Investment ramifications of a Trump Presidency

It was a bruising campaign but with control of all three branches of government the Republican Party now has a relatively unfettered path to introducing a broad range of policy options. The one obstacle of course is that the entrenched bureaucracy in Washington and the various unions are totally opposed to just about any change to the status quo.

Corporate taxation and the tax code more generally could be up for debate. Securing a budget large enough to make a dent in the deferred maintenance of the USA’s infrastructure is perhaps the clearest ambition of a Trump Presidency. Protectionism is also high on the agenda and the responses of NATO and EU spokespeople to the news was a picture of unease at this new source of uncertainty. Immigration is also likely to be a major topic of conversation for this administration.

The Mexican Peso has been the lightning rod for bets on a Trump presidency since it is a major centre for US offshoring as well as a conduit through which hundreds of thousands of people migrate into the USA every year. The Dollar has been trending higher against the Peso since 2013 and bounced rather emphatically from the region of the trend mean this week. A sustained move below MXN18 would be required to question medium-term scope for continued upside.

However the primary spot rates exhibited even more volatility. The Euro spiked higher in a kneejerk reaction overnight but the Dollar has been strengthening all day and moved into positive territory about midway through the US trading session. The Euro’s progression of lower rally highs, evident since May, remains intact.

The Yen strengthened all the way back to ¥101 but closed out the day closer to ¥105 suggesting the 5% decline on the Nikkei-225 will be completely unwound tomorrow.

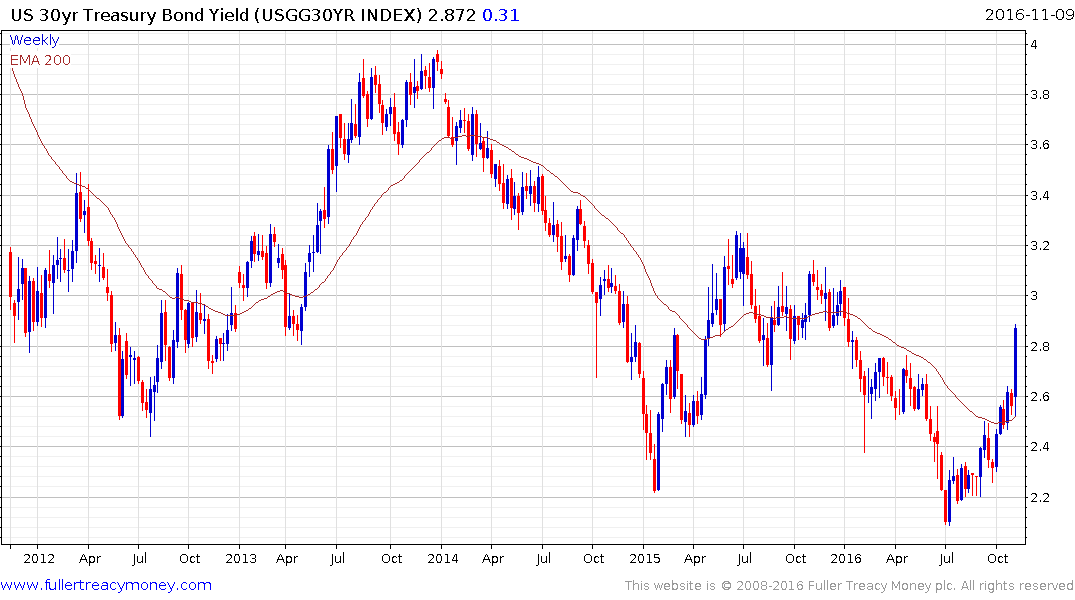

I saw a large number of articles last night quickly concluding that the Fed would not raise rates in December. However if Trump does indeed pursue a fiscal spending spree when the US is already at full employment there will almost certainly be inflationary ramifications. The Fed might have no choice but to raise rates and the moves in the bond market today support that view. 30-year yields, which are most at risk from interest rate hikes, surged higher today.

I reviewed cement companies on November 2nd. The majority of companies with substantial US businesses are already in well-defined medium-term uptrends but today’s news will have added additional impetus to their advances. For example Vulcan Materials was among the best performing shares on the S&P500 today.

Caterpillar has held a progression of higher reaction lows just about all year and rallied again from the region of the trend mean today.

The resources sector generally has been boosted by the prospect of greater infrastructure spending.

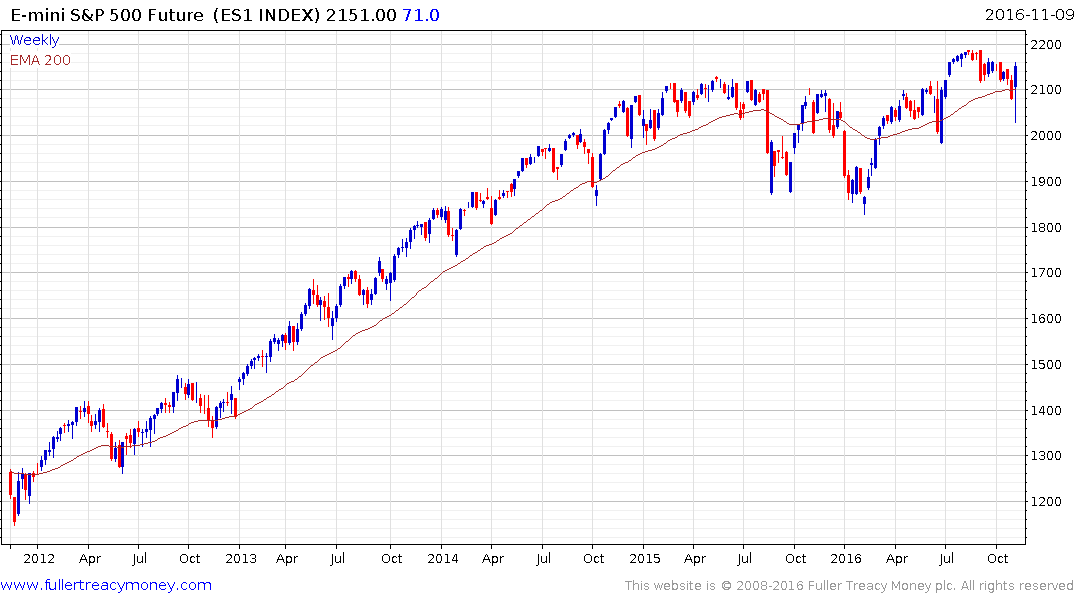

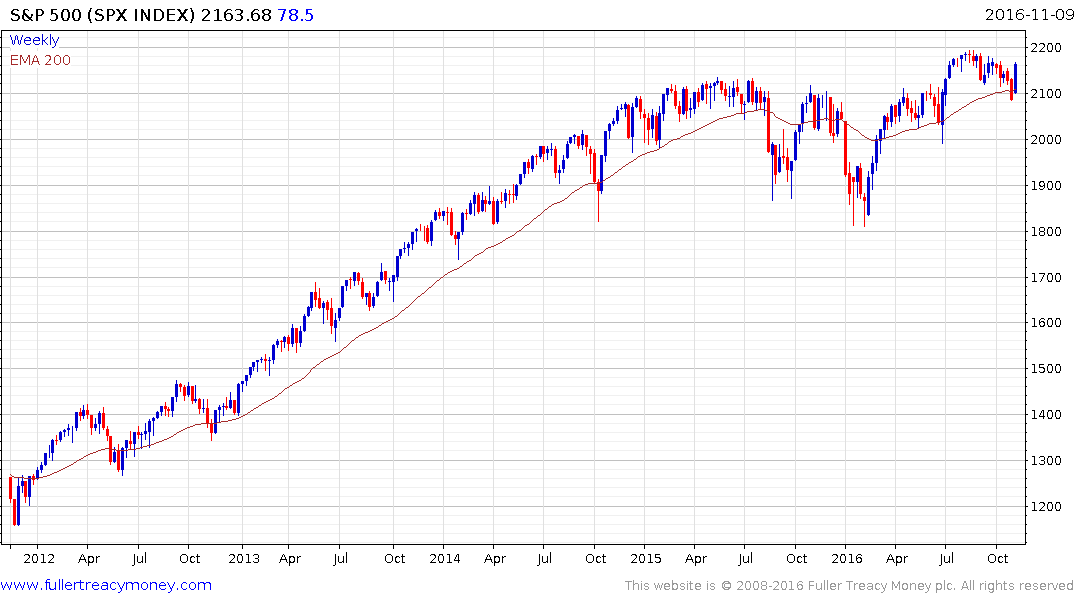

The performance of the S&P500 futures compared to the actual index is a great reflection of how the initial reaction morphed considerably as investors took stock of what it means for the Republican Party to control all three parts of the government. When the Pennsylvania results were announced the futures contract was reading a failed upside break, but by the time the market opened it had rallied all the way back up to unchanged and then rallied even further. Since we can really only give credibility to what happens during market hours the Index has successfully bounced from the region of the 200-day MA this week and reasserted demand dominance.

Back to top