India's Surprise Rate Hike Spurs Aggressive Tightening Bets

This article from Bloomberg may be of interest to subscribers. Here is a section:

The Reserve Bank of India stunned markets Wednesday with a 40-basis point rate increase and a move to suck out billions from the banking system. That was a remarkable U-turn from February, when it announced an ultra-dovish policy, highlighting a relaxed stance toward inflationary pressures at home and U.S. tightening abroad.

“We believe the rate hike is a belated acknowledgment of the inflation risks and that policy has been behind the curve,” Nomura analysts Sonal Varma, Aurodeep Nandi and Nathan Sribalasundaram wrote in a note.

Yields on the benchmark 10-year bond jumped as much as 30 basis points on Wednesday to 7.42%, the highest since 2019, while the shorter 4-year yield saw a nearly 50 basis point jump. Yields extended gains on Thursday.

Emerging market central banks have much more direct experience of the damage high inflation can do. They are usually alert to inflationary pressures and tend to implement remedial action quickly. Brazil hiking from 2% to 12.75% in little more than a year is a good example of that. That also helps to highlight just how out of step the RBI has been. The Repo rate was stock at 4% for nearly two years before this week’s hike.

India is relatively isolated from the global supply chain and is one of China’s smallest trading partners, so it has not been under as much pressure as other countries from bottlenecks. However, the strength of the Dollar and high commodity prices are boosting import prices. Even though India is still buying oil from Russia, the full effect of the price rises cannot be completely avoided.

The Rupee is back testing its lows which suggests the market does not view the recent hike as sufficient to get ahead of inflation.

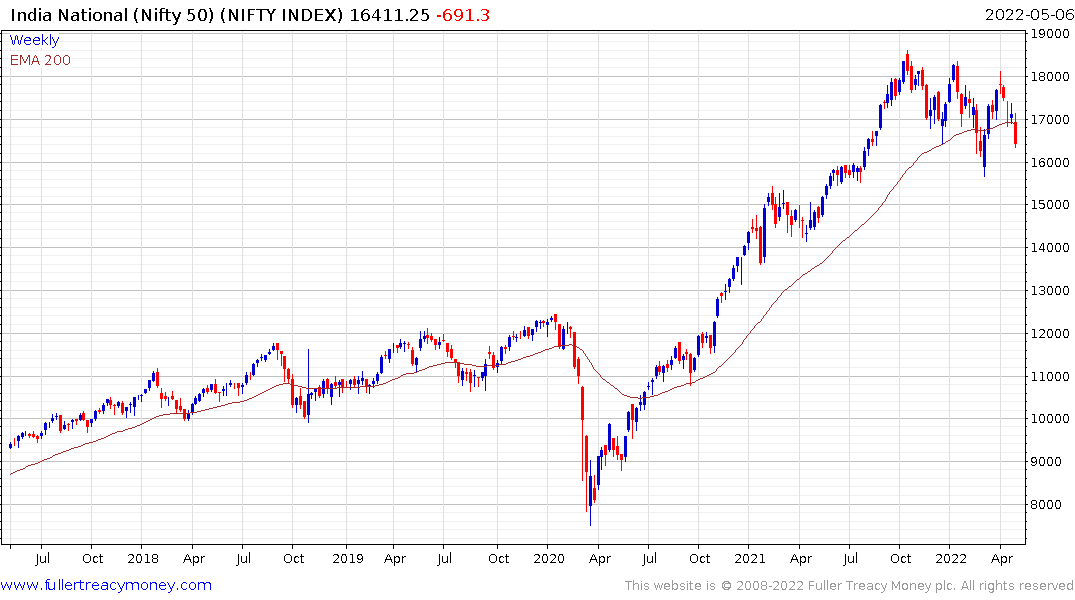

The Nifty Index has held up better than many other markets but is liable to play catch up on the downside if selling pressure persists on international markets.

Indian government bond yields are accelerating higher as they close in on the decade-long sequence of lower rally highs.