Inflation Regime Roadmap

Thanks to a subscriber for this report from MAN Institute which may be of interest. Here is a section:

So there’s plenty to choose from here and all seven are useful to hold in mind when thinking about inflation. For our part, we think an acceleration in inflation could now be driven by a combination of the following – the first two being critical to our case:

Monetarism – expecting persistent deficit financing causing the money stock (M2) to rise relative to GDP. Some would classify this as demand-pull inflation;

Marxism – believing that it will be impossible to re-impose austerity after the Coronavirus is over and that voters will demand rising real wages to control income inequality. Some would classify this as cost-push inflation;

Neoclassical effects – the just in time, Asia-dominated global supply chain is likely to morph into a just in case, home-grown supply chain, causing a large-scale supply-side disruption;

Environmental effects – on the basis the one should never let a good crisis go to waste, it’s likely that G7 governments now use their new-found balance sheet room to accelerate the capital investment required to make their economies ecologically sustainable, which will have the side effect of raising fixed capital costs for private sector firms.

Here is a link to the full report.

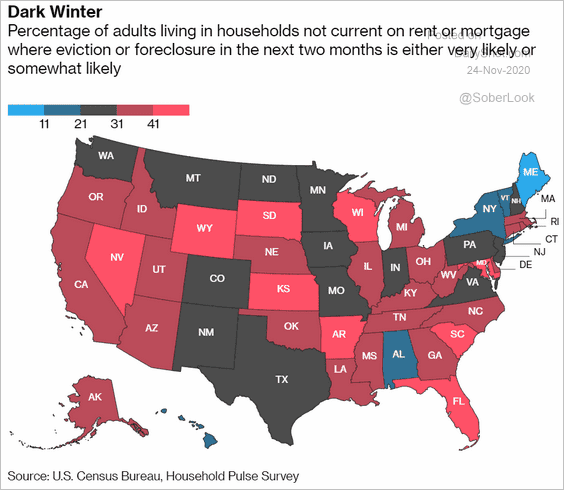

Some concern has been expressed this week at the impending expiry of the moratorium on evictions in the USA. This is a useful graphic.

It highlights the fact that many states have 30% delinquency on mortgages/rent. Interestingly, despite the widely held view that New York is on the cusp of being denuded of inhabitants, it is far from the worst in terms of delinquency.

With upwards of a third of the population behind on their mortgage or rent it is impossible for the government to let the moratorium on evictions expire or to fail to extend unemployment benefits. The scale of evictions would dwarf the foreclosure crisis in terms of its scale and it would cause a revolution. Therefore, it is unlikely to occur.

Instead yield curve control is much more likely. The Fed is already stretching the maturity of its purchases and a move to outright targeting of longer-dated bonds is inevitable. The alternative would be to allow the government’s debt service costs to climb to levels that would result in a massive hit to spending which no one is prepared to all transpire.

Gold has been closely correlated with the 10-year yield this year. A rising yield has corresponded with the pullback in gold. With the clear intention of the monetary and fiscal authorities to codify their negative real interest rate plan, the correlation between bonds and gold is unlikely to persist.

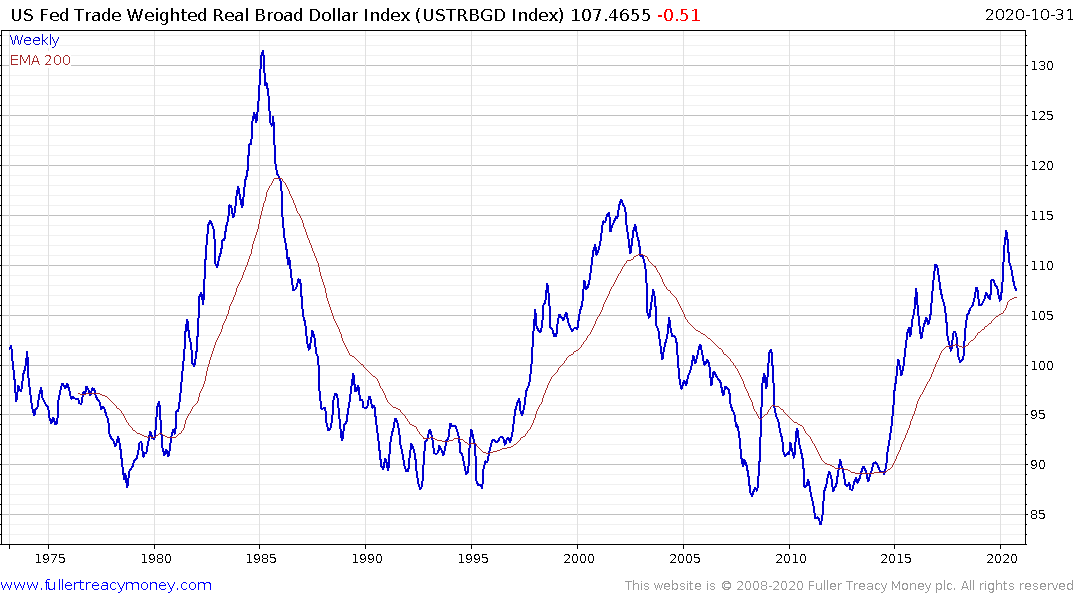

The old calculation of the US Trade Weighted Broad Dollar Index was discontinued in December and this is the new formulation.

It’s not all that different from the Dollar Index but the uptrend since 2011 is more noticeable. It is looking increasingly likely that the spike higher earlier this year was a failed upside break and that the almost decade long trend is over.