Just Five Stocks Account for Nearly 75% of the Nasdaq's Plunge

This article by Julie Verhage for Bloomberg may be of interest to subscribers. Here it is in full:

When it comes to the ongoing technology beat-down in the stock market, it appears not all shares are created equal.

Indeed, just five names account for nearly 75 percent of the drop in the Nasdaq Composite Index, which has fallen more than 2.1 percent since June 7. Meanwhile, the Dow Jones Industrial Average and S&P 500 Index are roughly unchanged over the same time frame.

Much of this dynamic is due to giants like Apple Inc., Microsoft Corp. and Goggle parent Alphabet Inc. falling as much as 6.5 percent. Those companies account for nearly 30 percent of the index’s weighting, and their outsize impact has driven the gauge lower even though the bulk of the stocks are doing fine.

This selloff was “way overdue given the extreme out- performance and positioning in technology shares,” Morgan Stanley analyst Michael Wilson wrote in a note to clients Monday, Shares of Apple, for instance, are still up 25 percent this year, giving them room to fall.

But while Wilson expects the drubbing to continue in the short-term, he doesn’t think the market has seen a peak in tech shares.

“We would be surprised if this is the end for technology stocks given the very strong earnings growth we are witnessing,” he wrote.

Analysts now believe performance in technology will depend on the economic outlook. And if conditions change, finance will be the likely beneficiary.

“If the current economic ‘Goldilocks’ environment persists, technology and other growth stocks should continue to outperform, despite today’s price declines,” Goldman Sachs Group Inc. analysts led by David Kostin wrote in a note to clients late Friday. “However, if investors recalibrate expectations for inflation and Fed policy to match the growth optimism suggested by the S&P 500 level, higher rates should lead to financial sector outperformance.”

Mega-cap technology shares dominate the Nasdaq-100 and accounted for much of the Index’s outperformance over the last few months so it stands to reason they represent a headwind as a potential reversionary process unfolds.

.png)

Amazon pulled back sharply on Friday but rallied significantly off its low intraday. This action confirms at least near-term resistance in the region of the roundophobic $1000 level and suggests a peak of at least near-term and probably medium-term significance.

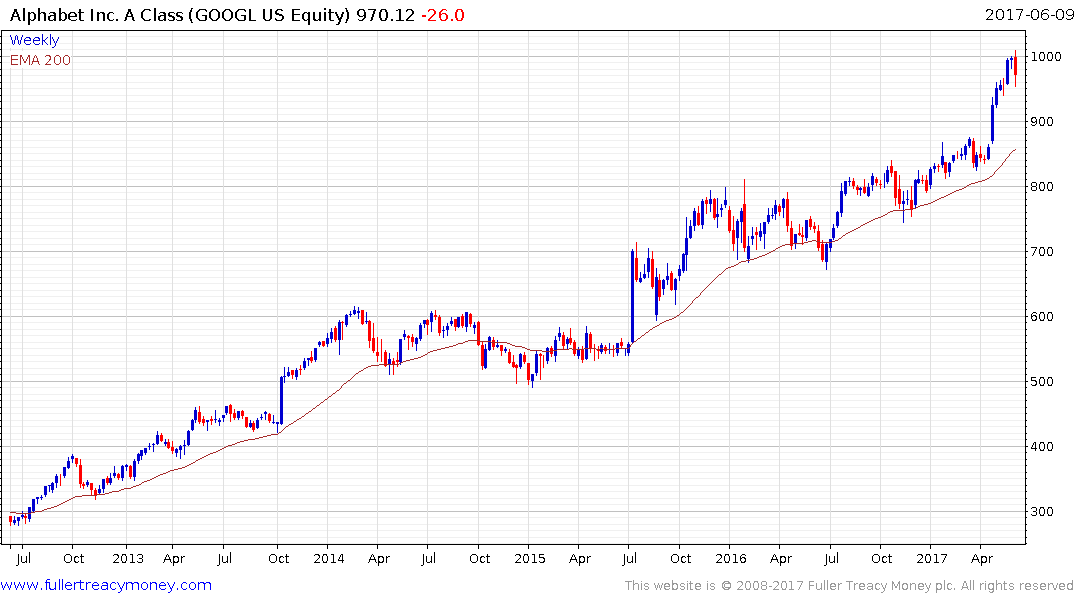

Google/Alphabet has also pulled back from the psychological $1000 level suggesting the short-term overbought condition relative to the trend mean will likely be unwound.

Apple has also pulled back and is now testing the progression of higher reaction lows evident since November and has now unwound about half its overextension in the last two sessions.

Microsoft was less overextended than the above shares and has pulled back to test the progression of higher reaction lows.

Facebook posted a large downside key day reversal on Friday and stabilised today near the May low.

Breaks below today’s lows would likely confirm a reversion back towards the mean is underway for these shares. The broader perspective is that these are leading shares and leaders tend to lead in both directions, so the relatively inert environment on the S&P500 and Russell 2000 is unlikely to persist if the pullback in mega-cap technology deepens.