India's Free-Market Oasis Aims to Take On Singapore and Dubai

This article from Bloomberg may be of interest to subscribers. Here is a section:

Another product has migrated to the financial center: a popular derivative based on a benchmark gauge of Indian stocks that was traded on the Singapore Stock Exchange. In 2022 the National Stock Exchange of India opened a cross-border trading link with Singapore—similar to the Hong Kong-Shanghai connect—to allow global investors to trade stock derivatives listed on the Indian market without needing to set up shop in India.

Trading volumes have increased since a single regulator, the IFSC Authority, was created by the Indian government in 2020 to streamline approvals and oversight in the special economic zone. In October, average daily turnover on the two stock exchanges in the financial center climbed to $14.6 billion, from $3.4 billion two years before, cumulative derivative transactions by banks jumped to $466 billion, from $22 billion, and cumulative banking transactions rose to $303 billion, from $45 billion.

“Beyond the shores of India, in some of those centers where India-centric business developed, they are able to notice that something is happening, and things may not be the same in the future,” says Injeti Srinivas, the IFSC Authority’s chairman. “Business is gravitating toward IFSC.”

A new international bullion exchange will let qualified jewelers directly import gold to India through GIFT City, a change from current rules permitting only some banks and nominated agencies approved by the central bank to do so. That loosening of restrictions is set to widen the importer base in India, the world’s second-biggest consumer. An aircraft leasing and financing business is operating in GIFT City to tap into the demand of one of the world’s hottest aviation markets for new-plane orders. Ship leasing will start soon.

Bull markets thrive on liquidity and so do economies. India has a burgeoning young population. The biggest challenge the government has is growing the economy quickly enough to absorb the productive capacity of that many people. Setting up special economic and financial zones is a vital step in attracting sufficient inward investment to make a difference.

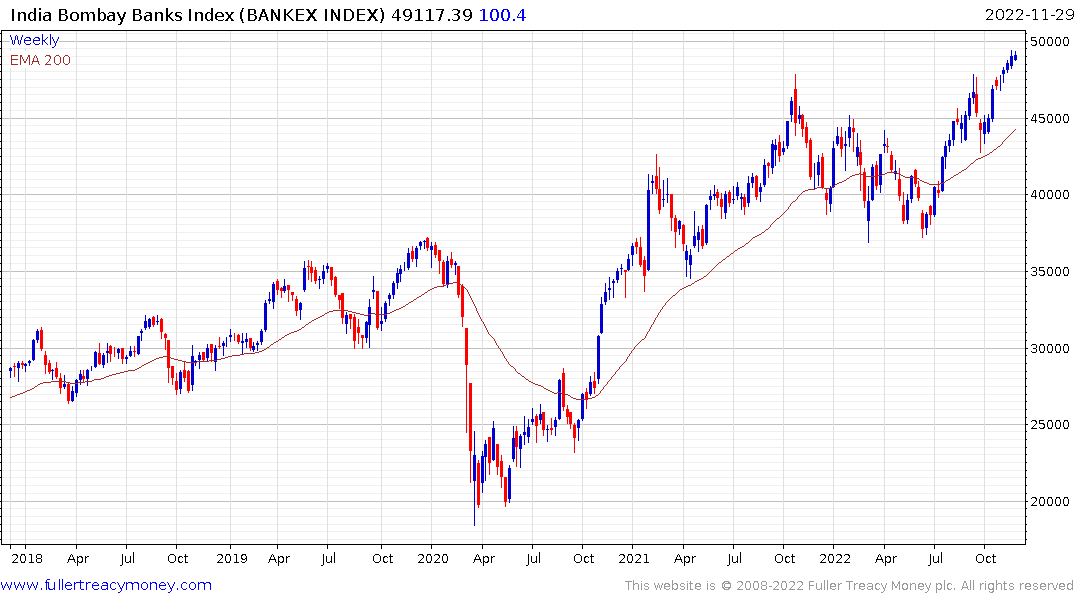

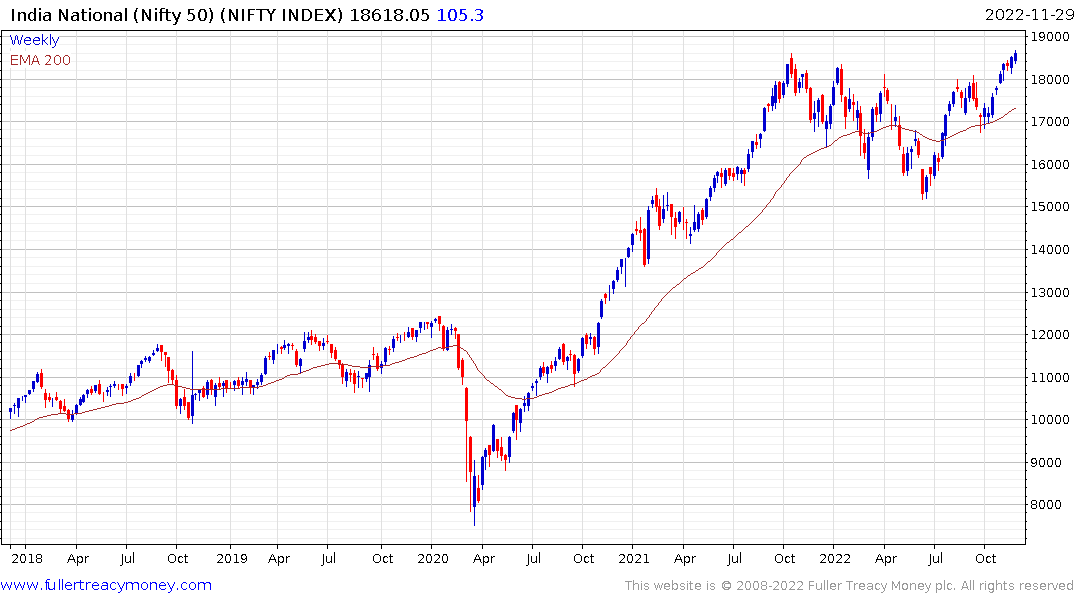

The Bombay Banks Index has been a reliable lead indicator for the wider Indian stock market for more than a decade. It hit a new all-time high 3 weeks ago. The Nifty Index made a new high today.

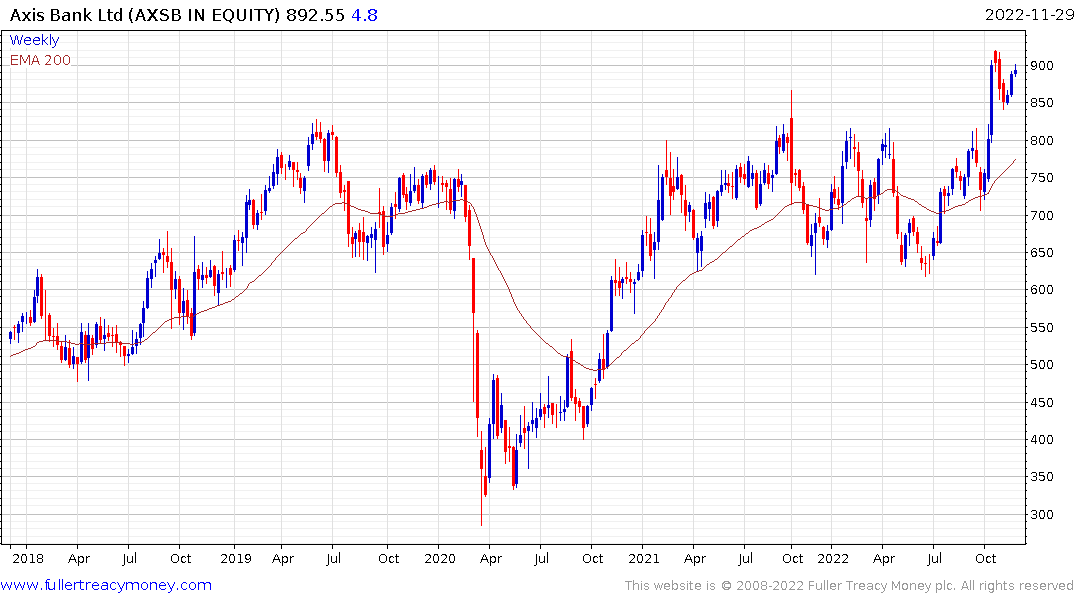

Axis Bank is consolidating near new all-time highs, following its breakout from a four-year range.

Axis Bank is consolidating near new all-time highs, following its breakout from a four-year range.

The weakness of the Rupee has been a headwind to the performance of overseas funds. By the same token, the times when the Rupee stabilises have been among the most rewarding for foreign investors. For now, the Dollar is still trading above its trend mean in Rupees.