JAB Trio Creates Global Coffee Empire for Billionaire Backers

This article by David de Jong for Bloomberg may be of interest to subscribers. Here is a section:

The Luxembourg-based group, known as JAB, has spent more than $30 billion in the past four years acquiring coffee companies in the U.S. and Europe to challenge global leader Nestle SA. Run by a trio of well-connected executives with decades of experience in food and beverage, JAB has bought assets including D.E Master Blenders 1753 NV, Mondelez International Inc.’s coffee unit and high-end chain Peet’s Coffee & Tea.

“This is part of a much, much bigger strategy. JAB wants to be the Budweiser of the coffee space,” Pablo Zuanic, a Susquehanna Financial Group analyst, said, referring to Anheuser-Busch InBev NV, the world’s biggest brewer. “Just as you’ve seen Bud consolidate beer, they want to consolidate coffee.”

Coffee is big business and with approximately 20-25 espressos from a pound of beans it is a high margin business. Little wonder then that the bulk of spending from coffee companies goes in the form of marketing and physical locations. Coffee also represents a growth market since it is considered a bourgeois drink in China and for many exemplifies modern living.

Another way of thinking about coffee is that consumption tends to trend higher as the pace of everyday life increases. People with busy work, family and social commitments tend to get less sleep either because of time or worry and need a pick-me-up in the morning. As the pace of economic development continues to trend towards urbanisation the pace of life inevitably picks up. That’s good news for coffee producers and helps to explain the race to dominate the market.

BBB+ rated JAB Holdings bonds jumped about 30 basis points on news of the additional acquisition. However at 2.57% on the 1.625% 2025 the valuation is not considered challenging for the group. Burger King’s merger with Tim Hortons can also be seen as part of the trend towards consolidation within the coffee sector.

Nestle (Est P/E 22.53, DY 2.95%) is highly diversified both globally and across products with no line representing more than 20% of revenue. This has helped the share be one of the best performers of any market over the long term. It was somewhat overbought when it tested the region of its previous peak last week and a process of mean reversion appears to have begun. A sustained move below the October low would be required to question the medium-term upward bias.

Starbucks (Est P/E 32.94, DY 1.28%) experienced a deep pullback in October, highlighting where many investors had stops in the market but it was among the first to bounce back and make new highs. A process of consolidation is underway but a sustained move below the trend mean would be required to question medium-term uptrend consistency.

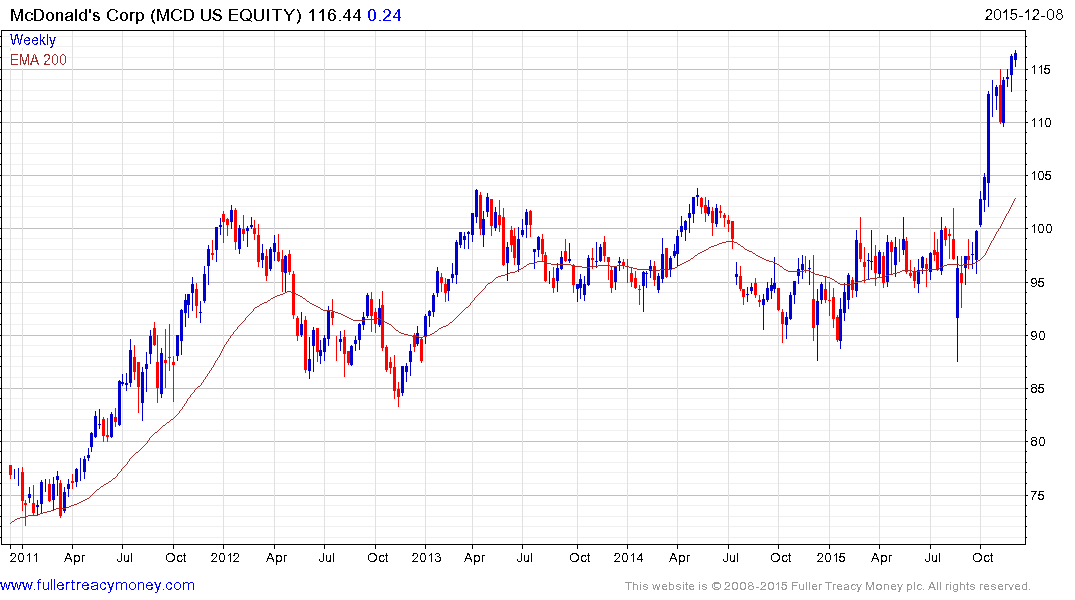

With the addition of its all-day breakfast offering McDonalds (Est P/E 23.84, DY 3.07%) may be highlighting that coffee represents a stalwart among its product offerings. The share completed a three year range in November and continues to extend the breakout. A sustained move below the MA would now be required to question medium-term scope for additional upside.

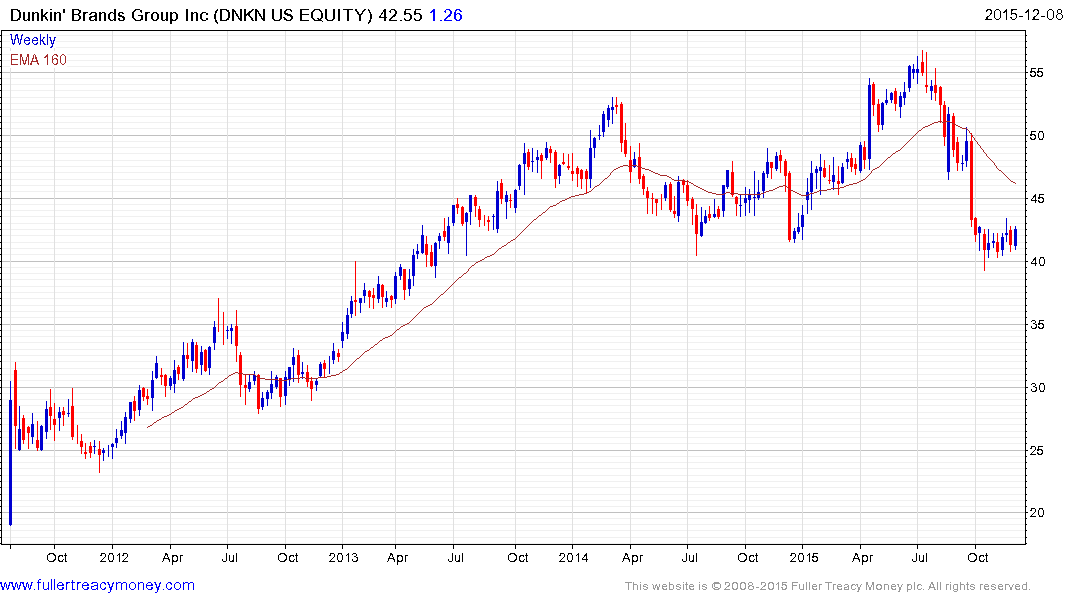

Dunkin’ Brands Group where the namesake brand accounts for 73% of revenue has fallen to test the region of the lower side of a two-year range. It has firmed over the last couple of days and a sustained move below $40 would be required question potential for additional upside.

The popular UK chain of cafes Costa Coffee represents 36% of Whitbread’s revenue, up from 23% five years ago. The share (Est P/E 19,05, DY 2.09%) hit a medium-term peak in May and has held a progression of lower rally highs since. It pulled back from the region of the MA last week and a sustained move above the 5000p area would be required to signal a return to demand dominance.

In the meantime Arabica coffee prices have closed an overextension relative to the trend mean but a sustained move above it would be required to confirm Type-2 bottoming activity.

Back to top