Iron Ore Imports Collapse as China's Great Cleanup Kicks In

This article by Jasmine Ng and David Stringer for Bloomberg may be of interest to subscribers. Here is a section:

Purchases dropped to 79.49 million tons in October, according to customs data on Wednesday. That’s down from September’s 102.8 million tons, and is the lowest amount since February 2016. Over the first 10 months, imports by the world’s top buyer still expanded 6.3 percent to 896 million tons.

Iron ore users and investors have been tracking China’s bid to rein in pollution this winter by imposing restrictions on mills’ production, in addition to curbs on other industrial activity. The drive has buttressed prices of higher-quality ores that are more efficient, while spurring speculation about a demand roller-coaster, with weaker consumption seen near term before a possible snapback in spring. At the same time, miners in Brazil and Australia have added supply.

The decline in China’s iron imports was the standout item amid a broader weakening of purchases, Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd., said in a note. “The closures of steel mills due to environmental concerns were behind the fall,” he said. Demand for raw materials imports is likely to rebound, according to the bank.

China’s pollution problem is a political liability. That fact highlights the evolution of a middle class, but it also reflects the transition underway as the consumer takes over as the engine for growth. China is gradually moving away from highly polluting industries while at the same time focusing on continued urbanisation and more value-added products.

That represents a change of focus but may not result in a major decline in overall demand for steel as new cities and infrastructure objectives are pursued. However, if steel mills are run on low capacity over the winter months, to cut down on smog, only to ramp up again in the spring, that is likely to represent a challenge for iron-ore producers.

Vale is perhaps the most leveraged of the major producers to iron-ore prices and it has been ranging around $10 since late September. It will need to hold the recent lows if potential for higher to lateral ranging is to be given the benefit of the doubt.

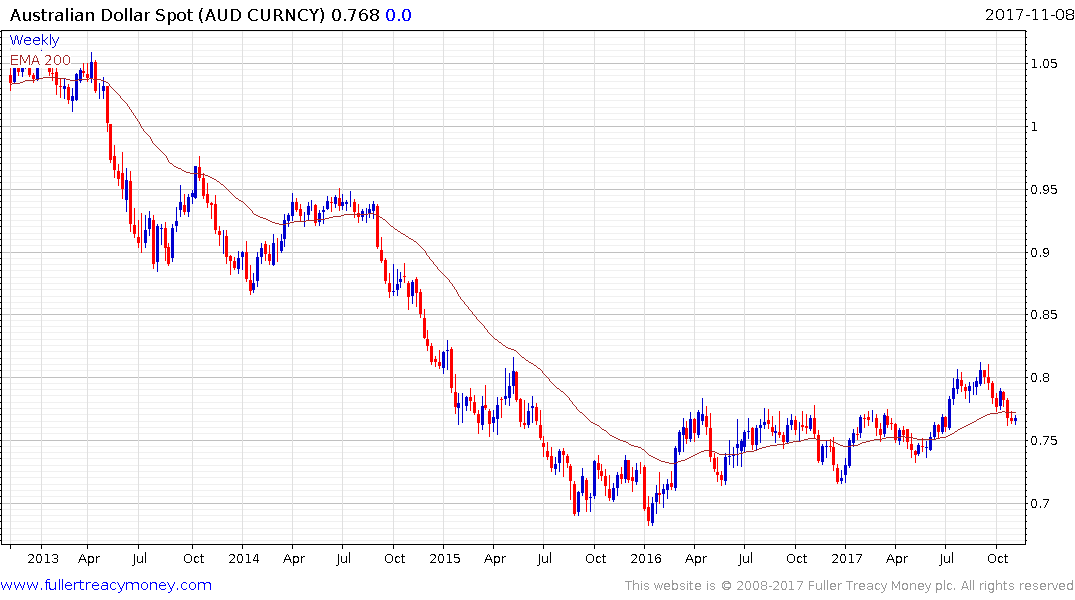

The Australian Dollar is trading below the trend mean as it tests the region of the upper side of its underlying range. It will need to sustain a move above 77¢ to confirm more than temporary support in this area.

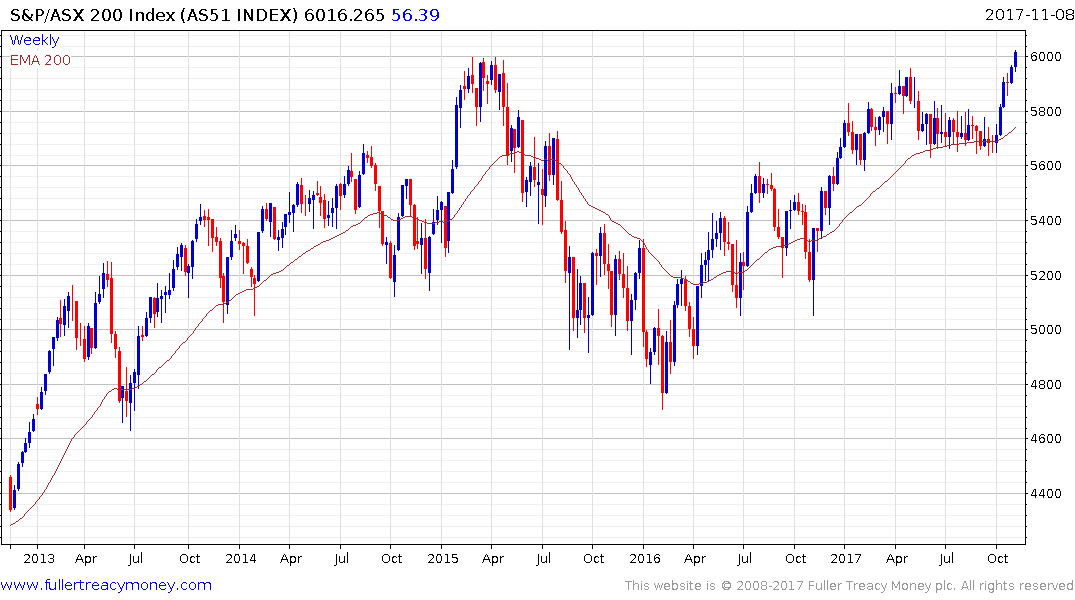

Meanwhile the S&P/ASX 200 broke successfully above the 6000 level this week for the first time in two years. A clear downward dynamic will be required to question medium-term scope for additional upside.

The S&P/ASX 300 Resources Index broke successfully out of this year’s range two weeks ago and a clear downward dynamic would be required to question medium-term recovery potential.