JPMorgan Guide to the Markets Q122

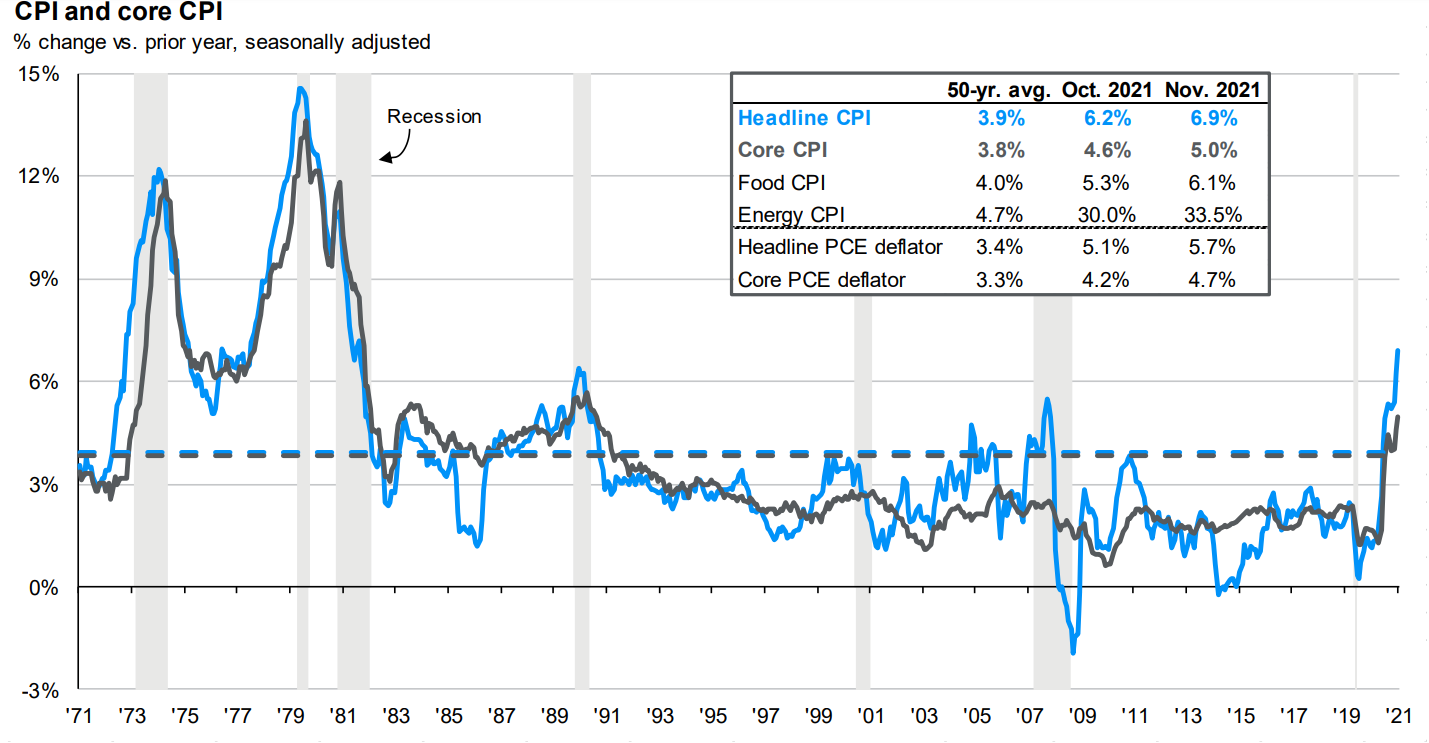

Thanks to a subscriber for this chartbook from JPMorgan. I thought this long-term chart of inflation and how it is breaking out of a long-term base formation to be particularly interesting.

Here is a link to the chartbook.

Here is a link to the full report.

At the same time the massive quantity of money printed to deal with the pandemic inflated asset prices in the property and financial markets. It swelled the earners of the corporate sector and simultaneously created bottlenecks in the commodity supply sector.

In 2022, some of these pressures will ease, others will not. The strongest likelihood is the year or year figures will moderate in the 1st half of the year and swell again in the next year. That longer-term outlook is why central banks are talking about raising rates.

I remain of the view they will be inhibited from following through on their most ambitious plans and not least as the stock market corrects in anticipation of tighter policy.