JPMorgan Just Cornered The Commodity Derivative Market, And This Time There Is Proof

Thanks to a subscriber for this article from Zero Hedge which may be of interest. Here is a section:

So in summary, this is what we do know:

In Q1, JPM cornered the commodity derivative market, with a total derivative exposure of just over of $4 trillion, an increase of 1,691% from just $226 billion in one quarter!

What we don't know is:

why did the OCC decide to effectively eliminate its gold derivative breakdown by lumping it with FX,why there was a 237% increase in the total amount of precious metals (which include gold) contracts in the quarter, from $22.4 billion to $75.6 billion

We have sent an email requesting much needed clarification from the Office of the Currency Comptroller, although we are not holding our breath.

A large number of investment banks have closed or sold their commodity trading operations as prices declined and speculative interest migrated. JPMorgan and Citigroup have stepped into that void and now occupy outsized positions in the commodities derivatives market.

Effective hedging of commodity contracts means investment banks must be able to source physical commodities to make delivery on occasions when that is demanded by counterparties. This is as sound a reason as any for JPMorgan to amass a large physical silver position. This practice also allows banks to make money on both sides of the trade. They sell the contracts, control supply and pick up the spread at expiry.

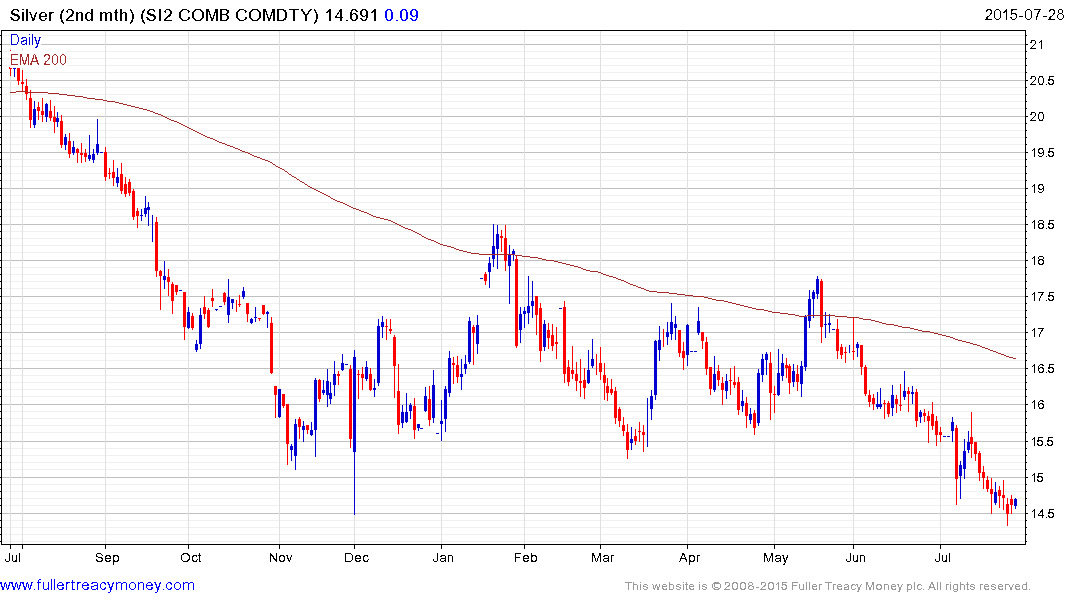

Despite the temptation to think this will all result in prices surging higher, there is no evidence of that on the chart. Silver is barely steady at the lower side of its 18-month range and will need to sustain a move above the 200-day MA to begin to suggest a return to demand dominance beyond short-term scope for steadying.

Back to top