In London, New York and Paris, a Giant Office Bet Goes Wrong

This article from Bloomberg may be of interest to subscribers. Here is a section:

Investors have also been shielded slightly by Europe’s approach to real-estate valuations, which doesn’t take market sentiment into account. With sales largely frozen, there have been few deals to measure the true decline in values. Inflation-linked rent increases have helped as well.

Nonetheless, opportunists are circling, ready to offer expensive new debt to refinance buildings whose owners can’t inject capital. Oaktree and other alternative-finance providers have held talks with Korean asset managers about large loan facilities to let landlords restructure investments, according to a person familiar with the discussions. Oaktree declined to comment.

Funds under pressure to extend the maturity of their borrowings are looking to inject more capital or inviting mezzanine investment rather than dumping assets on the cheap, says Yoon at Savills, who adds that a few have pulled sales. Increasingly, however, owners are following No. 1 Poultry’s path and having another crack at selling after several failed attempts last year — as seen with the rush for the exit in London.

In Seoul, meanwhile, there’s deepening unease about how the endgame will play out for domestic investors. “With overseas commercial real-estate assets declining, there are significant concerns about distress,” says Oh.

In London, a friend signed a seven-year lease for a suite of offices in early 2020 to accommodate 50 people. The rent was £33500 a month. Today half the workforce is gone and the remaining people spend most of their time working from home. Finding a sublet has proven difficult and rents have contracted substantially. Healthy companies can take the hit but those without financial resources will be closer to failure. That’s not good news for the commercial real estate market.

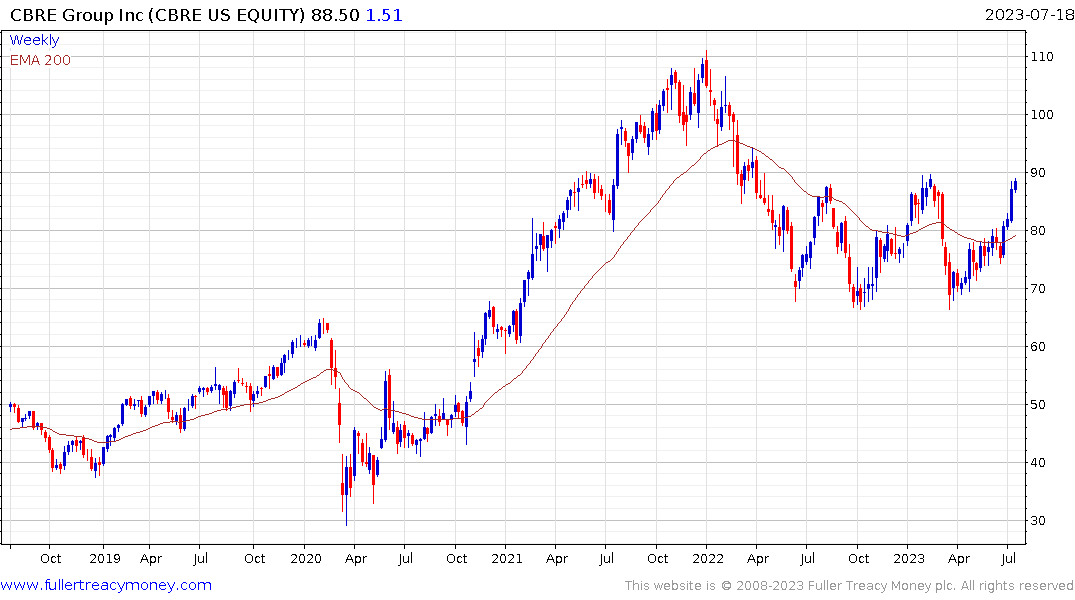

CBRE is still holding up surprisingly well. The share continues to firm from the region of the 200-day MA.

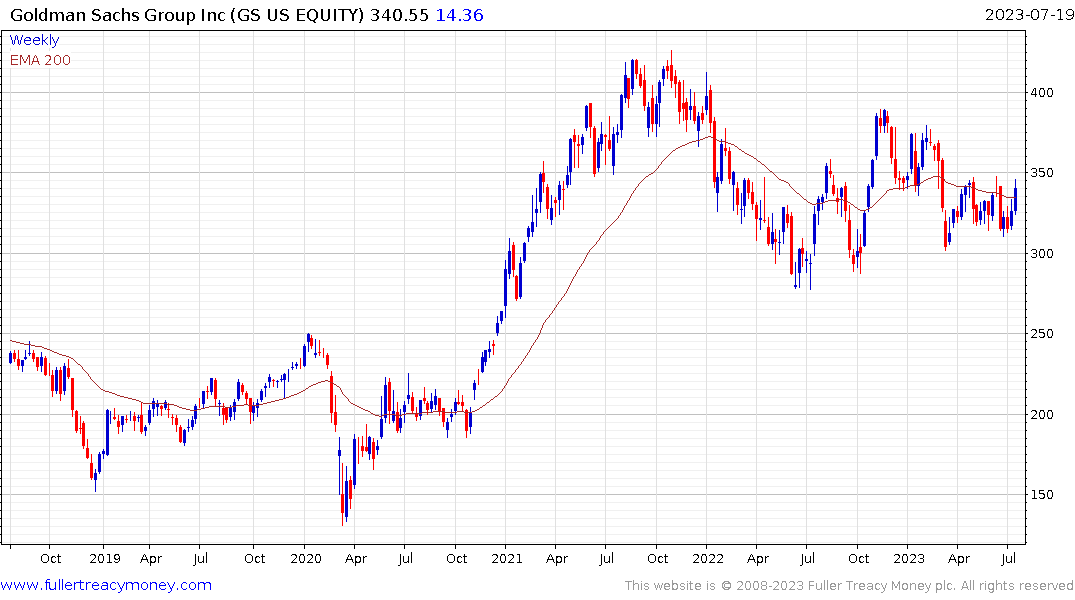

Goldman Sachs predictably announced losses from its property holding today. The share rebounded on the hope the trough in earnings has been reached.

As Blackstone approaches $1 trillion under management, the share is extending its rebound from the region of the 1000-day MA.

Brookfield has also firmed over the last week to close above the 200-day MA.

This is further evidence investors are willing to bet the peak of the interest rate cycle is at hand and the challenges in commercial property will be manageable.

Meanwhile, over in Chinese US$ high yield bonds continue to trend lower. That suggests the dearth of stimulus continues to weigh and offers a picture of what will happen elsewhere if other central banks prove less than willing to reflate asset prices following an historic inflation scare.