Letting Foreign Investors Open Wholly Owned Hospitals Hardly a Cure-All

This article by Zhou Tian for Caixin may be of interest to subscribers. Here is a section:

Liao Xinbo, an official with the health commission's Guangdong branch, said this amounts to granting foreign investors the same type of treatment as Chinese nationals when founding hospitals.

?There is little doubt that foreign investors can bring advanced technologies and management expertise to the domestic health care industry, but we should not go so far as to celebrate the development as a solution to the problems of expensive drugs and the hardship many have experienced trying to find a good doctor.

In general, foreign-invested hospitals cater to wealthy patients. That means their services often cost a lot. It is unrealistic to hope that more foreign hospitals can make health care more affordable. By diverting wealthy patients away from ordinary hospitals, they might help with easing overcrowding.

But it is too soon to say whether foreign investors will line up for a hospital of their own now that restrictions on their share ownership have been lifted. Other authorities related to the opening of a hospital, such as those overseeing the sales of land and the health insurance and social security systems, must play along as well.

Offering the opportunity to foreign groups to build wholly owned hospitals within China probably has more to do with tapping into the global market for medical tourism than any specific aim to improve coverage for Chinese consumers. As the middle classes swell, demand for cosmetic surgery and other elective procedures is rising. Why send wealthy Chinese to Hong Kong, Singapore, the USA, Thailand or India when they could have the procedures at home for a comparable price and to a high standard.

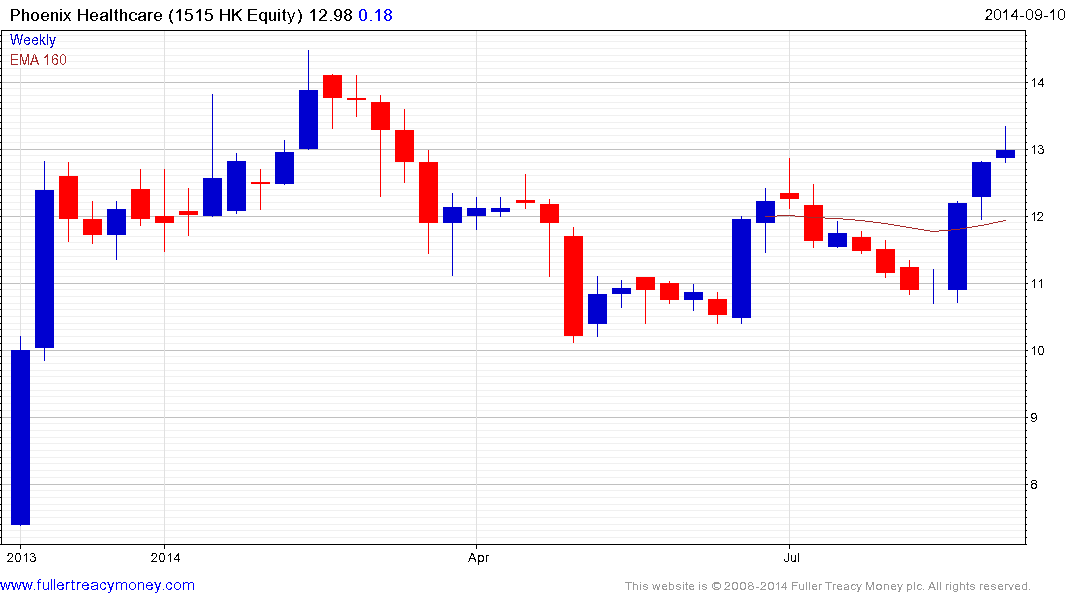

China’s Phoenix Healthcare was listed in Hong Kong in late 2013 and remains largely rangebound. It is currently rallying from the lower side.

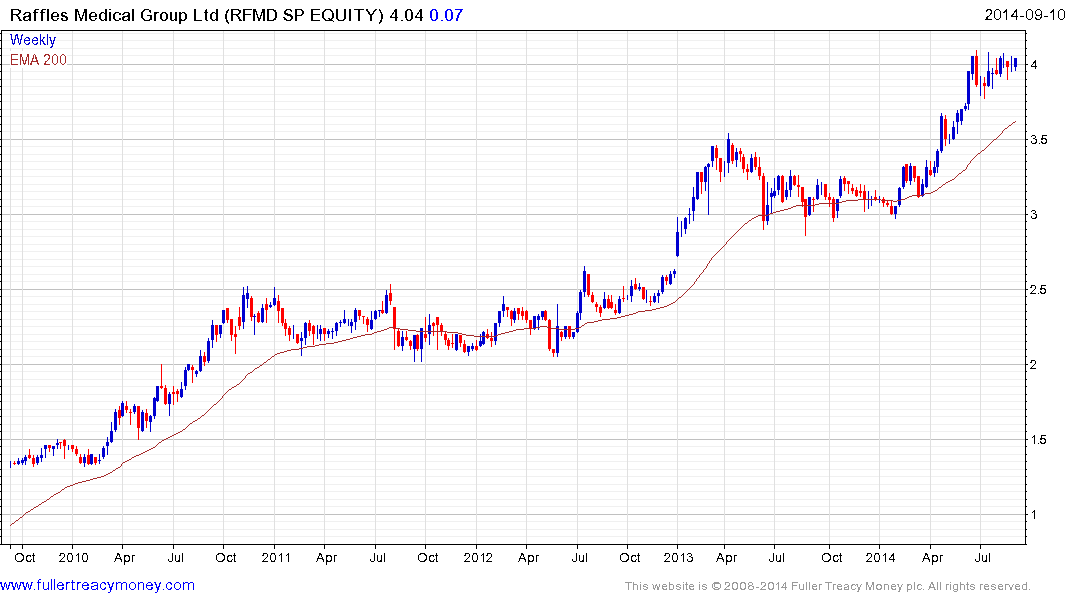

Singapore listed Raffles Medical remains in a relatively consistent medium-term uptrend. Despite a tendency to range for lengthyperiods, the share continues to find support in the region of the 200-day MA following pullbacks.

Back to top