Latest thinking

Thanks to a subscriber for Howard Marks’ latest memo for Oaktree which may be of interest. Here is a section:

Today there’s beginning to be talk of a possible late-bull-market melt-up, making investors more money but perhaps fulfilling he requirements for a full-fledged bubble. (This may be part of the usual pattern of capitulation that occurs when those who haven’t fully participated lose the will to keep abstaining after years of market gains. The basic theme supporting the “melt-up” theory include (a) the existence of the fundamental positives listed above and (b) the arrival of euphoric psychology, which has been absent to date.

For me the key points regarding the general market outlook are as follows:

The absence of widespread euphoria certainly is an important flaw in the near-term bearish view.

Thus there’s no reason for confidence in the existence of a soon-to-burst bubble.

Investor psychology continues to grow more confident, however.

Asset prices are already unusually high.

Future events remain unpredictable, but today’s high prices mean the odds are against a significant long-term upward move from here.

No one can say what’s going to happen in the short term.

Asser prices and valuation metrics are certainly worrisome, but psychology and its implications - -well as timing – are unpredictable. I think that’s about all we can know.

Here is a link to the full memo.

Veteran subscribers will be familiar with my refrain from the Big Picture Long-Term videos, since at least September, that we are in the 3rd Psychological Perception Stage of this impressive almost decade-long cyclical bull market.

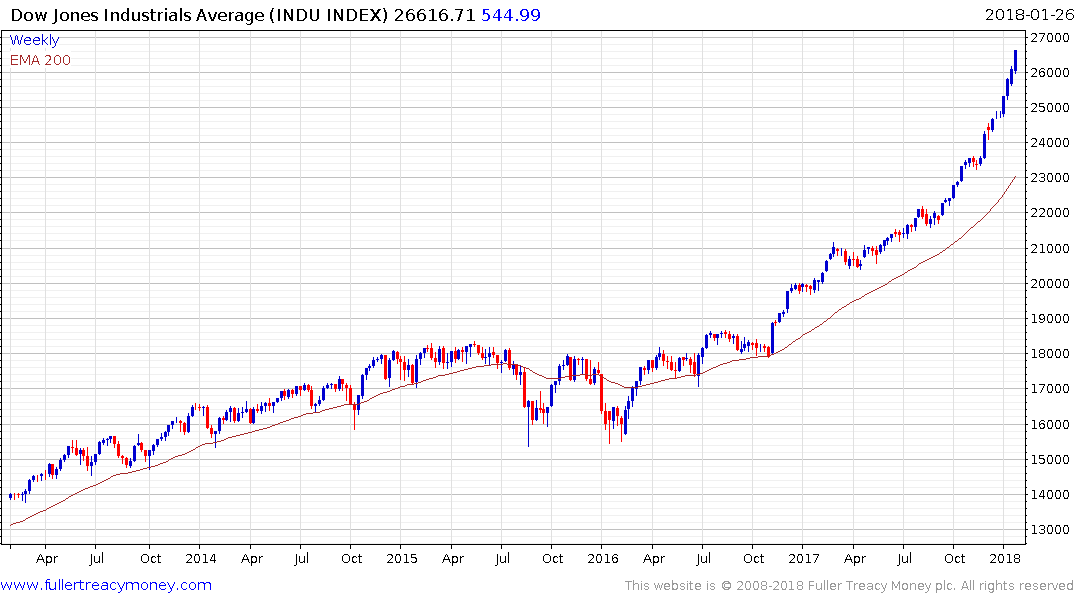

There is increasing evidence of accelerating trends in the major Wall Street indices. The Dow Jones Industrials Average, in particular, is accelerating higher. Mega-cap technology shares like Apple, Amazon, Alphabet, Facebook, Microsoft, and the semiconductor sector generally have some of the clearest signs of acceleration. The Hang Seng’s advance has also picked up pace in a high beta related move.

The success of earnings agnostic strategies like ETF buying, risk parity strategies and short volatility are all representative of the move towards momentum rather than value investing.

The return to performance of liquidity providers like banks, and cyclical sectors like resources producers and biotechnology, is also supportive of the view we are in a maturing cyclical bull market.

At the same the loss of momentum in previous leaders like Starbucks and Disney highlight the narrowing the breadth that this acceleration represents.

The most important characteristic is that trends are still consistent, volatility is still low and there is no sign of recession. The market continues to price in the boon of tax cuts and until that process has reached its conclusion there is potential for the market to continue to rally; subject to the continued absence of downward dynamics.