Interesting charts April 29th 2015

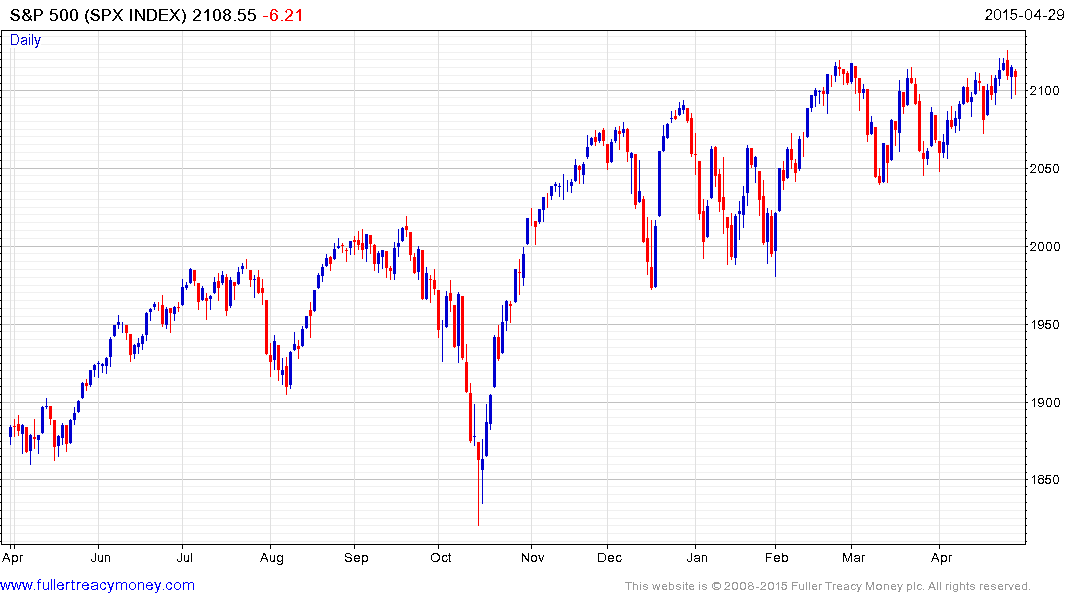

If the Dollar acted as a headwind for Wall Street while it was surging, its decline should help to act as a support. The S&P 500 was relatively inert today against a sharp decline in Europe. A sustained move below 2040 would be the minimum required to begin to question potential for continued higher to lateral ranging.

If the Dollar acted as a headwind for Wall Street while it was surging, its decline should help to act as a support. The S&P 500 was relatively inert today against a sharp decline in Europe. A sustained move below 2040 would be the minimum required to begin to question potential for continued higher to lateral ranging.

NYSE Arca Gold BUGS Index – has been ranging with a mild upward bias since late 2014 and has now returned to test the region of the 200-day MA. The Index has not traded above the trend mean for more than a week since 2012 so a sustained move above it would suggest demand has returned to dominance beyond the short term.

Continuous Commodity Index is breaking out of the short-term range to post its first higher high in a lengthy period. A sustained move below 420 would be required to question potential for an additional reversionary rally.

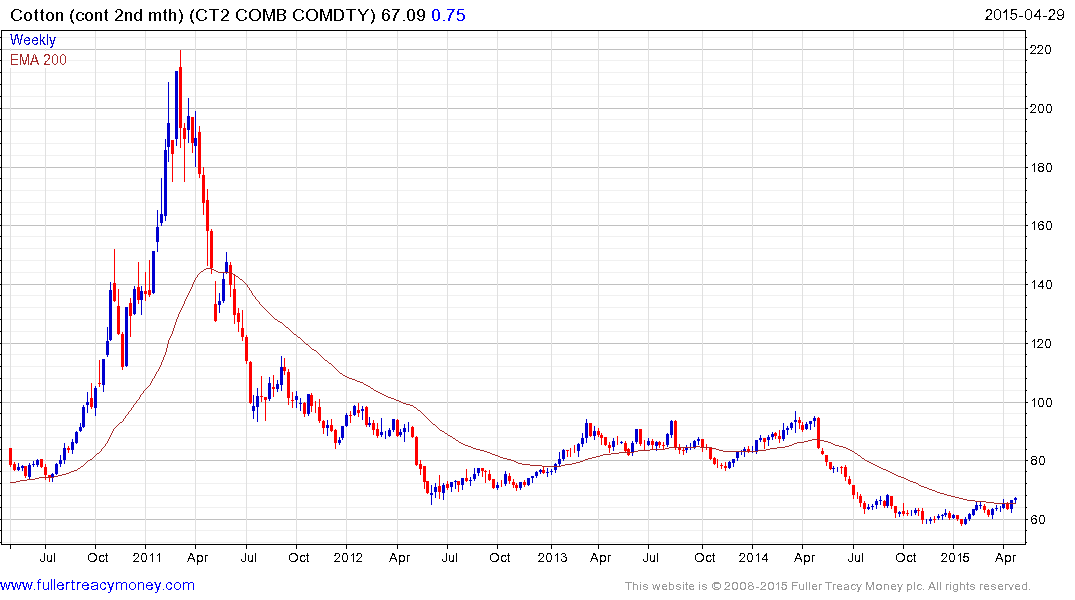

Cotton exhibits a rounding characteristic over the last 9 months consistent with accumulation.

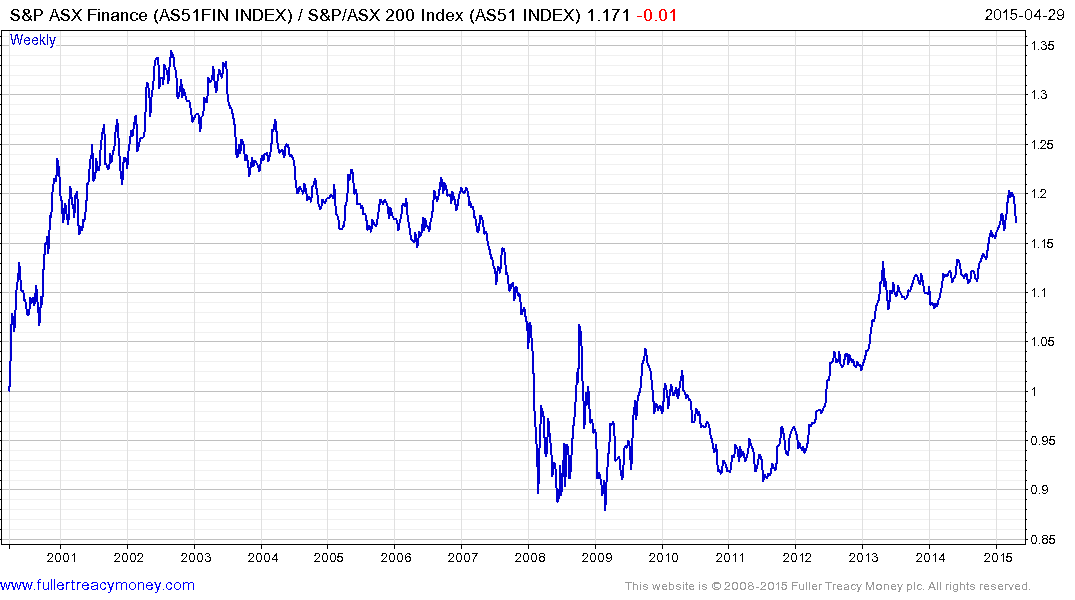

The Australian Financial sector has been leading the wider market higher since 2011. It is currently pulling back to unwind an overbought condition and will need to find support in the region of 1.14 if the medium-term pattern of outperformance is to remain intact.

Back to top