Interesting charts on April 12th 2016

Brent crude has now closed its overextension relative to the trend mean and has sustained two reactions of approximately $6 from its January low. This has been a 64.5% rally to date and a reaction of greater than $7 would be required to question potential for continued upside.

This oil rebound is acting as a much needed bullish catalyst for commodity related stock markets and currencies.

The Canadian S&P/TSX has now pushed back above its 200-day MA.

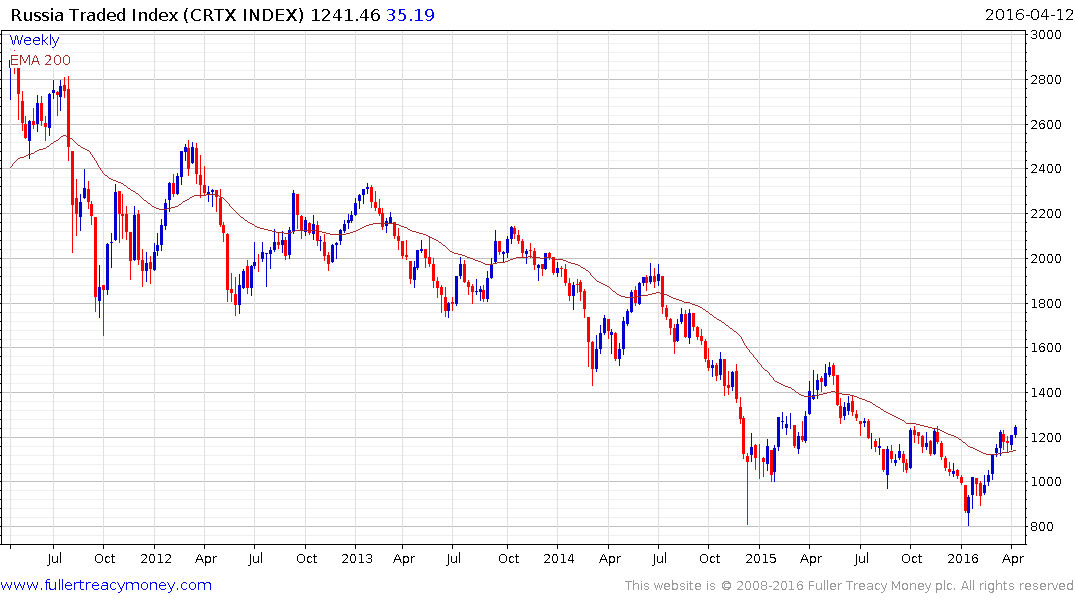

The Russian RTS has broken a lengthy progression of lower rally highs.

The Johannesburg All Share index, where BHP Billiton represents a significant weighting, has benefitted from the weakness of the Rand. It firmed this week from the region of 50,000 and a clear downward dynamic wold be required to check potential for continued outperformance at least in nominal terms.

The Brazilian iBovespa Index continues to rebound and found support last week in the region of its trend mean. With rebounding commodity prices and the increasing potential for a new administration, a sustained move below 47,000 would be required to question potential for additional upside.