Lawyers, Guns and Money

Thanks to a subscriber for this edition of Grant’s Almost Daily. Here is a section:

The prospect of a bruising stretch for the pension industry at large colors the migration into the deeper end of the risk swimming pool. An analysis from Moody’s Investors Service last Wednesday projects a systemwide 12.2% loss over the 12 months through June 30, far below the assumed 6.8% return target. That shortfall would leave assets sufficient to cover 6.9 years of retirement benefits, down from 8.3 years in mid-2021 and the lowest figure since at least 2016.

Moreover, the ratings agency noted that “a persistent environment of high inflation would likely drive up wages for active employees and cost-of-living adjustments for retirees, increasing future pension obligations and governments' budget outlays.” State-directed efforts to contain raging price pressures may prove less-than-effective, as California Governor Gavin Newsom announced plans to distribute $1,050 direct stimulus checks to 23 million local residents “who are grappling with global inflation and rising prices of everything from gas to groceries,” his office declared.

Nothing a bit more leverage and alternative assets can’t fix.

The success of the FANGMANT shares is well understood. They benefitted from their all-in bets on 4G connectivity, and their market cap appreciation was amplified by the ballooning interest in ETF investing which concentrated flows in the largest names.

It is much harder to monitor the size of the private markets because they are unlisted by definition. The one thing we can be sure of is private markets have exploded in size since 2008. Their performance has been amplified by the exceptionally low interest environment.

The Indxx Private Credit Index is trending lower.

This article by Richard Ennis may also be of interest. Here is a section:

The endowment model is a thing of the past. Large endowments have been piling into investments that provide sure access to the US equity factor to the virtual exclusion of everything else. Each fund has fashioned its own complex portfolio in its own unique way. But the collective effect is as clear as it is simple: For all intents and purposes, the endowments own the US stock market. They are not, however, getting a competitive return. They have experienced an annual opportunity cost of 2.24% to 2.5% a year since the GFC, which approximates their estimated cost of investing of 2.5% a year. Performance in the Modern Era is even less favorable. These results cast doubt on the ability of investment managers to beat the market before fees, even when they are free to roam from the beaten path.

If private markets ape the performance of public markets but with higher fees, that suggests the stress coming to bear on this sector is particularly acute as liquidity is withdrawn.

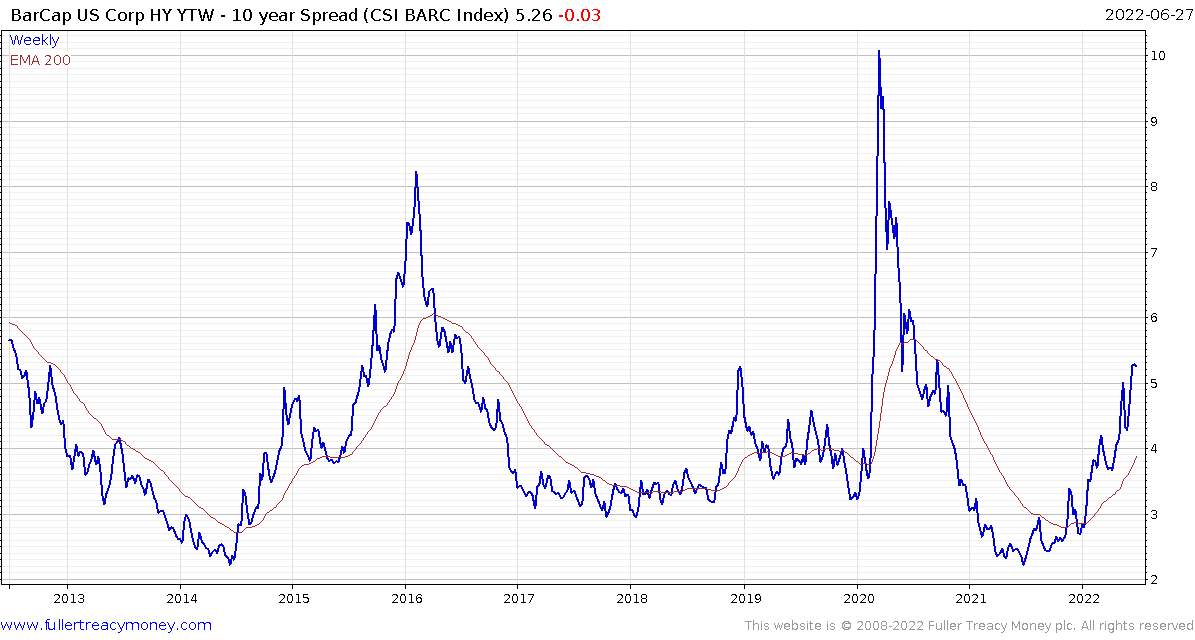

High yield spreads are trending through 500 basis points. This kind of activity tends to coincide both with stress in the stock market and tight liquidity conditions. A clear downward dynamic will be required to begin to signal a nadir for risk assets.

Investment grade spreads are now also trending higher. Even a AAA rated credit like Microsoft’s 30-year 2.92% bond is trading at a 192 basis points over 30-year Treasuries. That looks like value if one believes a recession will curtail the rate hiking ambitions of central banks. Meanwhile the share remains in a reasonably consistent downtrend.

Investment grade spreads are now also trending higher. Even a AAA rated credit like Microsoft’s 30-year 2.92% bond is trading at a 192 basis points over 30-year Treasuries. That looks like value if one believes a recession will curtail the rate hiking ambitions of central banks. Meanwhile the share remains in a reasonably consistent downtrend.

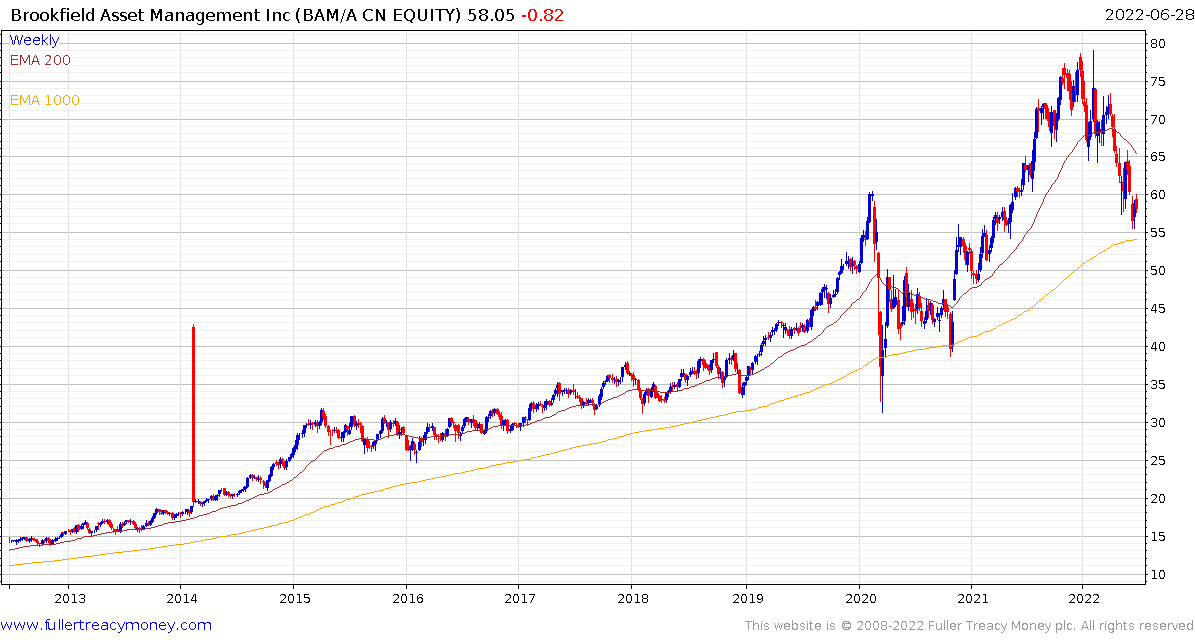

Brookfield Asset Management is considered by many as the best in class among real estate/private market investors. The share remains in a downtrend as its tests the region of the 1000-day MA. I do wonder how much of that performance was flattered by the spectacular run in Canadian property over the last decade.

The challenge for investors is yields have risen sufficiently to become attractive on a normal valuation metric. However, underlying assets are still expensive and no one knows what it is going to take to get inflation under control.

Back to top