Italy Slowly Moves Toward Comprehensive Bank Rescue

Thanks to a subscriber for this report from Kroll Bond Agency focusing on Europe. Here is a section:

One of the major sources of public anxiety is the fact that the EU nations have not followed established rules for dealing with troubled banks in a consistent and transparent fashion. EU officials also have refused to consistently “bail in” bond holders of EU banks by converting debt to equity, a partial solution to the solvency problem that apparently is politically unacceptable. The fact of a bail-in, however, while reducing debt service expenses, does not provide the financial institution with significant new cash. Because the EU lacks a federal fiscal agency with receivership powers similar to the Federal Deposit Insurance Corporation in the US, the community is essentially in the position of the US prior to 1933. Before the FDIC was created in that year, bank insolvencies were dealt with by receiverships overseen by the courts of the individual states. This arrangement made it problematic, for example, for the Federal Reserve System to lend to banks because the state courts would not give preference to the security interest of the central bank for discount window loans.

In the case of Italy, over the past decade the country’s banking system has moved from institutional funding sources to selling junior bonds to retail investors. As a result, the political system’s reaction to growing problems in the nation’s banks is one of growing alarm. Italian Prime Minister Renzi says he wants urgent bank reform but does not say how it should be accomplished. Significantly, the Bank of Italy has called for a ban on the sale of subordinated bank debt to private individuals. Such a ban would effectively cut off the remaining funding source for Italy’s banks.

Authorities ranging from Bank of England Governor Mark Carney to Deutsche Bank chief economist David Folkerts-Landau have called for a direct bailout of some $150 billion, but KBRA believes that this figure is inadequate and represents merely a down payment on a full solution to the crisis. Meanwhile, EU officials refuse to consider direct infusions of capital from the governments of the member states. Dutch Finance Minister Jeroen Dijsselbloem has stated that he is not "particularly" worried about Italian banks:

“The only thing that to me is very important is that we respect what we have agreed between us, because otherwise everything will be questioned in Europe… There have always been and will always be bankers that say ’we need more public money to recapitalize our banks.... and I will resist that very strongly because it is, again and again, hitting on the taxpayer… the problems with the banks need to be sorted out in the banks and by banks.”

Bail-In vs. Bail OutUnder EU rules requiring the “bail in” of debt holders in the event of bank , Italy faces the prospect of wiping out millions of retail investors. Estimates of the total amount of money that is potentially subject to a bail-in easily exceed €1 trillion, or twice the amount of bad loans admitted in official statistics. The pressures building on elected officials in the EU are intense and have caused Renzi to publicly attack ECB head Mario Draghi for not doing enough to help Italy’s banks. These striking developments have gone largely unnoticed by investors, media, and policy makers outside the EU.

For years now, the ECB has been pouring liquidity into the Italian banking system, in part because the banks are funding the debt issuance of the Italian government. As one well-placed EU analyst told KBRA last week, “the priority during the 2008 financial crisis was for the banks to fund the state, and for the private sector to fund the banks.” The liquidity provided by the ECB ran right back out the door, however, as retail and institutional investors frequently have been bailed out and the insolvent banks have been supported with government guarantees and inflows of fresh funds from new retail investors.

Here is a link to the full report.

Considering the relative strengths of the UK economy it remains highly likely Brexit will represent a greater challenge for the Eurozone than it does for the UK. The decision to leave for an island nation with its own currency is orders of magnitude less troubling than the inability of highly indebted governments to directly recapitalise banks while operating within the limits of a central bank focused on big picture pan European questions rather than national priorities.

In the early 2000s while at Bloomberg I was asked to give a talk to clients in Milan. While chatting with some of the delegates afterwards it came to light that the big sales push going on at the banks they worked for was to sell reverse convertibles to retail clients.

For the issuer, a reverse convertible is attractive because it comes with an embedded put so the principal can be converted into equity. For the creditor they often get an attractive face yield but the embedded put option held by the issuer means the rating on the bond is meaningless as it can be converted to equity at any time.

Anyone holding reverse convertibles will already have been wiped out but the reality is that these were not the only subordinated bonds sold to retail clients. Continental Europe has a much more developed retail bond market than either the UK or USA with retail investors comfortable with debt instruments and receiving periodic coupons in return for the perception of lower risk. The problem today is the bonds sold to retail clients represent a major burden for banks as the assets supporting them are often heavily impacted. The opacity of the system also means it is difficult for administrators to get a handle on exactly what is owed to whom.

Bail-ins followed by recapitalisation has always been the most logical solution but it is politically untenable. When it comes to a large country, the EU has a long history of looking the other way rather than be seen to impose the will of a foreign power on a vassal state.

With Europe in particular it is important to differentiate between politics and policy. Politicians in every European state make statements that play well on local media whether it is “No more bailouts”, “no more bailing out profligate layabouts in the sun” or “we need to protect the interests of our own people”. However until recently that has been mere rhetoric because behind closed doors they have done exactly the opposite. If rising populism is any guide voters are getting wise to this shell game and that is perhaps the greatest challenge for the continuation of the system.

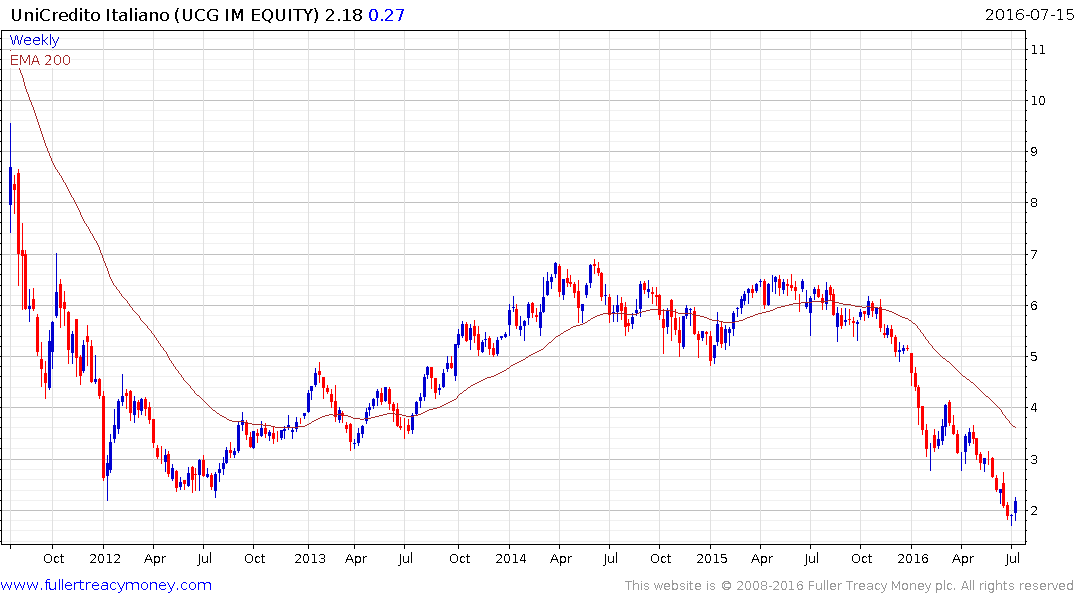

UniCredito Italiano has plunged over the last year to plumb new reaction lows. Its most recent bounce is similar to those posted in June and April. A break in the progression of lower rally highs currently near €2.75, would be required to question medium-term potential for additional downside.