Is this time different?

In watching to Jerome Powell’s press conference yesterday I was struck by the number of times he said this is not a normal business cycle.

The inflation that we originally got was very much a collision between very strong demand and hard supply constraints, not something that you really have seen in prior, you know, in business cycles.

And

I think it's -- because this is not like the other business cycles in so many ways. It may well be that as -- that it will take more slowing than we expect, than I expect to get inflation down to 2 percent.

And

this is not a standard business cycle where you can look at the last 10 times there was a global pandemic and we shut the economy down, and Congress did what it did and we did what we did.

There is some logic to that statement. We have never shut down the entire global economy or printed so much money in such a short period of time. The clear conclusion Powell is taking in predicting a soft landing is that inflation really is transitory.

With the Fed’s preferred measure of inflation (PCE at 4.4%) now below the Fed Funds rate (4.75%) they can credibly argue we have positive real rates. The Constant Maturity 10-year real yield is now contracting which suggests the market is well on its way to pricing in the potential real rates will not stay positive for long.

My initial hypothesis at the beginning of the year was we would see the best performance in the first half of the year. I was shaken out of my long position in the Nasdaq-100 which was a mistake. The Index has clearly broken its downtrend with today’s upside follow through .That confirms near-term support in the region of the 1000-day MA.

The ARK Innovation ETF is back testing the region of the 200-day MA and a clear downward dynamic would be required to check momentum beyond a pause.

The ARK Innovation ETF is back testing the region of the 200-day MA and a clear downward dynamic would be required to check momentum beyond a pause.

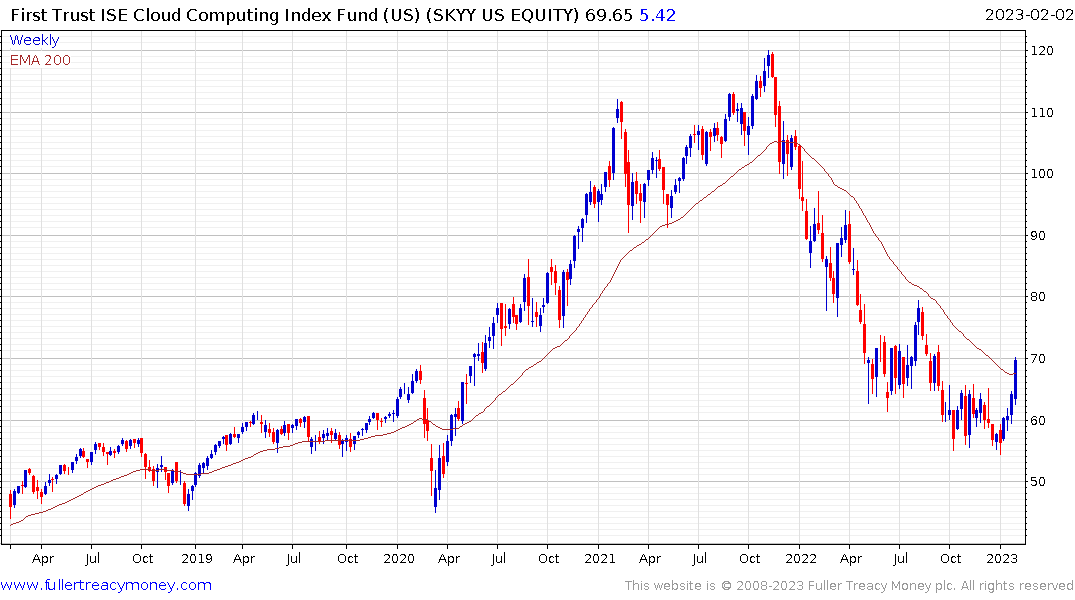

The First Trust Cloud Computing ETF has broken back above its 200-day MA to also break the consistency of its downtrend.

The First Trust Cloud Computing ETF has broken back above its 200-day MA to also break the consistency of its downtrend.

The big point to consider is we don’t know if the exogenous shock of the pandemic really means everything will soon get back to normal. The biggest change is surely in central bank attitudes to the likelihood of inflationary pressures.

We have just had the fastest pace of interest rate hikes in decades, simultaneously, central banks are reducing the size of their balance sheets and governments are struggling to balance budgets. That’s not only a US phenomenon but is present in the EU and UK too.

I remain very much of the view that a deflationary shock is the next big surprise for markets. That is the only way central banks will be encouraged to cut rates. Stock market investors cannot have their cake and eat it.

The first option is rates stay high and kill inflation, which will hit corporate profits and exacerbate the slew of liquidity events seen in the last year. The second is rates soon fall, inflationary pressures quickly rebound, corporate profits remain firm but that forces rates to rise even further later to really deal with inflation.

At present the market is betting on option 1 and everyone is willing to deal with the fallout later if option 2 comes to pass.

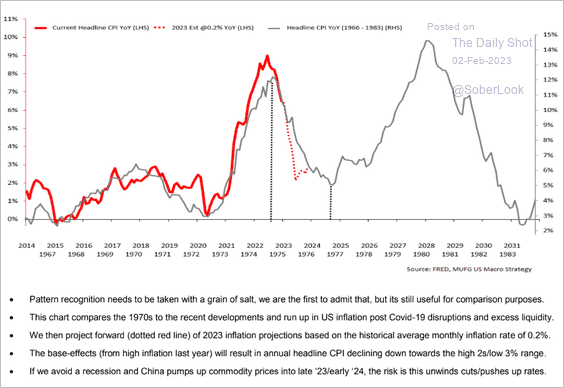

Something else to keep in mind is the trajectory of inflation is still following the 1970s analogue so it really is to early to draw clear conclusions just yet.

Something else to keep in mind is the trajectory of inflation is still following the 1970s analogue so it really is to early to draw clear conclusions just yet.

Some else to keep in mind is the Swiss National Bank is now talking about reducing the size of its balance sheet in more strident terms. Since they were among the biggest buyers of large cap stocks that is something to pay attention to as it represents a sizeable source of supply.

Back to top