Italy's Gentiloni Says Election Campaign Is 'Imminent'

This article by John Follain, Lorenzo Totaro and Chiara Albanese for Bloomberg may be of interest to subscribers. Here is a section:

The euro zone’s third-biggest economy, whose recovery is trailing most of its peers, risks a hung parliament after the ballot. Opinion polls show the anti-establishment Five Star Movement, which wants a consultative referendum on abandoning the euro if European Union treaties aren’t renegotiated, leading Gentiloni’s Democratic Party and groups in a possible center- right coalition that would include former Premier Silvio Berlusconi’s Forza Italia.

But neither Five Star, the Democrats headed by former Prime Minister Matteo Renzi, nor the center-right bloc would win a parliamentary majority, according to the surveys. A possible “grand coalition” of the Democrats and Forza Italia would not have a majority either.

“It’s virtually certain that we won’t have a clear majority,” said Sergio Fabbrini, director of the school of government at Luiss University in Rome. “The talks to verify whether a new majority can be formed could last until the summer. In Germany, the talks have dragged on for ages, and in Italy we may end up with about twice as many parties in parliament as in Germany.”

Political sclerosis is nothing new for Italy. With little chance of a clear winner from elections, the country will continue to be rule taker rather than a leader in the discussions about how the EU can be reformed, which Macron wants to get started.

While political populism is experiencing a renewal in a number of countries it is nothing new in Italy where Berlusconi’s Forza Italia has been in and out of government over the last decades. With such a splintered field the much vaunted Five Star Movement is unlikely to get the kind of backing it would require to force a vote of EU membership.

The Italian Index has been ranging mostly above 22,000 since September and is retesting that level which now coincides with the 200-day MA. It will need to bounce from this region if potential for additional higher to lateral ranging is to be given the benefit of the doubt.

.png)

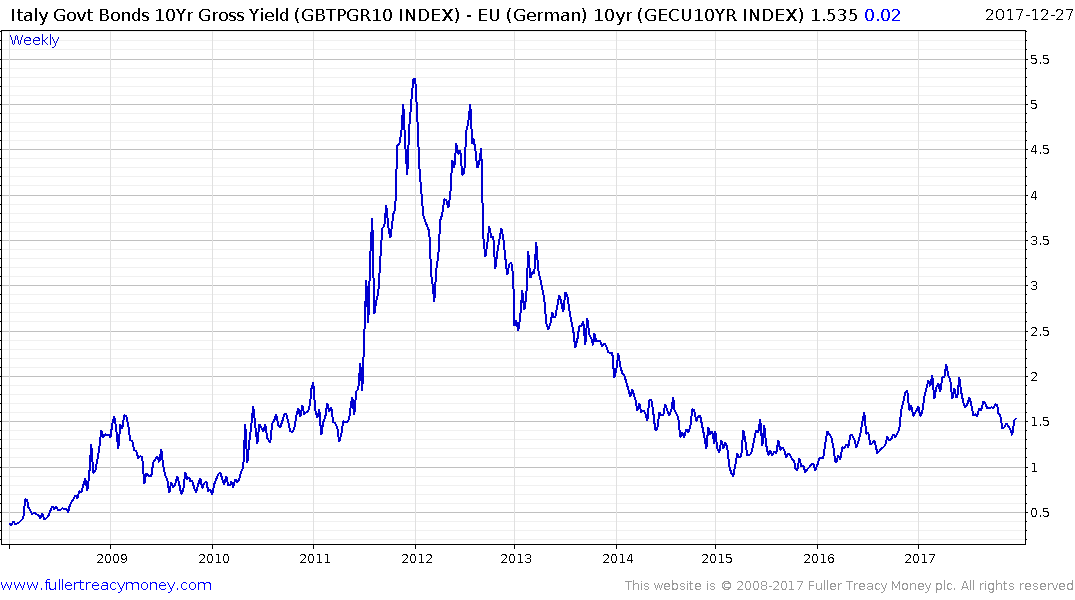

Italian government bond yields have bounced over the last two weeks to test the region of the trend mean. A sustained move below 1.9% would be required to signal more than temporary resistance in this area.

Meanwhile the absolute level of Italian yields, trading almost 60 basis points below US Treasuries, is a testament to just how distorting the ECB’s quantitative easing program has been for bond markets. With the ECB tapering its support, peripheral Eurozone sovereign spreads could begin to expand again in 2018.