Latest memo from Howard Marks: Expert Opinion

Thanks to a subscriber for a link to this letter which may be of interest. Here is a section:

I’ll end this section by sharing my latest epiphany on the macro. I realized recently that in my early decades in the investment business, change came so slowly that people tended to think of the environment as a fixed context in which cycles played out regularly and dependably. But starting about twenty years ago – keyed primarily by the acceleration in technological innovation – things began to change so rapidly that the fixed-backdrop view may no longer be applicable.

Now forces like technological developments, disruption, demographic change, political instability and media trends give rise to an ever-changing environment, as well as to cycles that no longer necessarily resemble those of the past. That makes the job of those who dare to predict the macro more challenging than ever.

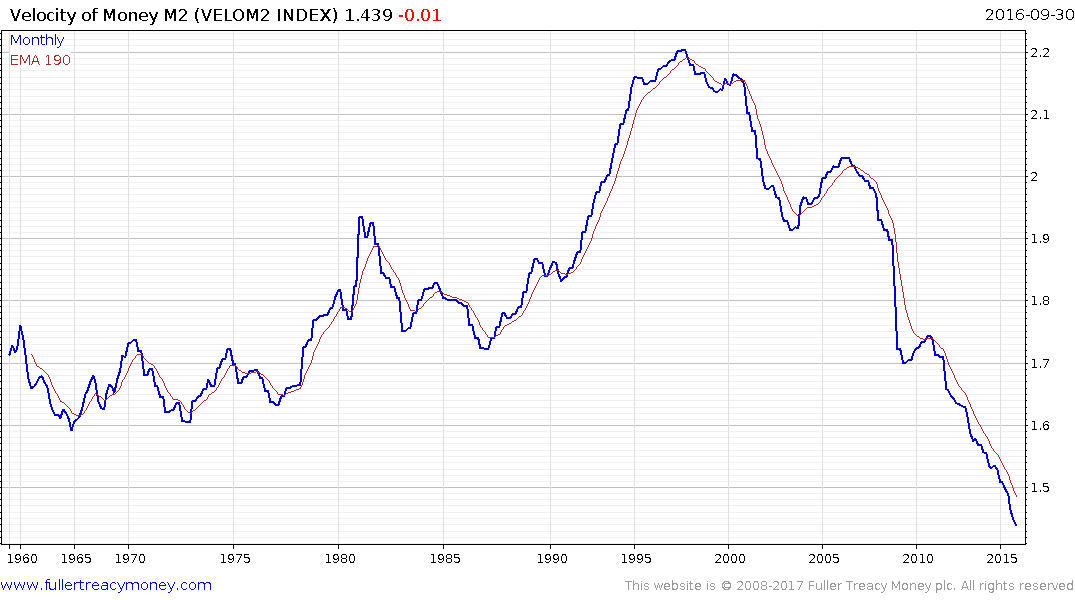

The Velocity of M2 has been declining since 1997. A housing bubble, sovereign debt crisis and bubble, commodity bull market and crash and massive monetary largesse have done nothing to stall the decline.

This argument from the St. Louis Fed in 2014 blames the refusal of consumers to spend as the primary culprit and suggests ultra-low interest rates are at least partially to blame. Here is a section:

And why then would people suddenly decide to hoard money instead of spend it? A possible answer lies in the combination of two issues:

A glooming economy after the financial crisis

The dramatic decrease in interest rates that has forced investors to readjust their portfolios toward liquid money and away from interest-bearing assets such as government bonds

In this regard, the unconventional monetary policy has reinforced the recession by stimulating the private sector’s money demand through pursuing an excessively low interest rate policy (i.e., the zero-interest rate policy).

That is certainly one answer and another is that technological innovation has removed whole swathes of intermediaries so far fewer transactions are required to get the same job done. That opens up the question of whether economic statistics adequately reflect underlying economic activity.

Perhaps fiscal stimulus will be the answer to getting people out making more transactions. If the new US administration does in fact following through on some of the post-election expectations we will have some answers to that question and it is likely to have considerable influence on monetary policy. After all inflation has been absent because the upswing in supply has been at least partially counterbalanced by the downtrend in velocity. All that money sloshing around would be inflationary if velocity picks up.

Back to top