Jingle bulls, jingle bulls, jingle all the way!

Thanks to a subscriber for this report from the team at Deutsche Bank which may be of interest. Here is a section:

The reality is that company managers are not Scrooges. Indeed aggregate real capex as a proportion of output is at or near record levels in America (figure five). It’s obvious! – Father Christmas would chuckle to his reindeer. What else has caused the rampant over capacity we observe down those factory chimneys as we zoom about? And clearly too much – not too little – capex also explains why businesses are having such a hard time raising prices and growing their top lines. More than 40 per cent of American companies will have seen no revenue growth this year – globally almost half won’t (figure six).

So the wise men were correct to point their fingers at businessmen – but for the wrong reason! Reckless over spending rather than deliberate under spending has led to the lack of growth and general unease. Investors were also oblivious to the decline in revenue growth caused by a profligate expansion of assets. Or maybe they were just not bothered. After all, toy factories were returning sacks of money to shareholders and equity prices were somewhere north of Lapland. This was sustainable, Father Christmas knew, because the erosion in asset-turn (revenues divided by assets) was being off-set by rising margins (figure seven) – thus supporting returns on equity.

This overlooked dynamic explains everything from anaemic growth and booming equities to the rise of passive funds and lull in corporate deal making. What is more, it is a global phenomenon – especially so in emerging markets where excess capacity is chronic. To most people this looks worrying, given the tailwinds of lower wages, lower rates, and worldwide tax fiddling, which have pushed margins higher, are becoming headwinds. Only Father Christmas understands what an opportunity this is. Margin pressure will force companies to change behaviour for the better – with dazzling repercussions.

And the winds have already turned in America. For example, average hourly earnings growth has doubled since two years ago (figure eight) and keeps rising. Even Father Christmas’s laziest elf appreciates that his labour is scarce these days and has demanded more porridge. Meanwhile borrowing costs have turned upwards having declined for most of the millennium (illustration nine). Finally, there is less scope for taxes to fall than everyone thinks – American companies already pay a much lower effective tax rate than they did a decade ago (figure ten).

Margin pressure is the snowball in the face company bosses need to start investing more cleverly. Out with the irrational extra production line, fourteenth systems patch or mindless overseas expansion in order to boast being global. And in with capex that boosts productivity and returns. So ineffectually have most firms been spending money that investment will rise despite being elevated in real terms. The biggest gains will be made by the lowest quality companies. Forget about robots and artificial intelligence; this is about basic new IT infrastructure, client relationship software or logistics systems. So many companies do not do the simple things well because the tailwind of low wages, taxes and interest rates has meant they haven’t needed to. Only the top ten per cent of American companies have managed to significantly boost their returns on capital, excluding goodwill, over the past 15 years (figure 11). Other developed countries have similar skews too.

Here is a link to the full report.

There are a number of important points raised in this short report that are worth considering. Corporate margins are close to record highs and the loss of momentum in margin expansion has been a source of concern for many investors over the last couple of years.

In boardrooms there will of course be similar discussions about how to keep the bandwagon moving and investment in productive assets is at least part of the answer. Coupled with potentially lower taxes and a fiscal bump there is scope for additional margin expansion which may allow valuations to catch up with expectations without the need for prices to fall significantly.

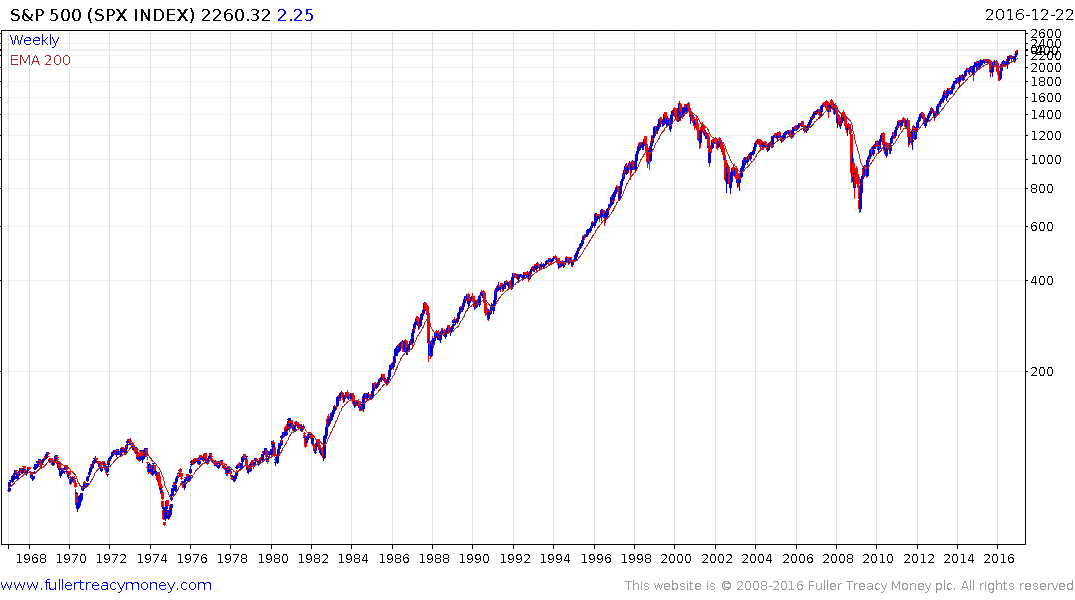

At The Chart Seminar we describe a range as an explosion waiting to happen. It is beyond question that the last two years of trading represented a lengthy range which has now been successfully resolved with an upside breakout. The Dow Jones Industrials Average., Dow Jones Transportations Average, S&P500, Russell 2000, Nasdaq Composite and 100 and KBW Regional Banks Index are all now trading at new all-time highs.

Inside a range expectations for future upside potential deteriorate because we are conditioned to expect more of the same. When the breakout occurs it is always surprising because prices move faster and farther than we are used to seeing. It’s important to remember that there is the world of different between something that is accelerating after an already well developed uptrend and something that is accelerating out of a range. In the latter case we expect the breakout to be surprising and the price can become quickly overbought and stay in that condition because the previous environment was so inert.

Breakouts occur because a vacuum of supply forms above the range and once penetrated waves of new buying are unleashed as traders and investors panic in. The breakout will persist for as long as it takes supply and demand to come back into balance. A consolidation then unfolds..

So far the breakouts on Wall Street are still in the explosion phase. There is room for consolidation and the end of the year has the potential to offer a catalyst for some profit taking. Provided the breakout holds during any consolidation that occurs pullbacks can be viewed as buying opportunities.