L'Oreal's Asian Sales Just Overtook Europe for the First Time

This article by Robert Williams for Bloomberg may be of interest to subscribers. Here is a section:

"It’s true that the growth is not broad-based,” RBC analyst James Edwardes Jones said in a note to clients, “but given L’Oreal’s proven ability to identify, stimulate and capitalize on those parts of the business where the most attractive growth is to be had, we struggle to find fault with this.”

The results show luxury’s resilience, as surging demand from Chinese shoppers fueled 14 percent quarterly growth for the division selling brands like Armani, Kiehl’s, and YSL.

Meanwhile, some other manufacturers of products such as automobiles and electronics were hurt by a slowing Chinese economy.

“It’s a real appetite of the young generation in China to go directly to these luxury brands. It’s really positive for us,” Chief Executive Officer Jean-Paul Agon said on a call with analysts. Western Europe showed some signs of improvement and could post a solid year, Agon said, “but nothing that would

compete with what we see in Asia.”

The growth of the global consumer’s appetites for the trappings of modern living is likely to be an upward trajectory for decades to come. The first thing people buy when they have a little more money is soap. That feeds demand for progressively more cosmetics as incomes rise. With economic development peoples’ priorities shift from survival to enjoying life to longevity and the products tailored to those demands increases in price commensurately.

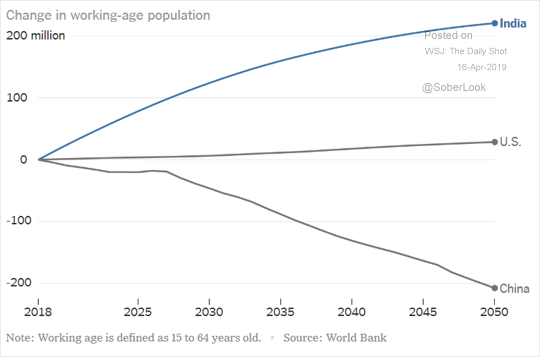

This chart of the number of workers available over coming decades in India, China and the USA, coupled with the relative demographics of the respective regions suggests longevity treatments are already a major business in the USA. Wellbeing and antiaging are a growth business in China while India is only at the dawn of what has the potential to be a decades long cosmetics demand trend.

That demand growth profile fits in very well wit the view that globally oriented companies offering leverage to the growth of the global consumer are likely to continue to prosper over the medium term. It was that assumption led to the creation of the Autonomies designation seven years ago.

In tandem with the at long-term growth outlook comes the security of cashflows which have bond-like characteristics. That results in the shares often being traded as bond proxies. Higher yields generally result in dividend yield compression for related shares until they become competitive again.

L’Oreal is currently overextended relative to the trend mean but a sustained move below €200 would be required to question the consistency of the medium-term trend.

P&G has rebounded impressively from the early 2018 decline but is also overextended right now relative to the trend mean and susceptible to mean reversion.

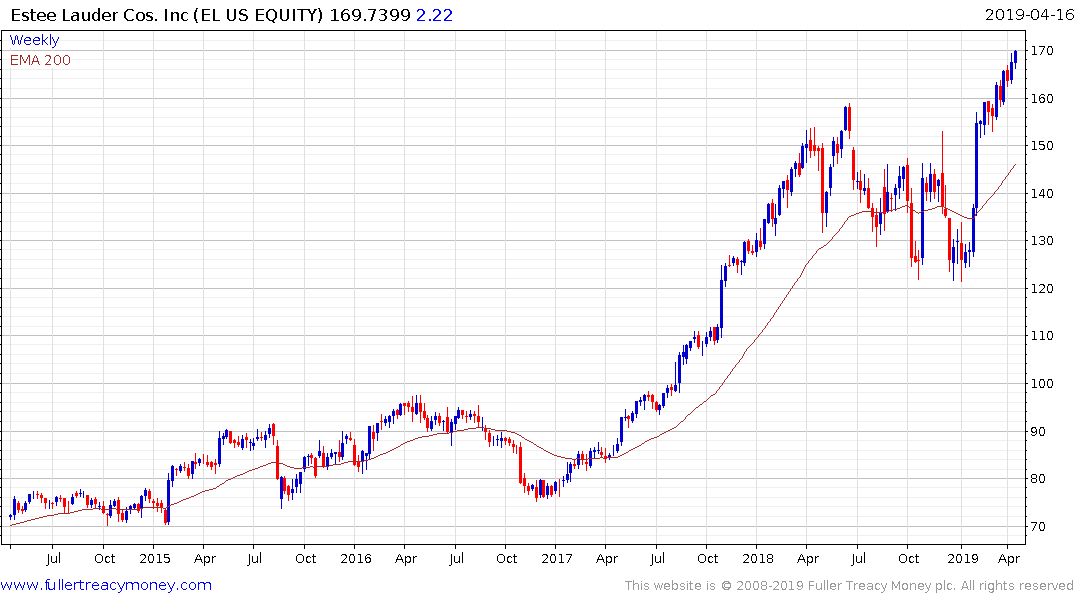

Estee Lauder completed an eight-month range in March and continues to extend its breakout.