Investment Implications of a Shorter Cycle

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

The last four cycles were unusually long. This one could be shorter: The last four US expansions were unusually long, ranking as the first, second, third and sixth longest among 34 business cycles over the last 164 years. We think we’re now in a new cycle, and that it could burn hotter and shorter.

Why it could be shorter: 1) Record fiscal and monetary stimulus; 2) High savings rates; 3) A concentration of job losses in COVID-19-impacted sectors (which could reverse); and 4) A greater willingness of policy-makers to run a “high-pressure economy”. Shorter cycles can co-exist with good growth (i.e., the 1920s and 1950s).

Equity market implications: A shorter-cycle narrative fits with our call for a ‘V-shaped’ earnings recovery. Equity leadership is already starting to shift from ‘early’ to ‘mid’-cycle, and we have closed our preference for long US small versus large caps, initiated in April last year.

Cross-asset implications: Early-cycle positioning has been central to our cross-asset views, but this suggests that more flexibility will be needed. Look for opportunities to rotate out of strong-performing early-cycle assets, and towards strategies that tend to perform best as the cycle matures (Europe and Japan equities, short-dated high yield).

The long expansions we have seen over the last decades have been followed by very sharp corrections with one sector or another crashing to previously unimaginable lows. That begs the question if a potential return to shorter cycles will result is less excess and shallower reactions? There is not a great deal of evidence to support that contention unfortunately.

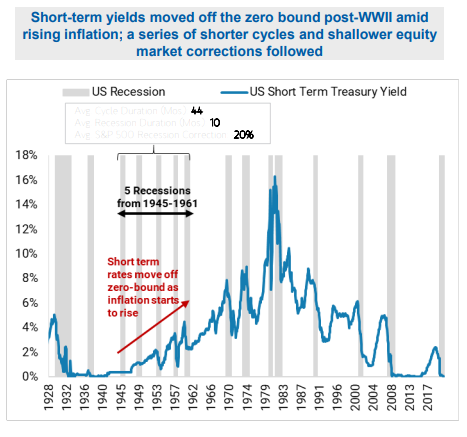

When interest rates rose from the zero bound as inflation picked up in the 1940s coincided with a series of short sharp recessions which saw significant bond and stock market volatility.

At present, we have little choice but to take the Federal Reserve at its word that they will tolerate higher inflation for as long as it takes to trend higher. That infers the first rate hike a couple of years hence.

In the short-term, sovereign bonds have sold off aggressively all over the world. If inflationary pressures do not manifest themselves quickly there is scope for a rebound. 10-year Treasury futures have lost downward momentum suggesting less eagerness to short. Meanwhile their will be plenty of people who think of 1.7% as a desirable yield if they think it will shrink rather than expand from here.

If dip buying in Treasuries takes place in earnest, that will certainly aid the argument for additional upside in the growth portion of the market, The Nasdaq’s rebound today may already be pricing in that potential.