Incrementum AG Investors Letter

Thanks to a subscriber for this letter by Ronald Peter Stoferle and Mark Valek which may be of interest. Here is a section:

That the Fed is walking on eggshells has become obvious from the complications related to hike rates for the first time in 10 years. This impressively demonstrates that the market is highly dependent on low interest rates. It seems as if the market participants would be conditioned on ever increasing money stimuli like Pavlovian dogs.

Regarding commodities, the fear of the first rate hike could turn out to be a huge “buy the rumor, sell the fact”. Contrary to the common assessment, commodities are the best performers after historical rate hikes of the Fed when comparing different asset classes.

On the other hand, the US dollar tends significantly lower after the first 100 days after the first rate hike.

Even though confidence in the equity markets continues to be exceptionally high, the actual performance is anything but formidable. While European stock indices were outperforming American titles, this primarily results from a significantly weaker euro. The term “devaluation boom” hits the bull’s-eye in this context.

With regard to the broad stock market, we think the party is pretty nearly over.

Here is a link to the full report.

A point made earlier by Allen Brooks’ is that the US Dollar does not tend to do well in the first three months following the first hike after an easing cycle. This is an important consideration because the majority of investors now seem to adhere to the medium-term Dollar bull story. We were early in identifying the relative strength of the Dollar and continue to believe that its secular decline is over not least because of widening interest rate differentials. However it is also worth considering the US administration does not want to have a currency which is appreciating against its international competitors in a linear fashion.

The Dollar Index continues to range below the psychological 100 level and a sustained move above that area would be required to reconfirm Dollar dominance.

Of particular interest is the fact that precious metals appear to be rallying more on Dollar weakness and falling less on Dollar strength of late. That represents tentative evidence this year’s weakness has been overly bearish and a great deal of bad news is already in the price.

Gold continues to firm from the $1050 area and a process of mean reversion looks more likely than not. A sustained move above the 200-day MA, currently near $1150, will be required to challenge the medium-term downtrend.

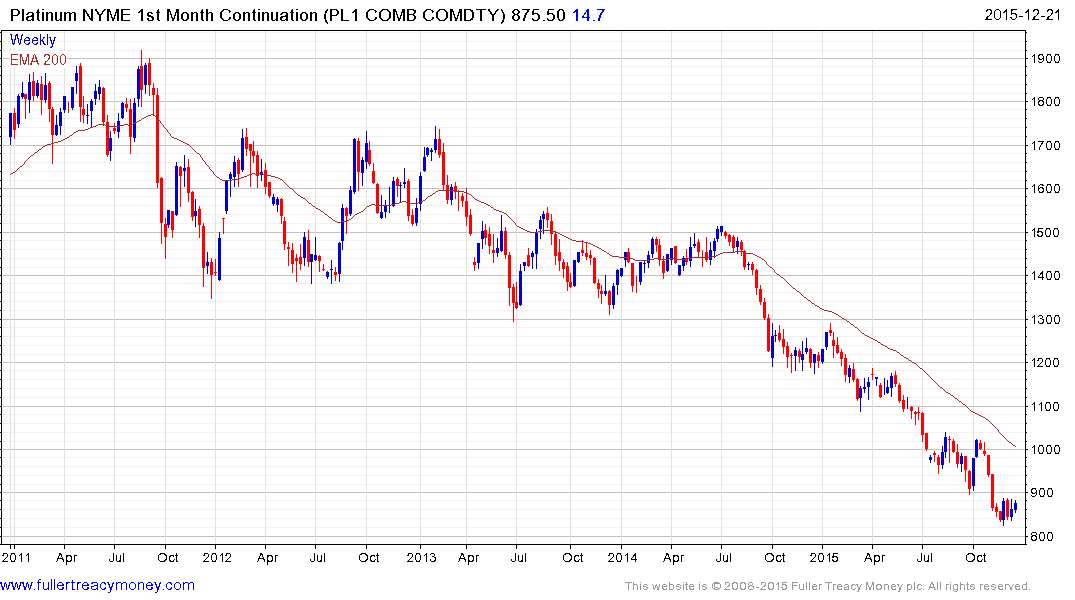

Platinum is even more overextended relative to the trend mean than gold and a reversionary rally appears to be underway.

Silver has been the subject of some quite extreme volatility over the last five trading sections, rallying and falling 5% on an almost daily basis. Some additional upside follow through would confirm a failed break below $14. A sustained move above $16 would be required to break the medium-term downtrend.

Palladium has at least paused above $500 and a sustained move below that level would be required to question potential for a reversionary rally similar to those in evidence in the other precious metals.

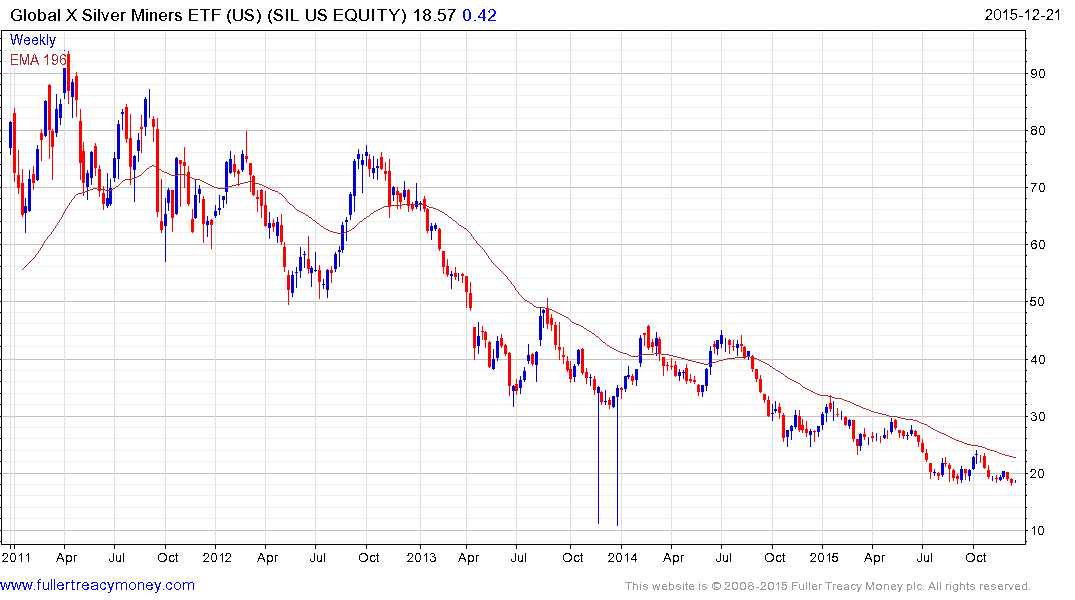

The Market Vectors Gold Miners ETF, Market Vectors Junior Gold Miners ETF and Global X Silver Miners ETFs have all been ranging for much of the last six months in relatively gradual processes of mean reversion. This inert trading is noteworthy considering how volatile the precious metals mining sector has been over the last few years. This also highlights how low prices are particularly relative to gold.