Imperial Brands Joins Snoop Dogg as Cannabis Investment Heats Up

This article by Lisa Pham for Bloomberg may be of interest to subscribers. Here it is in full:

The U.K.’s medical cannabis industry is getting another boost, with cigarette maker Imperial Brands Plc investing in a British startup that’s developing treatments derived from the marijuana plant.

Imperial Brands Ventures Ltd. and rapper Snoop Dogg’s Casa Verde Capital have invested in Oxford Cannabinoid Technologies, or OCT, which focuses on researching, developing and licensing compounds and therapies based on the plant. The total investment is approaching $10 million, with pain, inflammation, cancer and gastrointestinal diseases among areas of focus, Casa Verde Capital managing partner Karan Wadhera said in a Bloomberg TV interview.

“Cannabinoid products have significant potential and our investment enables Imperial to support OCT’s important research while building a deeper understanding of the medical cannabis market,” Bristol, England-based Imperial Brands said on its website Thursday.

Belief in the potential of medical cannabis is gaining steam with the U.S. Food and Drug Administration’s approval this week of Cambridge, England-based GW Pharmaceuticals Plc’s Epidiolex epilepsy treatment. The liquid is made from a compound in the marijuana plant called cannabidiol, a different chemical from tetrahydrocannabinol, or THC, which gets users high.

The investment in OCT comes as tobacco companies look for new business lines amid slowing sales and tightening regulations for cigarettes. Imperial Brands’ stake in OCT is “the most significant move among the global tobacco players in the cannabis industry to date,” Cowen analyst Vivien Azer wrote in a note Thursday. “We continue to expect to see more activity in cannabis from both global tobacco and global alcohol.”

Simon Langelier, who had a 30-year career with Philip Morris International Inc., joined the board of Imperial Brands as non-executive director in June 2017. He is chairman of PharmaCielo Ltd., a supplier of medicinal-grade cannabis oil extracts.

Here is a link to a CNBC interview of Karan Wadhera of Casa Verde Capital discussing the medium-term outlook for cannabis. Even when I worked in Amsterdam I never had any interest in smoking cannabis so I cannot speak from personal experience about the sector. However, it is hard to argue with people who suffer from chronic pain conditions who attest to the easing of symptoms they experience when consuming cannabis products over the highly addictive and often unsatisfactory results they get from consuming opioid painkillers.

The tobacco sector has long been seen as a defensive sector and it has sold off over the last year not least because of rising bonds yields. An additional reason for underperformance has been declining rates of children smoking which is unabashed good news for society but not great for tobacco company cashflow expectations for future growth.

At its base tobacco is one of the most successful cash crops and so is cannabis. The reason cannabis is referred to as weed is because its growth is so prolific in a range of terrains. It’s a natural step for tobacco companies to step into the cannabis sector if laws change on a federal level in the USA which already one of the world’s largest markets.

Canopy Growth Corp paused yesterday on weaker than expected earnings but since Canada just opened it recreational market earnings from subsequent quarters will probably be a better reflection of earnings.

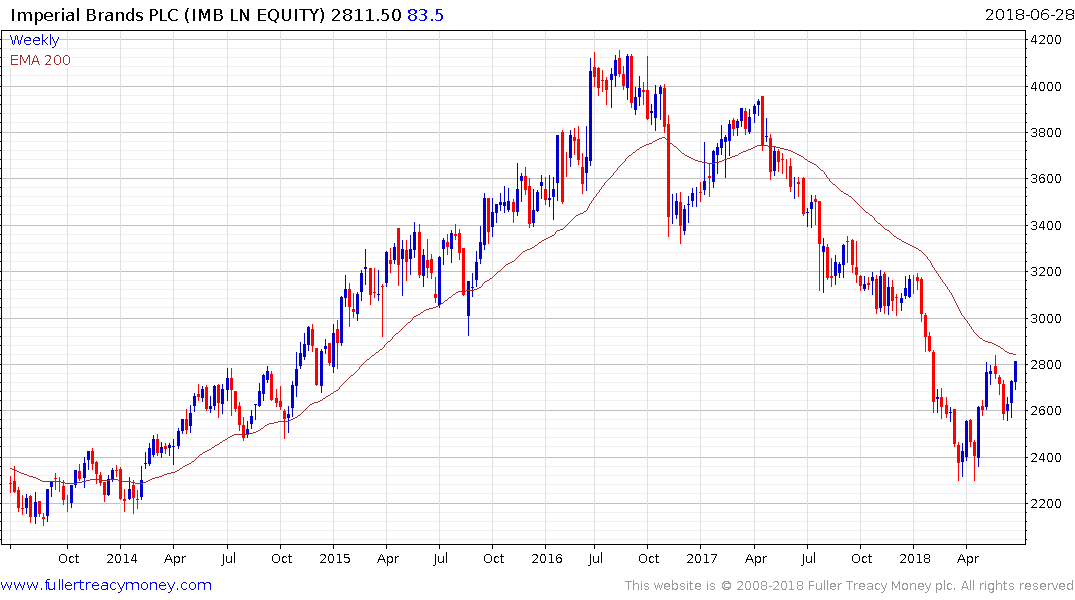

Meanwhile Imperial Brands (Est P/E 10.66, DY 6.26%) has now posted a higher reaction low and is closing in on the region of the trend mean.

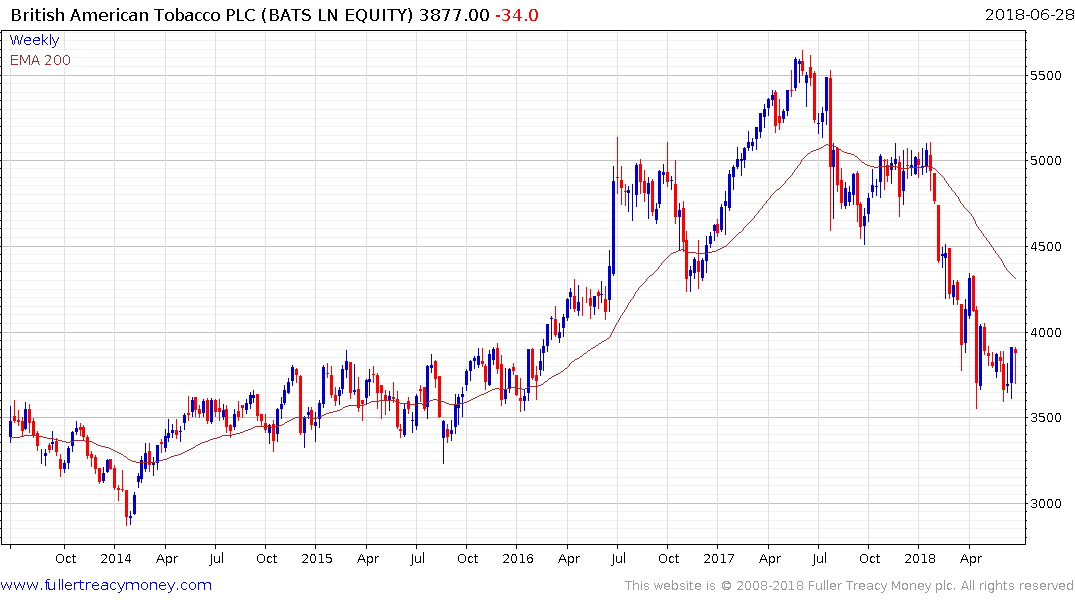

British American Tobacco (Est P/E 13.12, DY 5.03%) is currently firming from the region of the April lows.