market areas that could offer value for long-term investors. In January, we saw opportunities to increase risk exposure, starting with EM and credit (now partially exploited). We are now closely monitoring European equities which could now be an investor focus again. It is true that economic momentum remains weak, but further fiscal impulses could help stimulate domestic demand and a re-acceleration in EM growth could also benefit Europe. Earnings revisions reflect the pessimism associated with a slowdown, but we now see signs of deceleration in negative revisions, a signal that we are likely moving past the pessimism. Valuations are not discounted as they were at the beginning of the year, but they are not expensive either, with areas of opportunities in some cyclical sectors (i.e in industrials). Investors should not yet be in a hurry, but there could be reasons for deploying capital in European equities during the year, and we don’t believe there is cause to be short now on this asset class.

A European portfolio manager recently remarked to me that India is better covered among analysts he talks to than Europe. That is a clear testament to how much the constant barrage of negative news from Europe on the political, social and economic fronts have damaged sentiment.

That has understandably stoked interest among value investors in the potential for a rebound. This note from Morgan Stanley highlights the positive catalyst bottoming PMI figures generally have on the performance of stock markets in subsequent months. Here is a section:

MSCI Europe has always been higher 6 months after a PMI trough. Any upturn in European economic data should also improve sentiment around the relative investment case for the region's equity market. Post better data in February, it looks like the euro area composite PMI troughed in January, and this suggests a better risk-reward for EU equities ahead. The median increase in MSCI Europe from prior PMI troughs has been 9.4% over the N6M, and there have been no negative readings – i.e. stocks have always been higher six months after the PMI bottoms.

MSCI EMU is positively correlated with China equity performance. History suggests that our positive view on China equities should also be helpful for European stocks. While MSCI EM is (unsurprisingly) the most positively correlated region to MSCI China, we note that MSCI EMU is the only other region that has also correlated positively over both the last five and 10 years. In contrast, the US has historically been the big relative laggard when China is outperforming.

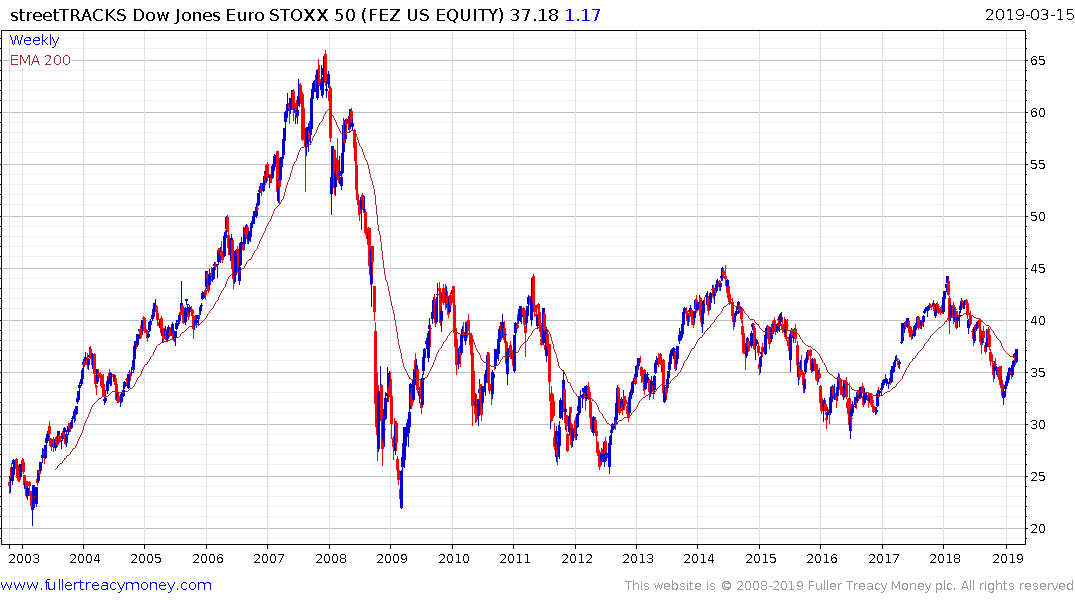

From a foreign investor’s perspective, the weakness of the Euro and the volatility of the political scene have been deterrents to investing. The US listed, SPDR Euro STOXX 50 ETF highlights the fact that from a foreigner’s perspective, the Index has been in a length base formation for a decade. It is worth highlighting however that a sequence of higher reaction lows is evident within the base and it is bouncing from the most recent.

I suspect a clear break in the Dollar’s uptrend is going to be required to act as a catalyst to shift money flows back in Europe’s direction.