Investors Can Clean Up With Italy's Biggest Bank

This article by Paul J. Davies for the Wall Street Journal may be of interest to subscribers. Here is a section:

The target is for returns on tangible equity above 9% in 2019. For that to make sense, the bank has to drive its cost of equity down below 10%, which means slashing risks.

That is where Jean Pierre Mustier, chief executive, is being most radical. He will use most of the money raised to pay for a deep clean of its balance sheet and restructuring. It will cut 14,000 jobs and close nearly 1,000 branches, mostly in Italy.

UniCredit will take €12.2 billion of charges including a whopping €8.1 billion of losses on its worst bad loans. That prices bad loans for sale, cutting their average net value to just 25.5% of face value, which compares with an Italian average of about 40%. The bank is selling a near €18 billion chunk of its worst loans to vehicles backed by U.S. fund managers Fortress and Pimco.

Action like this, and that being taken by Italy’s most troubled lender, Banca Monte dei Paschi di Siena, will put pressure on other Italian banks to clean house.

By 2019, UniCredit will have cut net bad loan exposures by almost €20 billion through sales and write downs, reducing the value of nonperforming loans to a respectable 4% of total loans.

The bank is assuming a weak economy where nothing in Europe gets much better and interest rates remain negative. That presents a challenge. With interest income under pressure, it will need to grow lending to maintain roughly flat net revenues.

Here is a link to a PDF of the article.

€13 billion is a sizeable equity raising for a company with a market cap of £17 billion following this week’s rally to date. Nevertheless, the fact that the bank is willing to commit to writing down bad loans in an attempt to clean up the balance sheet, in addition to the fact that Italy only represents about a third of revenue suggests the potential for a recovery cannot be ruled out. That is of course assuming it is successful in raising the capital required to fulfil the plan.

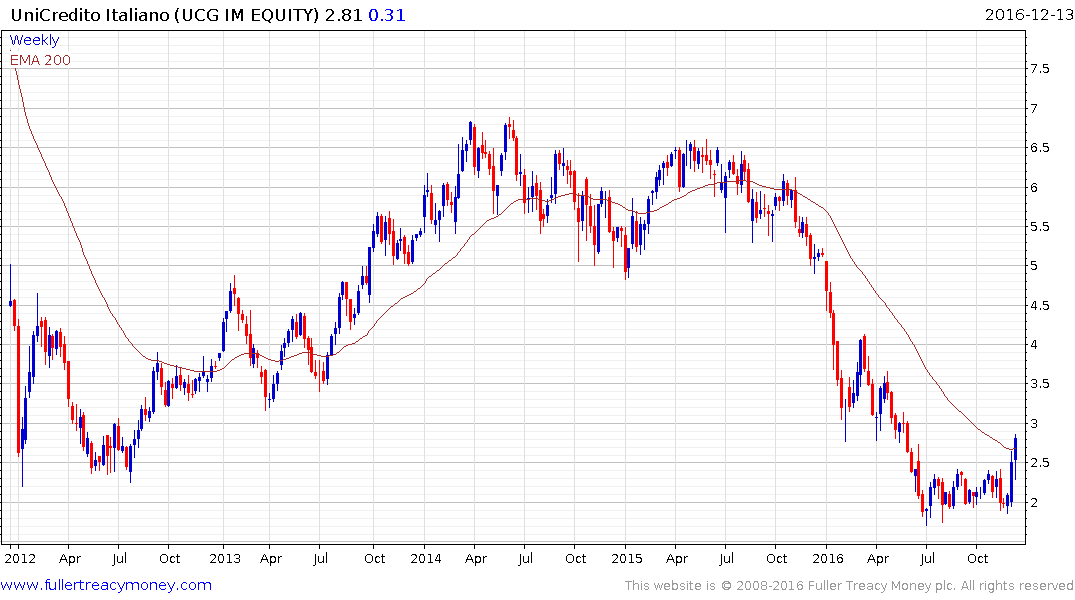

The share is following through on last week’s bounce and a sustained move below the €2 area would be required to question potential for some additional upside.

The fact that the European Commission does not appear likely to enforce sanctions against Italy for breaching the no bailout clause of its structures with regard to Banca dei Monte Paschi di Siena is a further indication of deteriorating standards of governance in the bloc but is real politic and is a bullish factor for the banking sector.

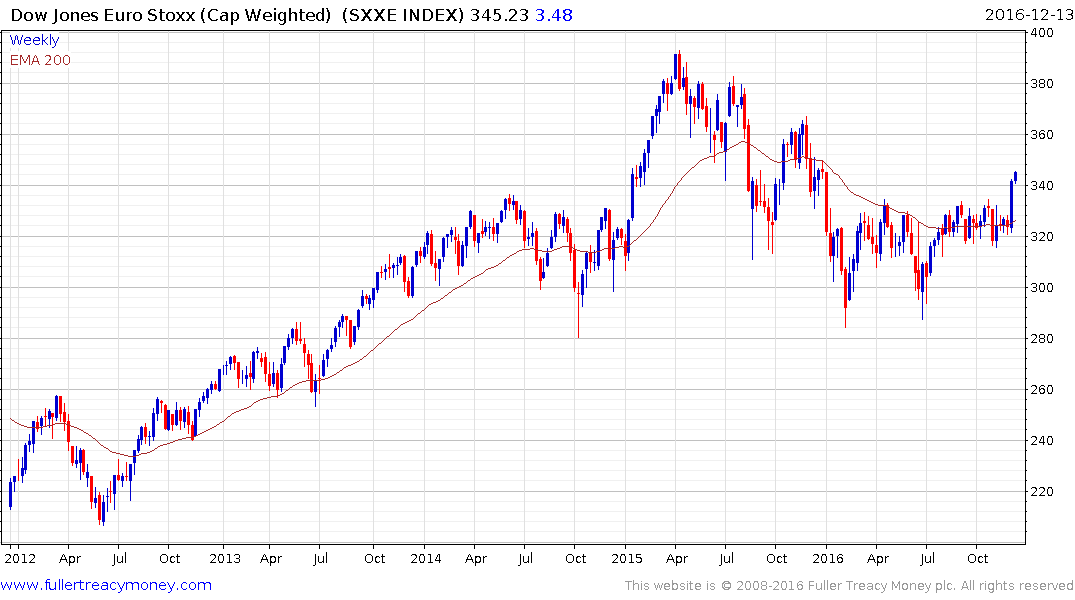

The majority of European stock markets are responding favourably to these developments.