Jeffrey Gundlach on Stocks, Trump, and Gold

Thanks to a subscriber for this transcript of an interview from Barron’s. Here is a section:

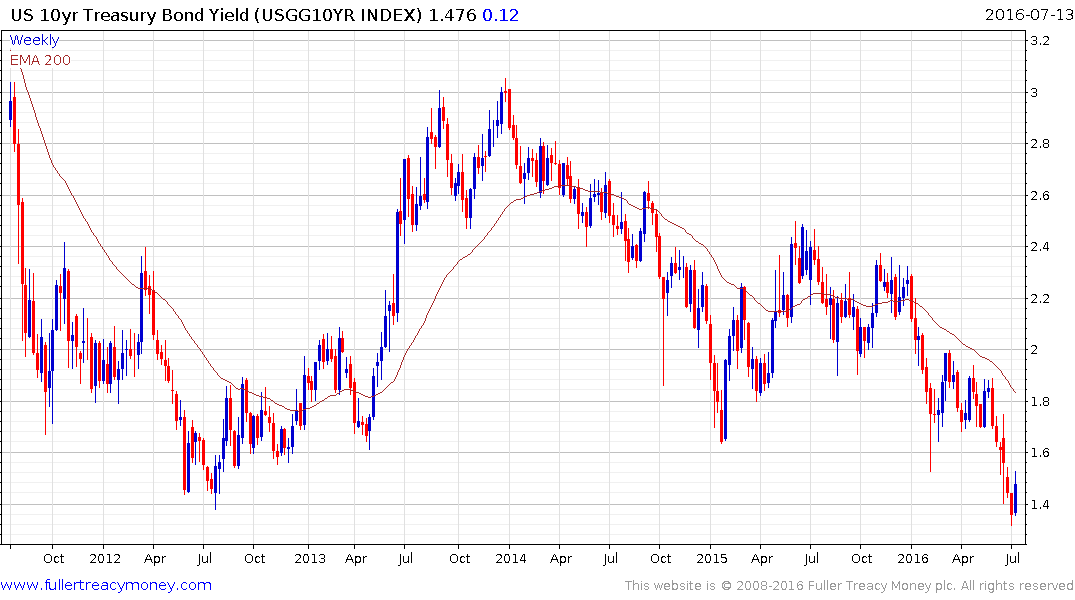

How much lower could yields on Treasury bonds go? Could we see a 1% yield?

We just passed the all-time low on the 10-year yield of 1.39%, which we saw in July 2012. It is no surprise the 10-year has been strong after Brexit. I’m not at all convinced that we are going to see much lower yields in the U.S. But even if we do, you’re talking about a de minimis profit. Even if the 10-year yield drops another percentage point, how much will you make? Less than 10%. There are better ways to speculate.Such as?

Gold miners have a very high probability—if you bought them today and were disciplined—of making 10%. One of the things driving markets lower is a declining belief in—and enthusiasm for—central-planning authorities and the political establishment. In this environment, gold is a safe asset. There’s an 80% chance of making 10% in gold; the probability of a 10% gain on Treasuries is 20% at best. I’ve never seen a worse risk-reward setup.

That doesn’t make for a very exciting portfolio.

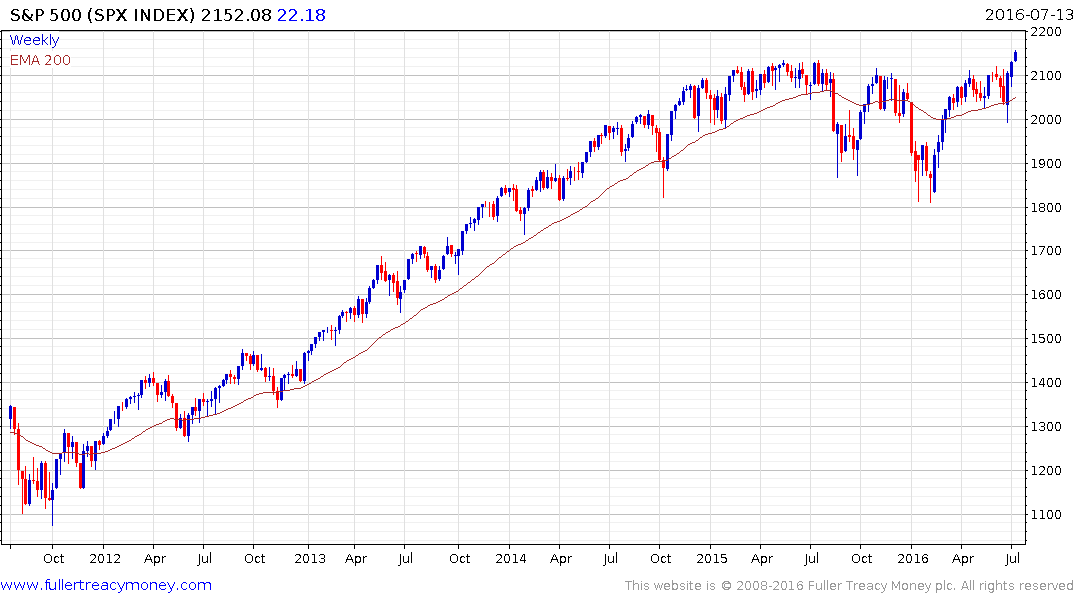

Our portfolios are high-quality bonds, gold, and some cash. People say, “What kind of portfolio is that?” I say it’s one that is outperforming everybody else’s. I mean, bonds are up more than 5%, gold is up substantially this year [28%], and gold miners have had over a 100% gain. This is a year when it hasn’t been that tough to earn 10% with a portfolio. Most people think this is a dead-money portfolio. They’ve got it wrong. The dead-money portfolio is the S&P 500.

With yields well below the dividend on the S&P 500 Treasuries are relying on momentum to boost returns. Like any market, when prices are accelerating higher, it will look like the strongest thing in the world until it turns. Then the repercussions of running a momentum strategy will become painfully obvious for those not also running a tight money control exit strategy such as trailing stops and diligent position sizing. Quite when that is likely to happen is another question entirely.

While the path to even easier monetary policy would appear clear for the BoJ, PBoC, BoE and ECB, the Fed is in something of a quandary. Growth is positive, the USA has close to full employment (at least for those who want a job), asset prices including housing are trending higher and the Dollar is firmer than it has been in years. The problem is that growth is modest and lopsided with increasingly vocal claims that central bank policy has favoured those with assets ahead of savers. If even easier monetary policy is adopted in the USA there is a real risk that a bubble in one asset class or another will inflate. In fact that remains the base case since the Fed is doing nothing to correct the imbalances it has created and the most likely candidate remains the stock market.

That’s the reason I don’t share Gundlach’s negativity towards the stock market. I agree valuations are no longer cheap and are becoming increasingly expensive as measured by Shiller’s cyclically adjusted P/E measure. However with interest rates where they are and the prospect for both monetary and fiscal expansion there is scope for prices to move higher because investors need to source yield somewhere and stocks, with their capacity for dividend growth, represent an attractive alternative to bonds.

US 10-year Treasury yields remain in a reasonably consistent medium-term downtrend and while there is room for some steadying around current levels or perhaps a reversion back towards the mean, a sustained move above 1.85% will be required to question the medium-term contractionary bias.

A clear downward dynamic would be required to check potential for both the S&P 500 and Dow Jones Industrials to extend their respective breakouts.

Gold has a singular advantage relative to other major asset classes. It is still trading well shy of its all-time peak, having only broken a medium-term downtrend in February. Some consolidation of recent gains is underway but a sustained move below the trend mean would be required to begin to question recovery potential.