Italexit Risk Low, Debt Re-Profiling Better Option: Mediobanca

This note by By Francesca Cinelli summarises a report issued by Mediobanca earlier this week discussing the economic implications of Italy exiting the Euro. I’ve read the original report but we are precluded from posting it on the site.

Time costs money for Italy, due to collective action clauses (CACs) and thus, purely on financial grounds, it reduces Italexit risk and makes any voluntary debt re-profiling a better option to eventually sustain its borrowings, Mediobanca says in note.

Highlights no growth undermines debt sustainability; Sentix Index, which estimates the one-year probability of Italy leaving the monetary union based on the assessment of investors, signals stress

Says redenomination in any Eurozone country is a function of the freedom allowed on bonds issued under domestic law and the constraints of the recently introduced EU discipline on

CACsQuantifies cost of re-denomination, says four variables suggest EU280b loss, partly offset by EU191b gain from the Lex Monetae on bonds under domestic law

Compares CACs and non CACs pairs of Italian govies displaying similar features in order to test Mediobanca’s “time costs money” finding; that means as time goes by the

financial incentive for redenomination declinesData suggest 30bps yield premium on 3.5yr non CACs bonds actually drops to 10bps on 12yrs

Says “Quanto” spread captures the “convertibility risk” implied in the premium between USD- and EUR-denominated CDSs

Data suggest that at end 2016 for the first time Italy’s “Quanto” exceeded Spain’s, confirming Italy crucial role for eurozone future given a 90% correlation the brokerage notes between Italexit probability and a euro break-up probability

I think most people would agree that if Italy quits the Euro the currency will be unable to function as a cohesive unit. Italy would use the opportunity of devaluation to flood the Eurozone with cheap goods which would encourage other countries to follow its lead. That’s not news and the EU is fully aware of the implications of a large country like Italy leaving the currency union.

In that context Collective Action Clauses (CACs) were a rear guard action imposed in 2013. Ostensibly they would avoid the cost of negotiating with the kind of holdouts that prolonged the Argentine default resolution, but they also enhance the ability of creditors to either accept or refuse renegotiation of bond terms. For any country leaving the EU the redenomination of Euro currency bonds into New Currency bonds would be an obvious point of contention.

Since 2013, the EU has insisted that all new bond issues have embedded CACs which is the equivalent of stronger covenants in the sovereign sector. According to Mediobanca 2016 was the last year in which a redenomination would have made money for Italy. In future the potential loss from CAC bonds will outweigh the benefit of redenominating non CAC bonds.

There are two caveats to that conclusion which were not overly discussed in the report. The first is that they assume the New Lira would decline by 30%. It’s a handy number but nothing is set in stone. If we converted the Euro back into Lira it is currently trading at about 1800 to the Dollar. Before adoption of the Euro it was trading closer to 2250 or 25% weaker. Let’s ask a simple question is the Italian in better or worse shape today than in 2002? I would argue quite a bit worse so a 30% devaluation would be just for starters. Why not 50%?

Italy has repatronised approximately 60% of its outstanding debt. If it can gain control over enough of its debt to control the voting rights of the CACs then it can strongly influence what terms any renegotiation of payments take. Both these potential outcomes make a strong case for thinking outside the box when considering the terms of any potential breakup of the Euro.

However it is also worth remembering that these might be considered nuclear options and Italian public appetite for leaving the Euro has been sporadic. Provided the Italian people wish to remain within the euro and are willing to abide by the terms of what that means in terms of budgets and sovereignty then the potential for a negotiated easing of its debt burden still exists.

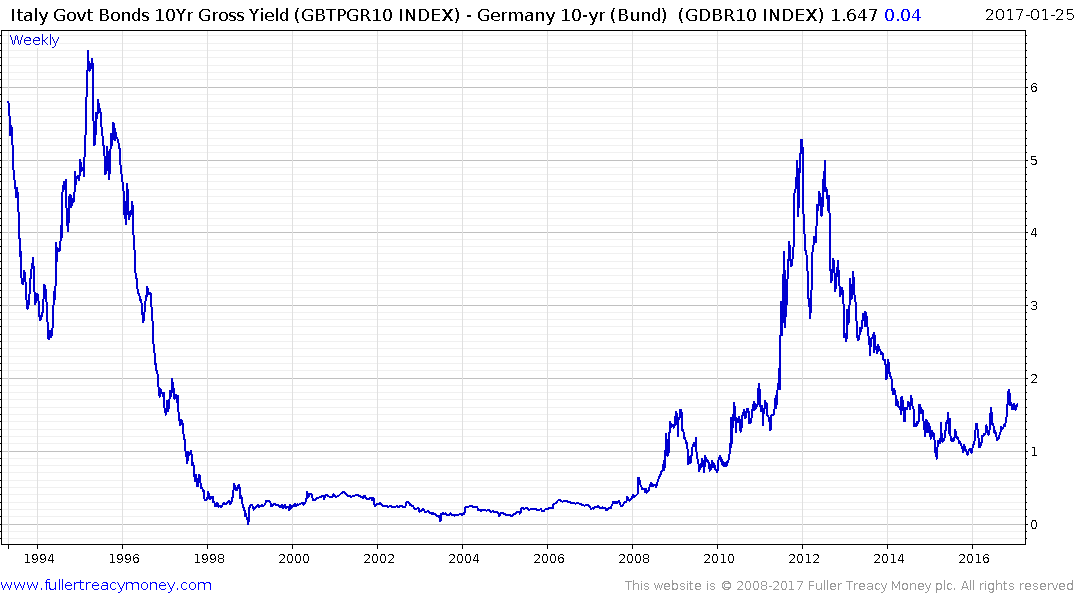

Right now the market appears eager to test that hypothesis. Italian 10-year BTP spreads over German Bunds are widening out once more and some clear intervention would be required to question potential for further expansion.