Jamie Dimon Jokes, but Will China's Leadership Laugh?

This article from Bloomberg may be of interest to subscribers. Here is a section:

“The Communist Party is celebrating its 100th year — so is JPMorgan,” the bank’s chief executive officer, Jamie Dimon, said Tuesday at a panel discussion at the Boston College Chief Executives Club. “I’d make a bet we last longer,” reported Bloomberg News.

And

In China, business dealings often come down to narrative. One day, a foreign bank is welcome, and its presence is seen as helping China improve its financial industry. The next day, the same enterprise could be painted as a predatory vulture. Words matter, and harmless intent or humor can be misconstrued in translation. Jamie Dimon has every right to tell a joke, but it always helps to know your audience.

The longevity and persistence of the Party are not topics of conversation in China. Jamie Dimon may as well have been using cartoons of the Prophet Mohammed in his PowerPoint. That’s the closest parallel for the gaffe committed yesterday. It is reasonable to expect JPMorgan’s prospective Chinese private banking clients to think twice before the starting a relationship. Retribution may not happen immediately but it will come.

Global banks are lining up to open wholly owned businesses in China. The Communist Party forced banks to have domestic partners until quite recently and they chaffed at the interference. They have wanted to have independent businesses in China for years and it is difficult to change course on such a policy. The fact China is only allowing them in when debt to GDP on any measure is elevated, should give anyone pause. If they are suddenly so eager to allow access, isn’t that the time to raise questions?

Perhaps Jamie Dimon’s quip was a sign of being overly comfortable or even hubristic. It may also have been more mercurial. Maybe, JPMorgan’s future is not in China after all.

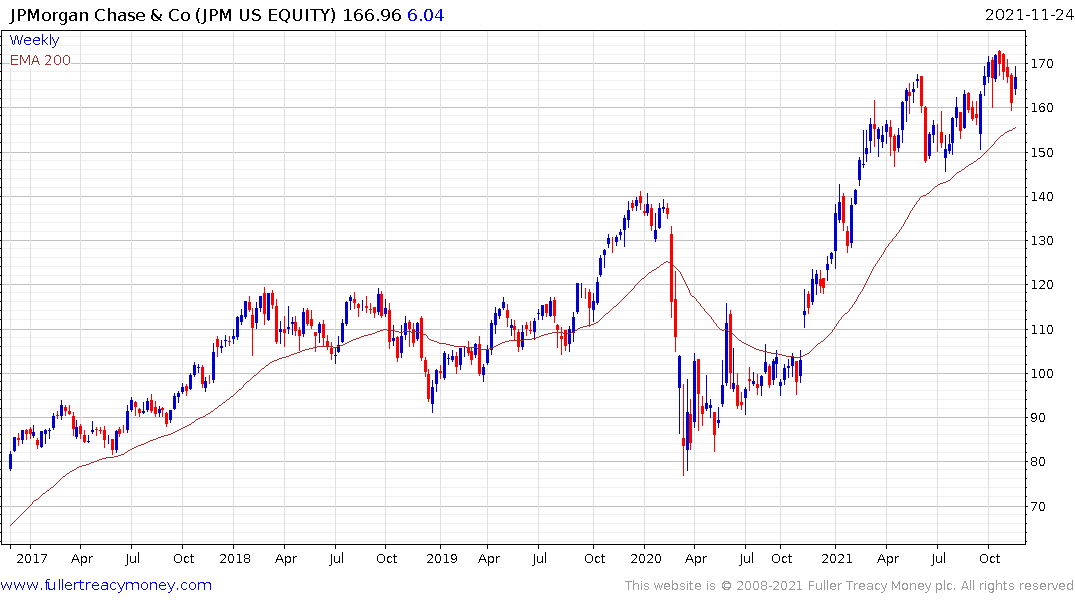

The share continues to trend higher and is currently bouncing from the region of the trend mean. Bank stocks tend to respond well to higher yields because their margins are flattered. This article from Bloomberg highlights how much cash banks have on hand to make loans since the loan loss provisions made in 2020 did not need to be used.