Junk-Bond Fund's Demise Mars Vulture Investor's Storied Career

Thanks to a subscriber for this article by Gregory Zuckerman and Daisy Maxey for the Wall Street Journal which may be of interest. Here is a section:

Traders said part of the reason the Third Avenue fund ran into deep problems: It allowed daily withdrawals but stuck with investments that have become harder to trade and have been steadily losing value as investors fled energy and other kinds of riskier debt. It has been harder to find investors willing to buy debt the fund holds, including energy company Magnum Hunter Resources Corp. and troubled Spanish gambling company Codere SA, traders said.

As the Third Avenue fund’s holdings began to decline, rival traders at hedge funds shorted, or bet against, some of the mutual fund’s holdings, wagering that Third Avenue would experience investor withdrawals and be forced to sell some of its holdings, according to the company and one trader who made this move.

“It all starts with maybe trying to overreach,” Mr. Tjornehoj said. “Maybe this is the strategy—focused credit—that should only be available to institutions or accredited investors.”

Now, investors are focused on whether other funds may run into similar investor withdrawals and problems as the year-end approaches. Many investors move to exit losing funds and investments late in the year to generate losses to reduce capital gains taxes, traders said.

When I started in Bloomberg in 2000 most of my clients on the Belgium and Luxembourg sales route were fixed income oriented so the first thing my manager had me do was read bond math manuals to get up to speed with what clients were looking at. I remember reading about convexity, how much of a move in price and yield duration can be expected from a move in interest rates, and it made sense to me since interest rates tended to move a lot. Little did anyone expect at the time that trading convexity would become a one-way bet, that would last for the better part of a decade.

That is now changing as the Fed approaches its first rate hike since 2006. I’ve written a lot about the role stock market volatility plays in the way automated trading systems size their positions. In the bond markets the sensitivity of yields to outside influences such as interest rates, reinvestment risk, inflation, credit/default, downgrades and liquidity have many of the same effects. Right now it is worth considering that interest rates are about to rise for the first time in a long time, reinvestment risk is being affected as a result because yields have only just started to rise, inflation is still not a factor but credit/default and downgrade risk is surging as the energy and resources sectors are battered.

One of the reasons the Third Avenue, Stone Lion and Lucidas funds ran into trouble is that the high yield bond market is not known for its liquidity. In fact the paradox of bond market indices is that the most liquid issuers, with the largest weightings are generally those with the most debt. Petrobras for example represents a significant weighting because it has so much debt outstanding not because it is particularly creditworthy. With interest rates rising, the status quo is being shaken up and this is creating a difficult situation for the most leveraged investors but particularly for those holding securities that might have been liquid six months ago but where there are no bids at present.

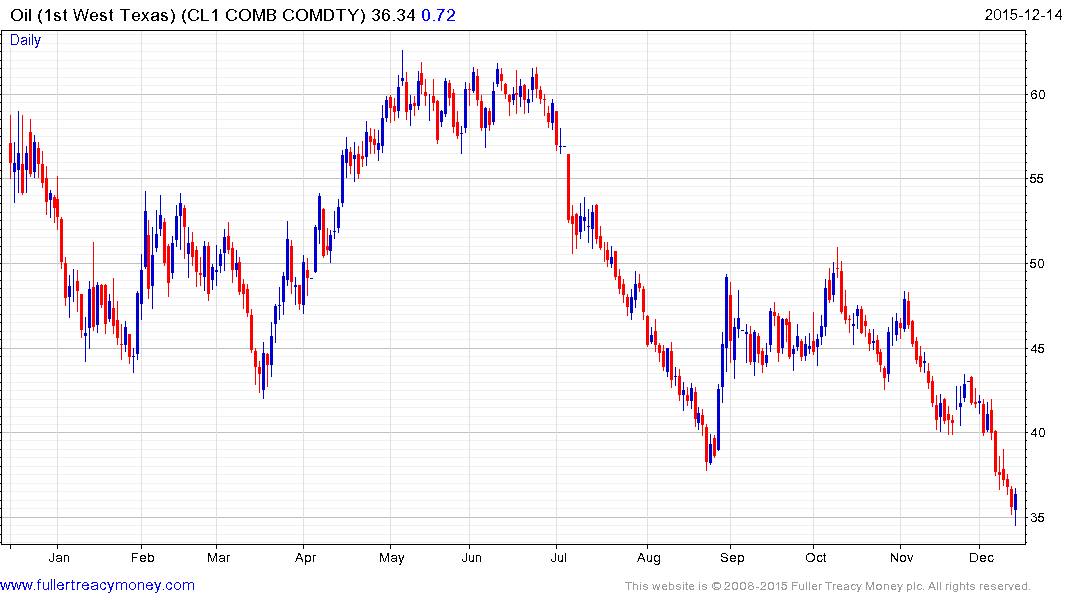

Oil prices found at least short-term support today and there is no denying a deep oversold condition is evident. WTI bounced from the $35 area and there is scope for some additional steadying. However it is questionable that such a small move, with no evidence yet of more than a lull in selling will have much of an impact on the travails assailing the high yield market dominated by energy issuers.

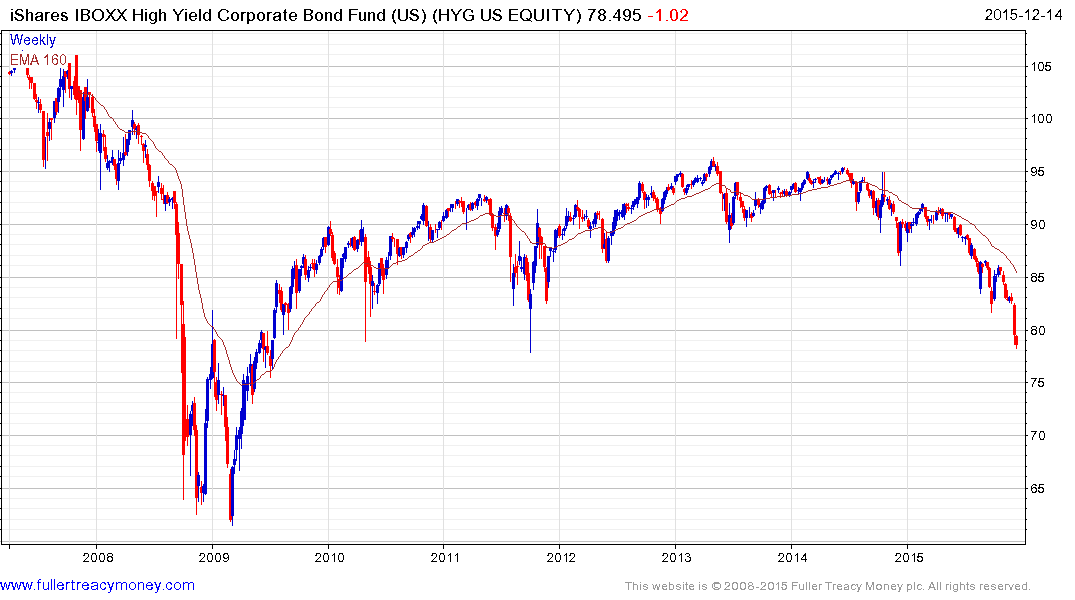

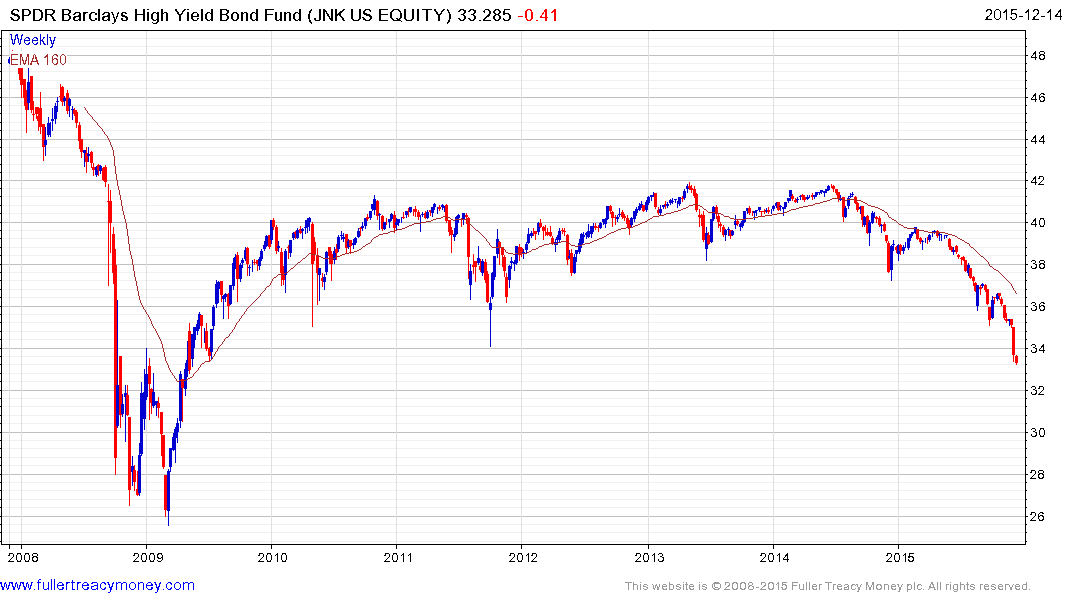

The iShares iBoxx High Yield Corporate Bond ETF and SPDR Barclays High yield Bond ETF have combined assets under management of $25 billion. They are accelerating lower but may also be in the process of completing Type-3 top formations. Clear upward dynamic will be required to begin to check momentum. Considering their size, selling pressure in these ETFs represents a headwind for other funds because of forced selling and as a result they represent the barometers for risk in the high yield sector.

Investors buying bonds can calculate value on a yield to maturity basis. However, if you invest in a bond fund you are at the mercy of other investors demanding their money back which forces sales and often not at advantageous levels. In addition a bond fund has to manage duration, even in a falling market, which means bonds often cannot be held to maturity. This means investors in bond funds risk underperforming the bond market in a rising interest rate environment.