Insights

Thanks to a subscriber for this edition of Gary Shilling’s report which is well worth taking the time to read, not least for the details of how many populist movements are gaining traction globally. Here is a section on Treasuries:

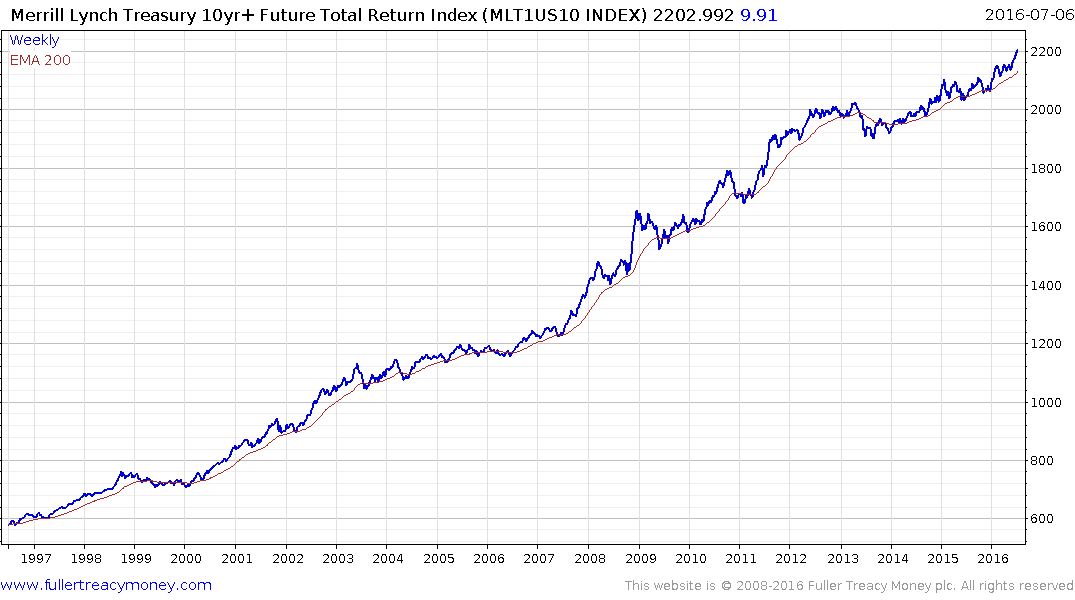

As for Treasurys, we believe that what we dubbed “the bond rally of a lifetime” 35 years ago in 1981 when 30-year Treasurys yielded 15.2% is still intact. This rally has been tremendous, as shown in Chart 33 (page 38), and we happily participated in it as forecasters, money managers and personal investors. Chart 33 uses 25-year zero-coupon bonds because of data availability but the returns on 30-year zeros were even greater.

Even still, $100 invested in that 25-year zero-coupon Treasury in October 1981 at the height in yield and low in price and rolled over each year to maintain its maturity or duration was worth $29,096 in May of this year, for a 17.9% annual gain. In contrast, $100 invested in the S&P 500 index at its low in July 1982 is now worth $4,608 with reinvested dividends. So the Treasurys have outperformed stocks by 6.3 times since the early 1980s. And as we’ve often said, most investors believe Treasurys are only suitable for little old ladies and orphans.

Most investors only look at the yield on Treasurys and say it’s now far too low to be of interest. But we’ve never, never, never bought Treasurys for yield. We couldn’t care less what the yield is as long as it’s going down—so prices are rising. We’ve always bought Treasurys for the same reason most investors buy stocks: appreciation.

We’ve discussed in detail in past Insights the many reasons that equity investors, investment bankers, Wall Street analysts and even institutional bond managers are negative on Treasurys and have been throughout this marvelous 35-year rally. The current disdain was expressed in the June 10 edition of The Wall Street Journal: “The frenzy of buying has sparked warnings about the potential of large losses if interest rates rise. The longer the maturity, the more sharply a bond’s price falls in response to a rise in rates. And with yields so low, buyers aren’t getting much income to compensate for that risk.” Since then, the 30-year Treasury yield has dropped from 2.48% to 2.15% as the price has risen by 6.5%.

Then, the July 1 Journal wrote: “Analysts have warned that piling into government debt, especially long-term securities at these slim yields, leaves bondholders vulnerable to the potential of large capital losses if yields march higher.” Since then, the price of the 30-year Treasury has climbed 3.1%.

But what if instead of rising, Treasury yields fall, as they have this year, returning 14.1% on the 30-year Long Bond compared to 3.9% for the S&P 500? And we believe there's more to go. Over a year ago, we forecast a 2.0% yield for the 30-year bond and 1.0% for the 10-year note. If yields fall to those levels in a year from the current 2.14% and 1.38%, respectively, the total return on the 30-year coupon bond will be 5.1% and 4.9% on the 10-year note. The returns on zero-coupon Treasurys with the same rate declines will be 4.2% and 3.8% (Chart 34).

Here is a link to the full report.

A big question right now is whether the stock market is rallying because investors believe the liquidity on which asset price inflation has been predicated over the last six years is going to get another big infusion. The Fed is unlikely to raise rates while global growth is mixed at best because of the upward pressure that would put on the Dollar.

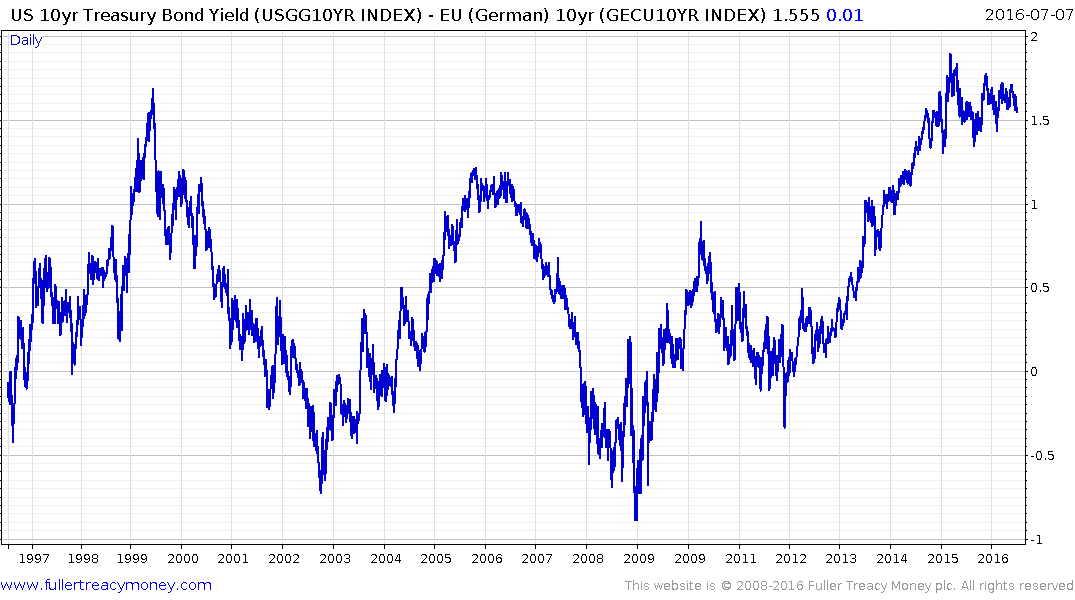

Bond investors are concluding that with negative rates in most of the G7 there is no prospect of the Fed or BoE raising rates and in fact they may be forced to cut. The spread between Bunds and Treasuries is close to historic peaks so the potential for contraction looks more likely than not. It’s another question entirely whether one can profit from this contraction given the currency volatility involved.

Meanwhile the Merrill Lynch 10yr+ Treasury Total Return Index continues to represent just about the most consistent long-term uptrend in history. Provided it does not sustain a move below the trend mean, there is no reason to question the consistency of the advance.

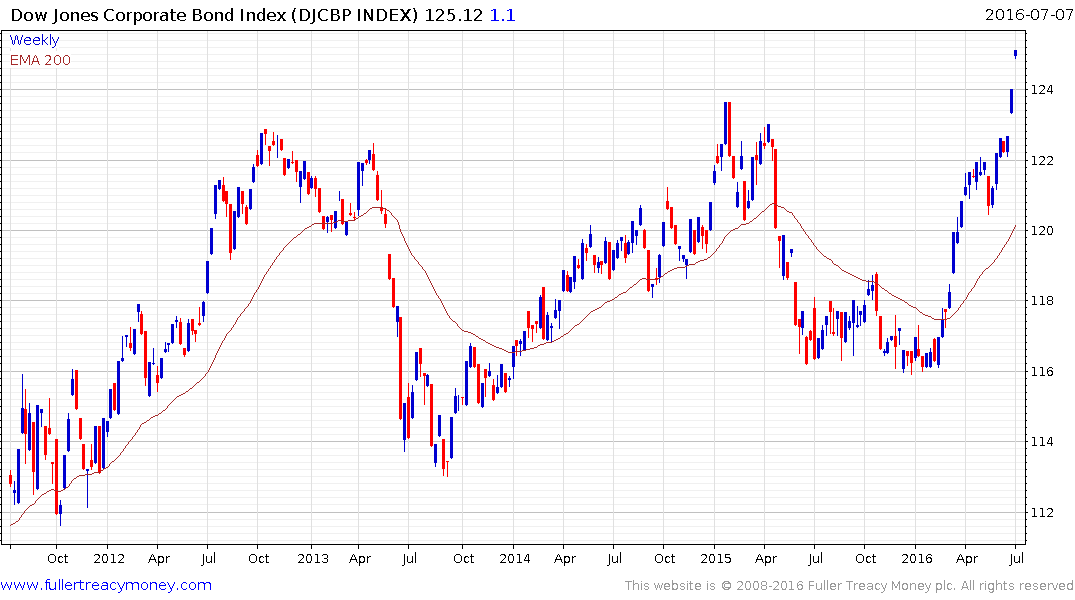

The Dow Jones Corporate Bond Index broke out of a three-year range this week to new all-time highs. While somewhat overbought in the very short-term, a clear downward dynamic will be required to check momentum.

The S&P500, which still yields 2.15%, is within 4 points of its all-time highs and could be primed for a similarly powerful breakout. With valuations at relatively elevated levels, if the 19-month range is indeed resolved to the upside it could represent the beginning of the third psychological perception stage of the bull market where valuations become considerably more expensive.