Ireland Hits Brexit Alarm in Biggest Foreign Crisis in 50 Years

This article by Dara Doyle and Marc Champion may be of interest to subscribers. Here is a section:

Sensing a shock, the head of IDA Ireland, the state agency charged with winning investment, returned to Dublin from New York a day early. During the flight, he sent a steward to the cockpit to check the emerging results. Before the vote, the IDA had pitched Ireland to companies including Standard Chartered Plc. Within hours of the result, the agency contacted thousands off clients, Shanahan said. “We were well prepared,” he said.

The plan now is for an advertising drive in Europe and the U.S. to underline Ireland’s advantages. Yet, even that’s not straightforward. The U.K.’s withdrawal from the EU could eat away one of Ireland’s key advantages for overseas investors -- it’s 12.5 percent corporate tax rate. A 15 percent rate in the U.K. has been mooted by the government to help offset the economic impact of Brexit.

Elsewhere, too, the loss of a key member of what one Irish official calls the “Northern liberal club” will be felt keenly. The U.K. and Ireland have led opposition to EU efforts to harmonize tax laws.

When pitching the country as an investment destination, Ireland’s development authority leads with the argument that not only do multinational corporations get access to an English speaking educated workforce, but they can also avail of the one of the lowest corporate tax rates in Europe. The prospect of the UK adopting a similar rate represents a significant threat to that model not least if it succeeds in negotiating a relationship similar to Norway’s with the EU.

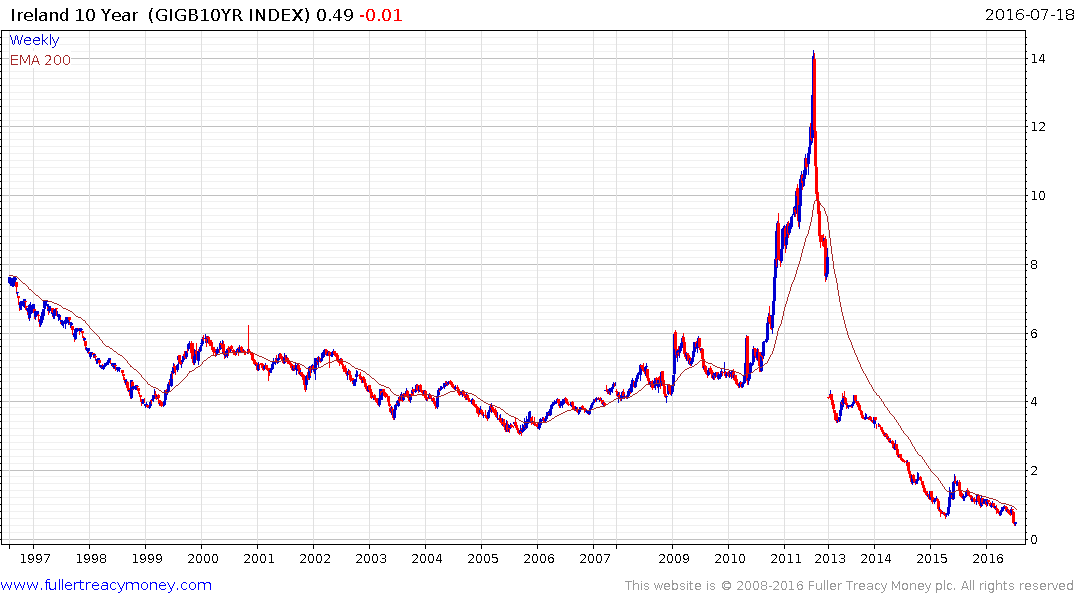

Irish government bond yield continue to reflect ECB bond buying and while not in negative territory, like Bunds, represent the lowest borrowing costs Ireland has ever enjoyed.

The ISEQ Index pulled back sharply on the Brexit news and has since posted a modest bounce. A sustained move back above 6150 will be required to question medium-term supply dominance.

CRH (25.9%), Ryanair (16.8%), Kerry Group (14.5%) and Paddy Power (10.2%) represent 67% of the Index. That’s a significant change from when it was dominated by banks ahead of the financial crisis but also highlights how small the domestic stock market is and the fact that the large foreign multinational sector is predominately listed on the Nasdaq.

CRH, among the world’s largest building materials and cement companies, does very little business in the UK. The share bounced back emphatically from the Brexit pullback but has been largely rangebound for almost 18 months and will need to sustain a move above €30 to signal a return to medium-term demand dominance.

Ryanair generated 27.4% of revenue from the UK last year and the decline of the Pound represents a challenge for its low cost business model. The share hit a medium-term peak in January, posting a large downside weekly key reversal, around the same time that oil prices bottomed and it broke down following the Brexit result. The share will need to sustain a move above €13 to question medium-term supply dominance.

.png)

Paddy Power generates 35% of revenue from the UK. It hit a medium-term peak in February and also broke down this month.

Kerry Group’s dairy and ingredients business in internationally diversified. The share, an S&P Europe 350 Dividend Aristocrat, remains in a consistent medium-term uptrend.