Italy lawmakers approve 20 billion euro plan to prop up banks

This article by for Reuters may be of interest to subscribers. Here is a section:

If Monte dei Paschi's capital plan fails, Prime Minister Paolo Gentiloni's new government is likely to meet this week to issue an emergency decree to inject capital into it.

But that could prove to be politically explosive given that investors are required to bear losses under EU bailout rules.

Parliamentary approval for the 20 billion euro government plan was needed to allow the state to take on new debt. Italy's debt burden, at about 133 percent of annual output, is already the second highest in the euro zone after Greece.

The measure approved by parliament on Wednesday says the state can borrow money to provide "an adequate level of liquidity into the banking system" and can reinforce a lender's capital by "underwriting new shares".

The failure of Monte dei Paschi, the world's oldest bank, would threaten the savings of thousands of Italians and could undermine confidence in the country's wider banking sector, saddled with a third of the euro zone's total bad loans.

Before the vote, Economy Minister Pier Carlo Padoan vowed to shield retail bank investors from losses.

"The impact on savers, if a (government) intervention should take place, will be absolutely minimised or non-existent," Padoan told parliament.

Italy Senate also approves government request to lift debt to help banks

Monte dei Paschi said it expected its net liquidity position, now at 10.6 billion euros, to turn negative after four months.

A bailout of Italy’s banking sector highlights clearly that the EU has one set of rules for small countries but is willing to set them aside in the cause of realpolitik to ensure the sustainability of the currency regime.

A rationalisation I have heard promulgated is that the bail-in imposed on the people of Cyprus was nothing more than a refusal to bailout Russian billionaires and that Italy represents an altogether different case. That of course ignores the very real pain and suffering of savers who had their assets confiscated simply because they were unlucky enough to live in Cyprus.

It makes a mockery of the four freedoms the EU’s elite cherishes so dearly. The freedom of movement of goods, people, services and capital over borders excludes debt. That has to stay exactly where it was issued. Apparently there is no such thing as a debt that was improperly lent. Only the borrower is to blame and everyone within a country is liable for that borrower’s miscalculation. This injustice represents a medium-term threat to the integrity of the union because smaller peripheral states are now nothing more than vassals at best in what is a modern feudal system.

In the short-term however news that Italy’s banking sector is going to be bailed out and that Italy’s government bonds will by extension be funded by the ECB is good news. Italian government bond yields have been contracting since November in a steady reversion back towards the mean. Whether a move below the trend mean is possible when there are such large questions about the legality of the bailout is another question entirely.

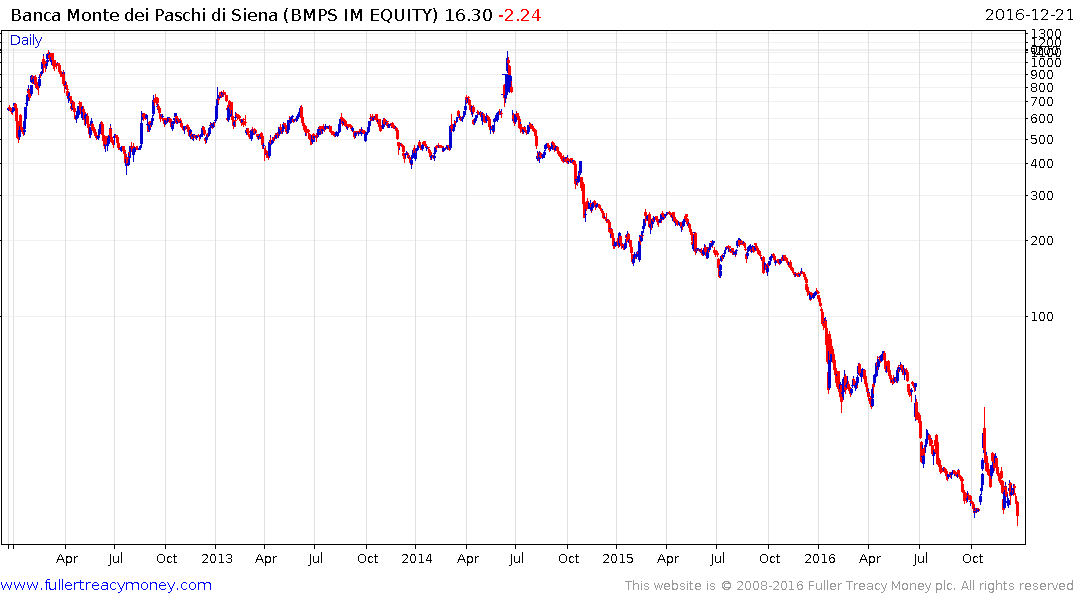

Banca di Monte De Paschi was the leading decliner on the Italian Index today and moved to a new low, but the wider banking sector was relatively quiet.

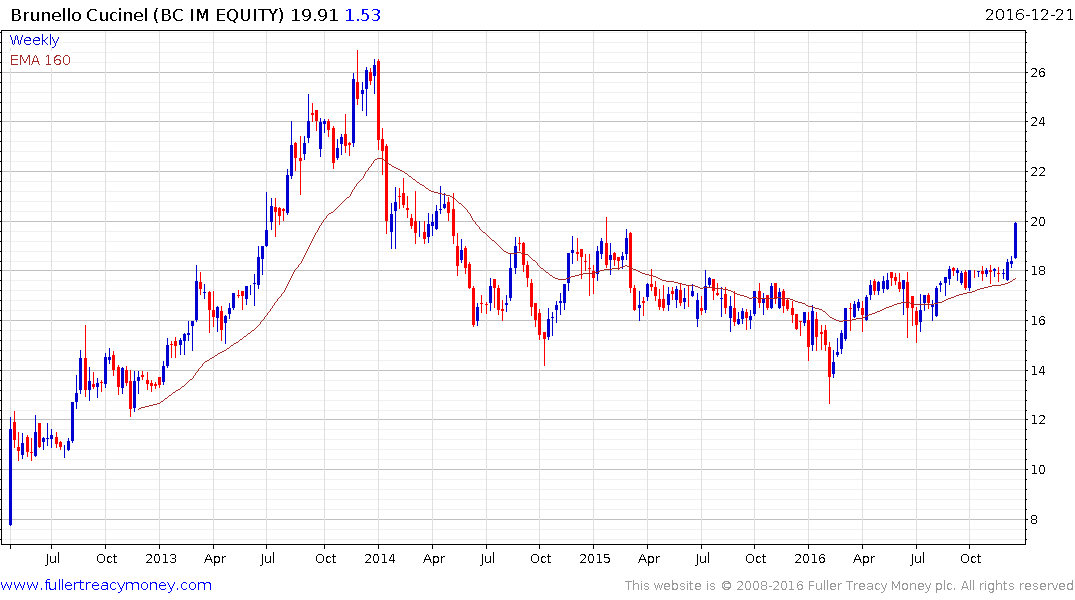

Meanwhile Italian exporters, not least in the fashion and luxury goods sector benefit from a weaker Euro. Brunello Cuccinelli for example is the process of completing a three-year base while TODs is trading back above its 200-day MA.