Interesting charts

West Texas Intermediate Crude oil has not rallied nearly as well as Brent Crude; emphasising the slow response of supply to the fall in prices despite the lower rig count. A process of mean reversion is underway but a clear upward dynamic will be required to signal a return to demand dominance.

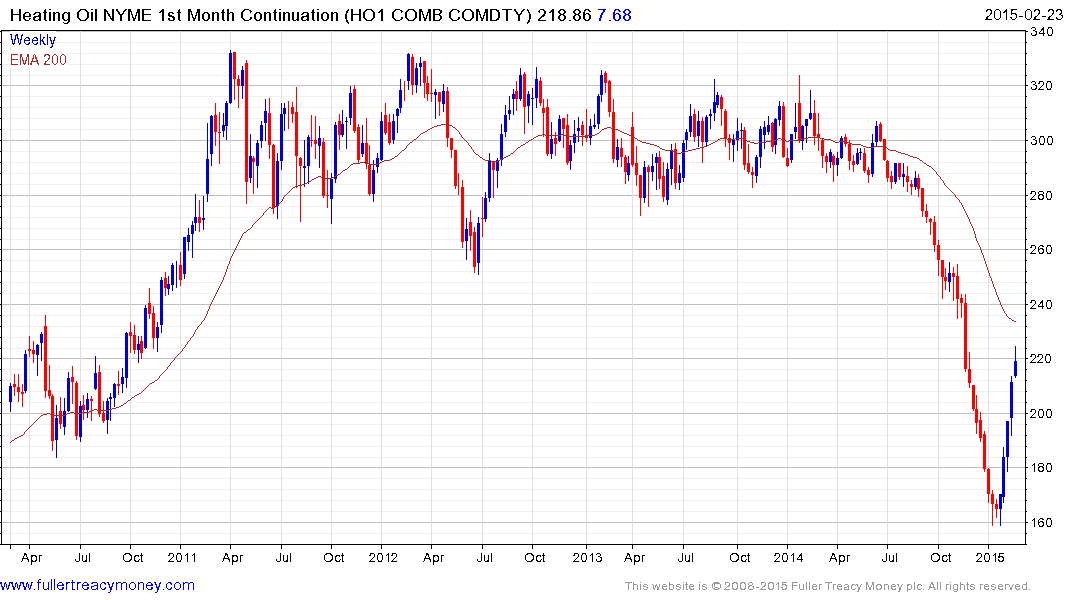

Heating Oil has almost completely unwound its oversold condition relative to the 200-day MA and some consolidation of this impressive four-week rally is looking increasingly likely.

Arabica coffee – failed to find support in the region of the 200-day MA from December, encountered resistance in the region of the trend mean in January and is now extending the decline. A clear upward dynamic will be required to check momentum beyond a brief pause.

Mexican Peso Per 1 US Dollar – The Peso had been among the steadier commodity related currencies until oil prices collapsed. The Dollar is now testing the region of its 2009 peak and a break in its progression of higher reaction lows will be required to suggest more than temporary resistance.

Back to top