It's Not Just Toys R Us. More Credit Weak Spots Emerge

This article by Sid Verma for Bloomberg may be of interest to subscribers. Here is a section:

Money managers are grappling with an uptick in operational and balance-sheet challenges late in the business cycle, with debt-laden Toys ‘R’ Us Inc. the latest retailer to file for bankruptcy this week, catching bond markets off guard. Just two weeks ago, credit-default swaps, which allow traders to hedge against losses, were pricing in a low probability of near-term default at about 10 percent based on contracts expiring in June.

"Companies with the weakest fundamentals often show problems first late in a cycle, and the retail sector has many such examples," said Adam Richmond, Morgan Stanley’s chief credit strategist.

"Investors initially treat those issues as idiosyncratic, and then the problems spread, when credit conditions begin to tighten,” he said. “That is how the late cycle can transition to end of cycle."

These risks are hard to see at the index level, with the Bloomberg Barclays U.S. high-yield benchmark up almost 7 percent this year, led by CCC-rated names. Still, the latter has underperformed the broader market over the past two months, suggesting investors are increasingly compelled to price-in deteriorating fundamentals -- reminiscent of a market in its late winter, according to the U.S. lender.

You don’t know who’s been swimming naked until the tide goes out” is one of Warren Buffett’s most memorable sayings. There is no doubt that abundant cheap liquidity has aided a considerable number of what might otherwise have been considered marginal businesses to remain solvent. The big question now is how they are going to refinance debt at equally attractive levels when it comes due over the coming years?

Toys R Us was taken private a few years ago so we don’t have a chart that would have signaled how the investment community viewed the company’s prospects after it was loaded with debt in typical private equity fashion. However, we have plenty of examples of retail or automotive parts companies that are under stress which also have large debt loads. It is reasonable to expect the default rate, which has been historically low, to pick up with interest rates but probably not until refunding schedules begin to mount from 2019 onwards.

The NASD Bloomberg Active High Yield Index is testing its 2013 and 2014 lows near 5.25% and a break above 6% would be required to question medium-term demand dominance.

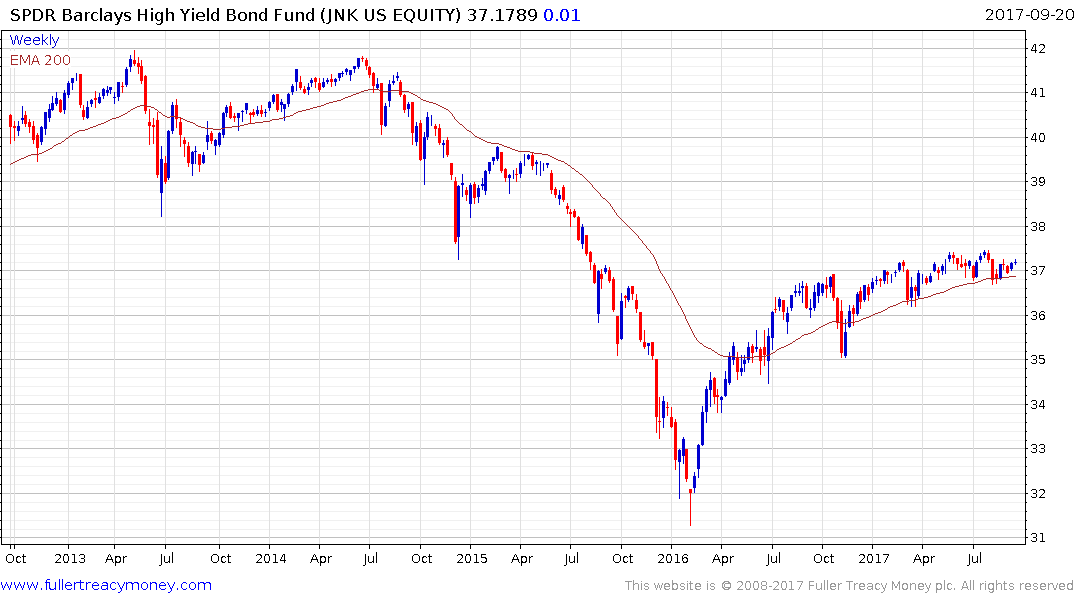

The SPDR High Yield Bond ETF (JNK) yields 5.29% and continues to hold a progression of higher reaction lows.

News today that Venezuela is late on a coupon payment did little to arrest the yield on the 9.25% 2027s pushing back up towards the peaks near 30% last seen in 2016. However, while these yields are among the highest on offer anywhere they do not, yet, signal the market is preparing for imminent default.