Inside China's Plans for World Robot Domination

This article from Bloomberg News may be of interest to subscribers. Here is a section:

Under a sweeping proposal called “Made in China 2025,” as well as a five-year robot plan launched last April, Beijing plans to focus on automating key sectors of the economy including car manufacturing, electronics, home appliances, logistics, and food production. At the same time, the government wants to increase the share of indigenous-branded robots in China to more than 50 percent of total sales volume by 2020 from 31 percent last year.

Robot makers and the companies that automate will be eligible for subsidies, low-interest loans, tax waivers, and rent-free land. “Fair or unfair, you can expect Chinese companies will get a lot of preferential treatment and funding,” said Rose with Boston Consulting. “They actually have a comprehensive plan to get there. And their track record isn’t terrible either.”

Industrial automation is crucial for China, home to an aging population and shrinking labor force. Manufacturing wages have more than doubled in the last decade. Also, younger Chinese workers, “don’t want to do repetitive work,” said James Li, President of ABB Robotics China, the local unit of Switzerland’s ABB Ltd. and one of the first robot companies to set up in China. It supplies machines that spray paint cars and man electronics assembly lines. “Robotics is hot,” said Li, who notes that local governments are investing heavily in industrial parks to develop the technology.

The big question for robot manufacturers is will China do for their sector what it did for the solar sector? My sense of the challenges involved is that Chinese dominance of the robotics sector is a medium-term rather than short-term possibility. The companies involved have a lot of progress than needs to be made in developing software, optics and interfaces to truly challenge incumbents. However we can be reasonably assured they will be get better every year.

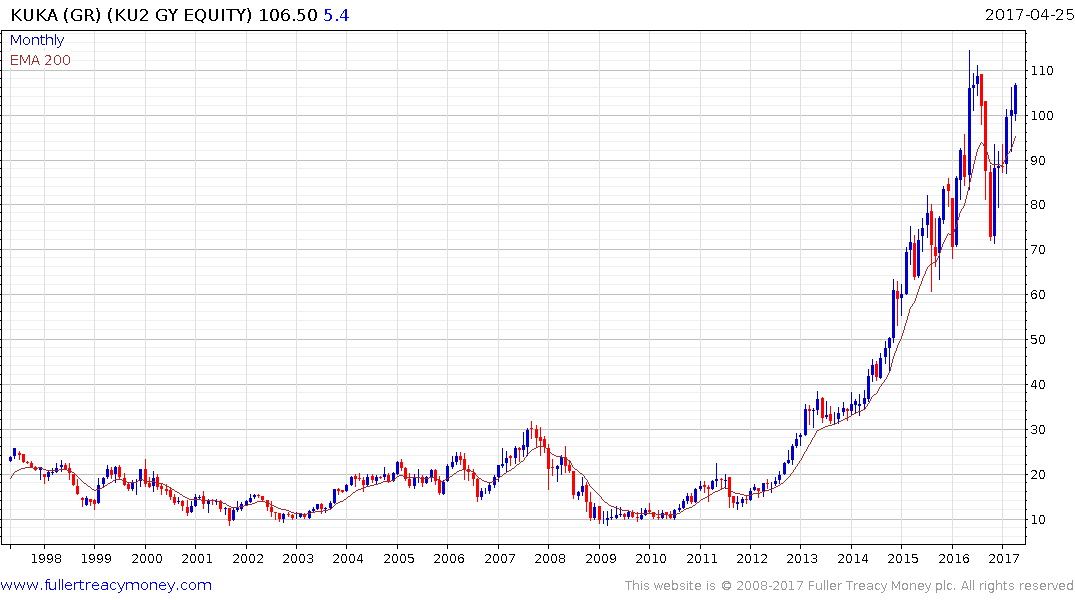

Midea acquired Germany’s Kuka last year so the flow of technical knowhow has already begun. As part of the deal they had to assure German jobs until 2023 and had to continue to maintain the company’s German listing. As one of the top 4 suppliers to China, Kuka might be considered a barometer for the success of Chinese robotics manufacturers. The share has recouped almost all of last year’s decline and is now challenging its peak near €110.

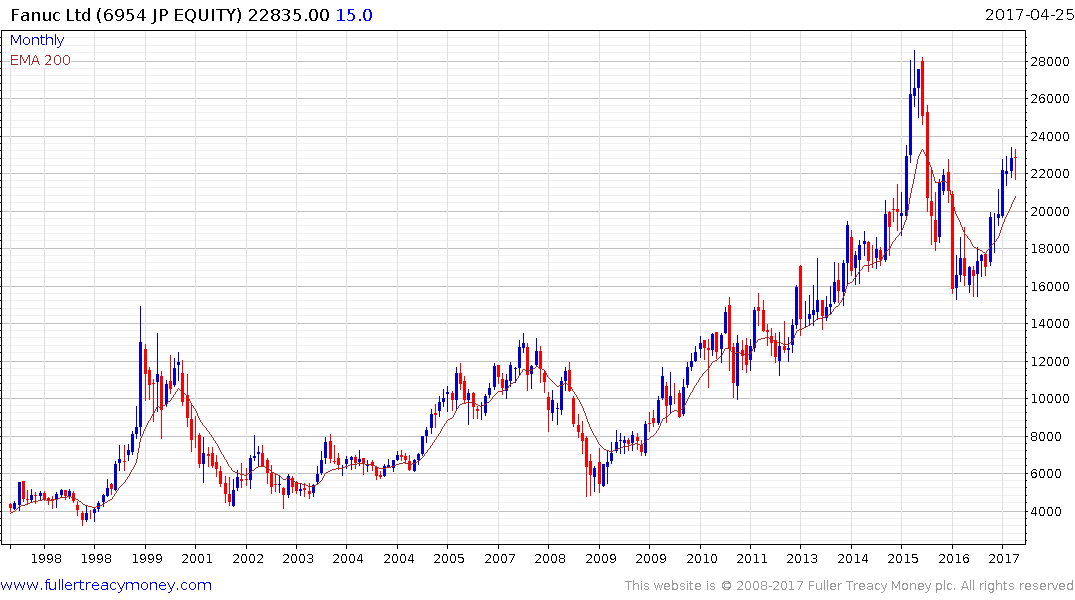

Fanuc rallied in October to break a yearlong progression of lower rally highs and remains on a recovery trajectory.

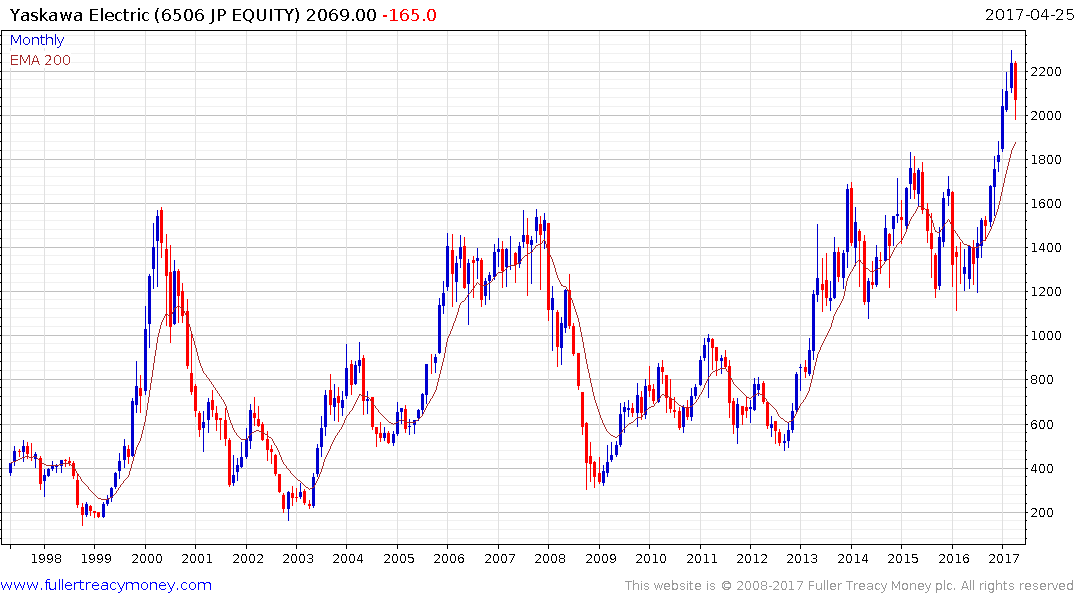

Yaskawa Electric completed a 17-year base formation in January and found at least near-term support this week in the region of ¥2000.

ABB has been ranging below CHF25 since 2009 but has held a progression of higher reaction lows since last year. A sustained move below the trend mean would be required to question potential for a successful upward break.