India's Real 10-Year Yield Turns Most Negative Since 2020

This note from Bloomberg may be of interest to subscribers. Here it is full:

India’s faster-than-expected inflation print for April has pushed the pace of consumer-price rises above the benchmark bond yield by the most since 2020. The return of the negative real yield suggests the Indian debt may suffer a deeper selloff.

India’s real policy rate -- the spread between the central bank’s main rate and inflation -- has been negative for several months, like almost all emerging markets (China, Brazil and Indonesia are exceptions). But the latest inflation data has turned the market-determined real bond yield negative too.

India might just be paying the price for its hesitation to raise interest rates. The Reserve Bank surprised markets last week with a 40-bp hike, after previously saying it would stick with a dovish policy as consumption remained below pre-pandemic levels. It had hoped oil prices might come down, but crude prices remain above $100 a barrel and the nation’s consumer-price inflation is more broad-based, including items like clothing and footwear.

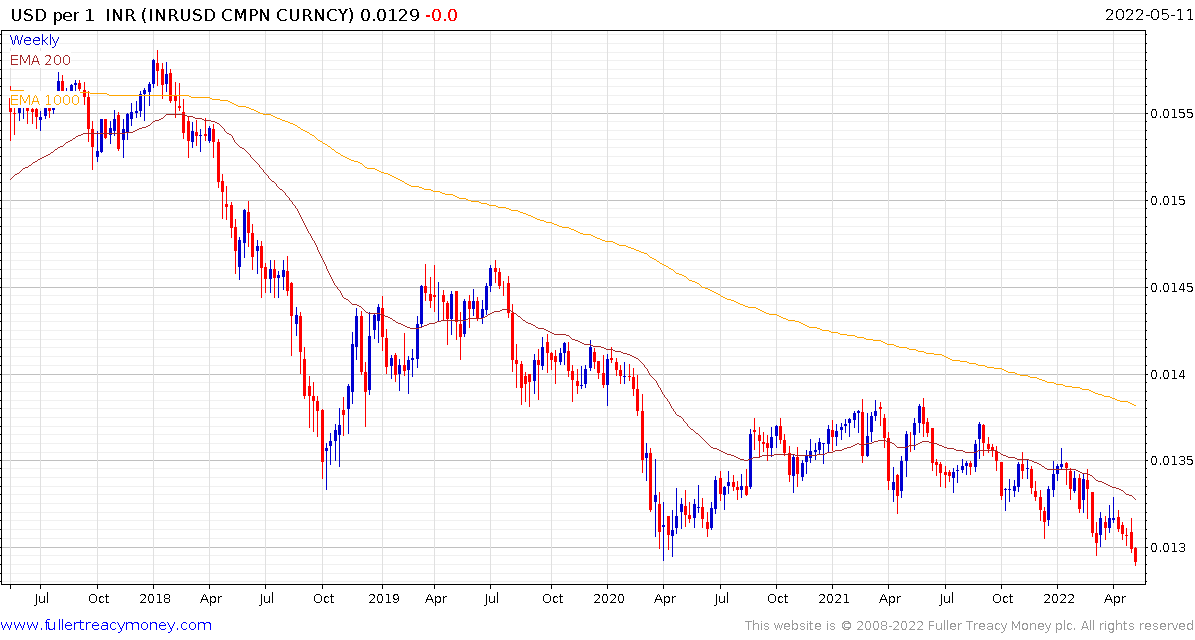

The upward pressure on inflation from the rising cost of commodity imports suggests the RBI will have no choice than to accelerate interest rate hikes. The Rupee has held a succession of lower rally highs since early 2021 and broke to a new all-time low today. Considering the strength of the US dollar, this has been a better performance than other regional currencies but that does not detract from the fact a weaker currency boosts inflation.

The Nifty Index is beginning to play catch up with the corrections on the wider global markets and dropped today to test the March low. A clear upward dynamic would be required to signal a return to demand dominance.