Japan Stocks Surge Most Since June 2013 on GPIF Buying Optimism

This article by Anna Kitanaka for Bloomberg may be of interest to subscribers. Here is a section:

Japan’s $1.2 trillion Government Pension Investment Fund will increase its allocation target for local shares to about 25 percent from 12 percent, the Nikkei newspaper reported without attribution. GPIF will also boost its holdings of foreign bonds and stocks to about a combined 30 percent from 23 percent, while reducing domestic debt to the 40 percent level from 60 percent, the Nikkei said Oct. 18

“Twenty-five percent is more than the market expected,” said Kenji Shiomura, a Tokyo-based senior strategist at Daiwa Securities Group Inc., Japan’s second-largest brokerage. “They probably can’t buy all the Japanese stocks they need to get to 25 percent by the time they announce it. However, it wouldn’t be a surprise if they’ve already started moving bit-by-bit.”

The Dollar unwound much of its short-term overbought condition from early this month and found support last week in the region of the January highs. Some additional steadying in this area is a possibility but a sustained move below the 200-day MA, currently near ¥105 would be required to question medium-term Dollar dominance.

The stock market’s reaction to mean reversion by the Dollar was to sell off aggressively. However with the Dollar stabilising and news of a substantial reweighting into equities by the world’s largest pension fund, one could reasonably conclude that the selling was too pessimistic. The Nikkei-225 found support in the region of 14,500 on Friday and bounced today. It will need to hold last week’s low if medium-term potential for additional higher to lateral ranging is to continue to be given the benefit of the doubt.

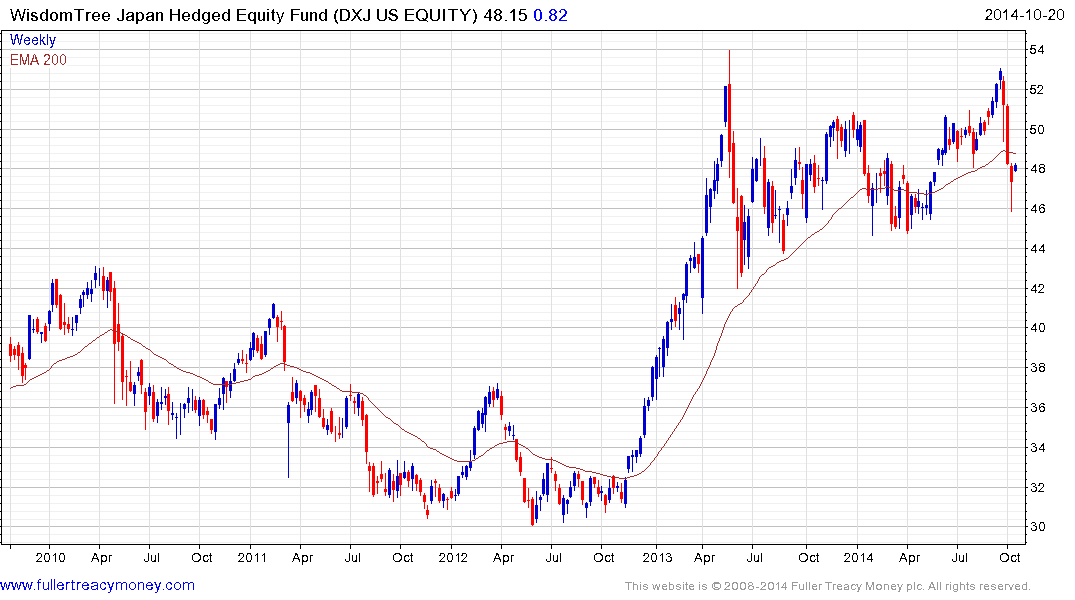

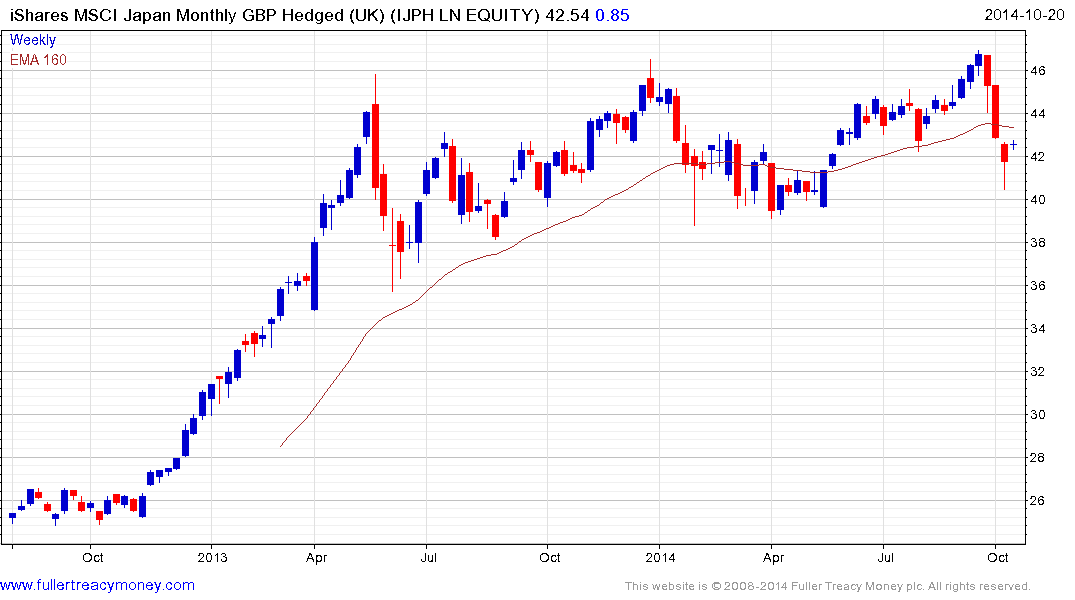

The US listed WisdomTree Japan Hedged Equity Fund (DXJ) and the UK listed iShares MSCI JPN GBP Hedged ETF share similar patterns to the Nikkei-225.

Back to top