Leveraging Platform Synergies to Break Adoption Barriers

Thanks to a subscriber for this heavyweight report from Deutsche Bank focusing on payments. Here is a section:

Although initial mobile payment developments were geared toward driving adoption and acceptance, focus has shifted to improving monetization. We believe Pay with Venmo remains a significant opportunity and conservatively estimate potential contribution to revenue growth in FY20 of ~3.5pts and given the higher transaction margins driven by cheaper funding sources (ACH, Balance), estimate potential EPS contribution of $0.28 in FY20. In addition, working capital loans to merchants and/or installment plans provided by PayPal, Square, and Alipay leveraging Big data offer high margin revenue opportunities. Providers are also emphasizing efforts on channels where adoption is easier as well as use cases which offer differentiated value propositions. Accordingly, we believe in-app and inbrowser will dominate mobile payments while in-store mobile payments will be predominantly focused on differentiated value propositions such as omni-channel support, order ahead, and offer/coupon redemption.

Here is a link to the full report.

One of the big questions for every online business is how to make it easier to take people’s money. Impatience, number of clicks, creating urgency, ensuring security and insuring purchases represent important considerations that have in many respects been solved by the various providers, with software and encryption getting better all the time.

The growth of the online retail sector represents a major opportunity for online payments since cash is simply not an option. Travelling internationally, it is easy to see just how much growth the sector still has.

Interestingly the US market is considerably farther ahead than either Europe or Japan in the trend of card usage. That might be because the benefits of card usage are so attractive in the USA and because credit scores are used for every form of credit. Alternatively it might be because Europeans and Japanese have a historical attachment to cash and businesses would rather not have the transparency of direct deposits when calculating how much tax they owe. However even that argument is largely generational since young people are much more comfortable with online payments.

Equally interesting is the fact that Chinese consumers are perfectly comfortable with mobile payments and the roll out of 4G in India represents a massive growth possibility for the sector as well as for online banking.

PayPal ranged with an upward bias from its IPO and broke out to new highs this week. A sustained move below the trend mean would be required to question potential for additional upside.

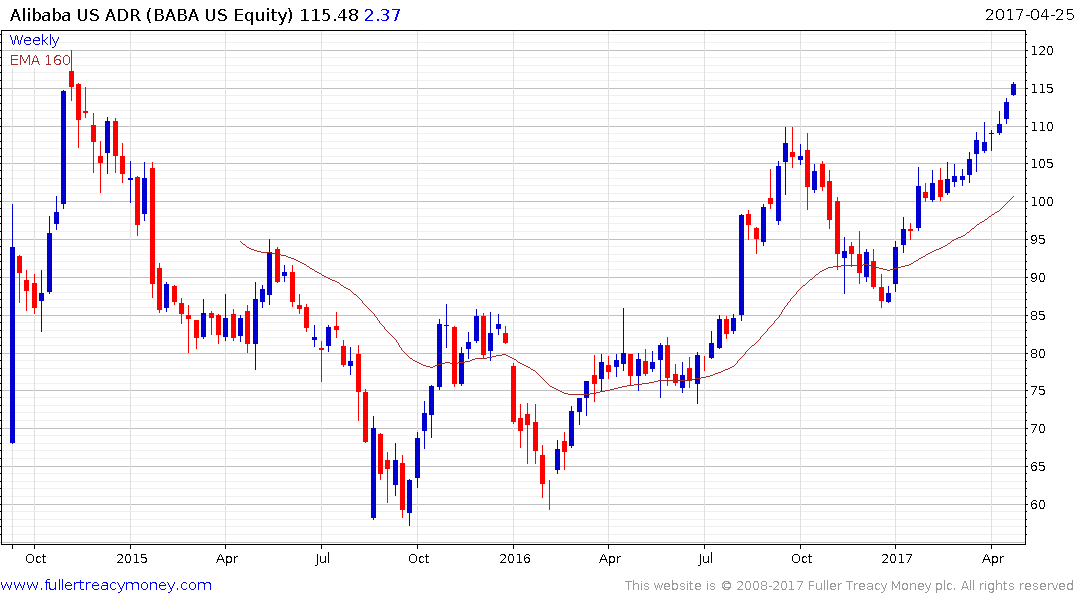

Alipay was not included in Alibaba’s 2014 IPO but may be listed at some point. The main share has been rallying for 10 consecutive weeks and a clear downward dynamic will be required to check momentum.

Visa and MasterCard exhibit a high degree of commonality. While increasingly overextended in the short-term, breaks in their medium-term progressions of higher reaction lows would be required to question the overall upward bias.

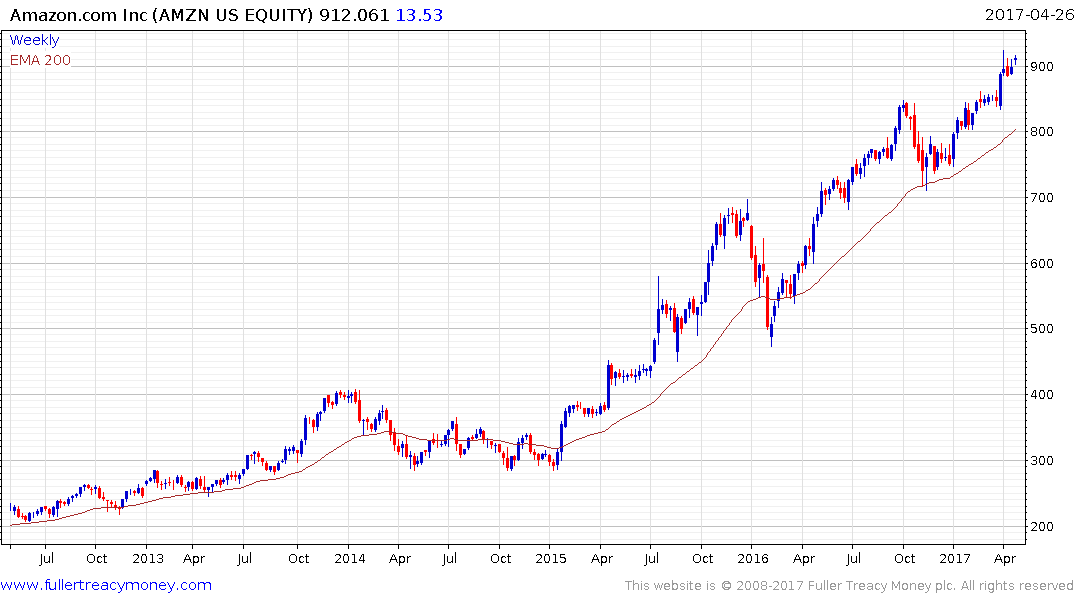

Amazon remains in a steep uptrend which has been punctuated by some sharp pullbacks to the mean. Those remain a risk as it becomes increasingly overextended once more.

Alphabet’s (Google) uptrend has morphed from a step sequence into a more persistent, less jerky advance characterised by support being found in the region of the trend mean.

Apple has surged higher since the end of last year and has paused near $140 over the last few weeks. A sustained move below that level would be required to suggest mean reversion is underway.