Ice Age - End In Sight

Thanks to a subscriber for this report from Morgan Stanley focusing on Asia. Here is a section:

Upgrade from Cautious to Attractive: No one knows exactly when this downturn will end and we find it difficult to get ahead of macro events, but we see signals that suggest we should no longer be overly pessimistic: (1) the cyclical sell-off has already been punitive in an historical context; (2) the magnitude of the valuation correction (YoY) is approaching extremes relative to the last two decades; (3) earnings risks are now well understood and it is surprises that will drive stocks from here; (4) green shoots are emerging while some consumer parts of tech are close to bottoming; (5) we are upgrading our top down EM strategy view on IT, Korea, and Taiwan; these are set-up for a reversal in returns in the coming weeks. What is not understood is cycle turns and the market's willingness to increasingly look through this late stage of the downturn and, hence, our focus on the other side of the cycle.

An inflection is near and we see reasons to be constructive on a 2H23 recovery. (1) Macro headwinds are fading with the bulk of the Fed’s heavy lifting likely to be done by year-end and benefits from China’s reopening; (2) demand elasticity and replacement cycles will be driven by the sharp fall in pricing, especially consumer products; and (3) supply adjustment is accelerating via significant production and capex cuts that are underway. We have clearly worked through the slowdown in the consumer and are most positive on 'first-in, first out' exposure in LCD panels bottoming now, followed by memory in 4Q22, while the trough for foundry, auto and semicap should come with a lag in 1H23.

Here is a link to the full report.

As the fourth quarter begins and investors position for how they hope to salvage returns for 2022, questions are already arising about the prospects for 2023. There is no doubt, steep declines in asset prices, particularly within the tech sector, have improved valuations. In normal circumstances that would be sufficient to create attractive entry points. Therefore, the question is whether this is a normal correction following the excesses of the pandemic or the end of the cycle.

Let’s consider first what supported the growth of the tech sector, and by extension demand for semiconductors, over the last decade. The rollout of 4G greatly enhanced the range of services that could be conducted on a mobile phone. The result is everyone already has a smartphone. Therefore, growth is likely to be limited.

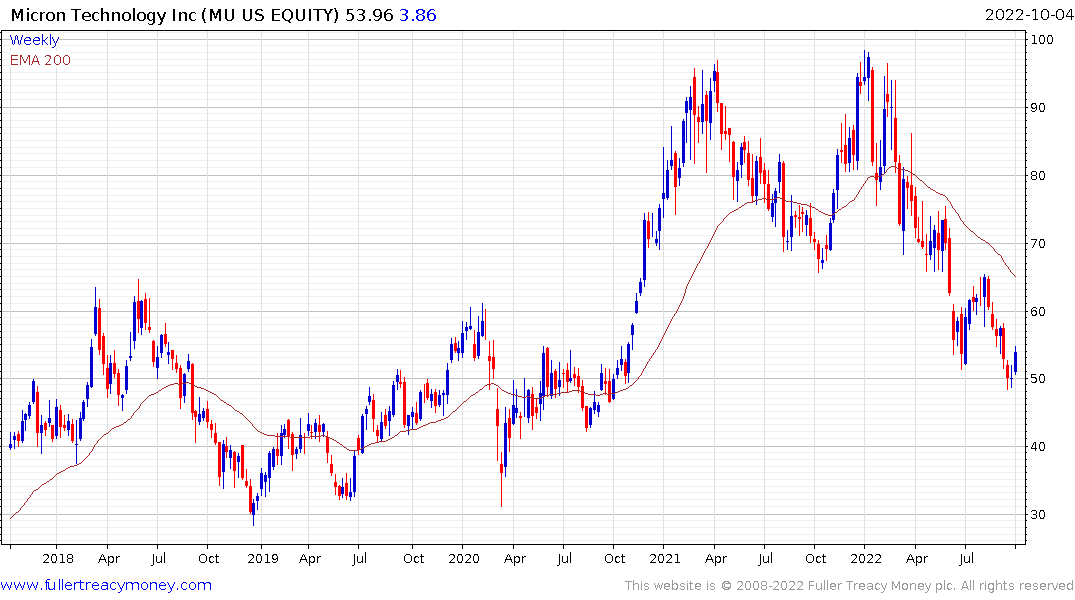

Today, trillions are being devoted to building out semiconductor manufacturing capacity. Just this week Micron Technology announced a $100 billion program to build the world’s largest fab in New York. That’s on the back of other massive commitments made over the last year. When that supply hits market, there is going to be an epic glut of supply.

The low interest rate environment supplied funding for companies best placed to leverage the 4G revolution. As rates rise, the hurdle over which new companies have to leap is getting higher. That suggests if a speculative company has not already reached profitability, the route to success is much harder today than it was two years ago.

Therefore, the success of technology ventures will depend on a well-funded sponsor and/or a commercialization path that is quicker than we are accustomed to. The one thing we can be sure of is not everything will succeed; technology will be a stock picker’s market for as long as interest rates remain high.

The big promises today for a tech recovery rest in 5G, artificial intelligence and autonomy.

At least 5G exists. It’s potentially beneficial for the corporate sector but less so for consumer. Artificial intelligence is one of the most hyped stories in the world according to people who work in artificial intelligence. A better term would be big data. The application of massive computing power to large data sets has great potential in drug development and materials science.

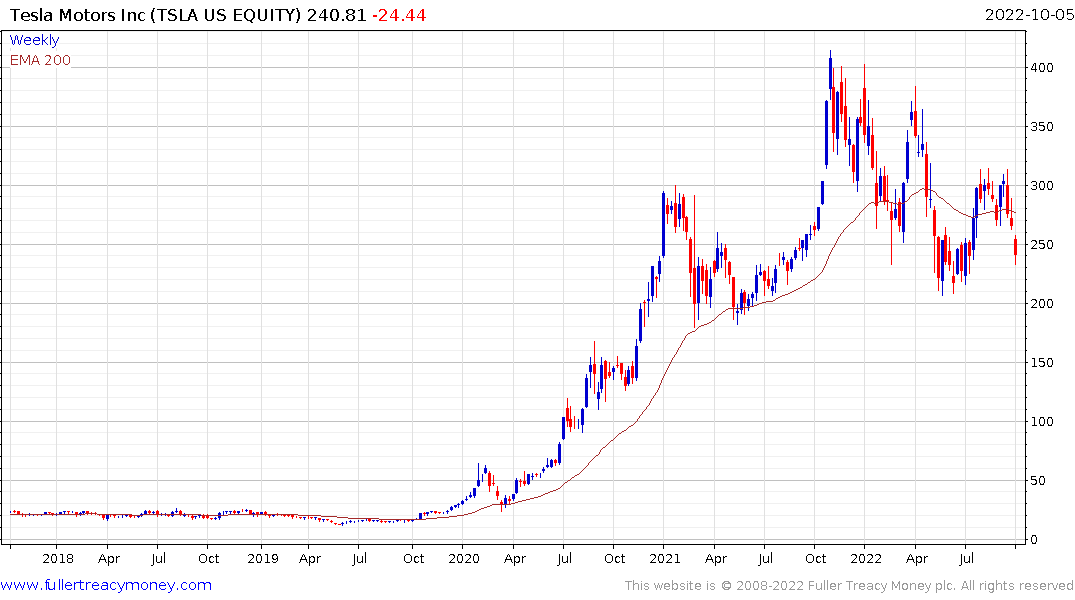

Tesla’s development plans for a humanoid robot rely on innovations in autonomy. This fits a pattern of making big promises about how able autonomous programs are before they are commercially viable. The company is now deploying a massive supercomputer to further the aim of creating a fully autonomous vehicle and a robot. I don’t know if brute force computing will solve the autonomy question, but they are certainly trying. Nothing has occurred to suggest a breakthrough is imminent.

This suggests there is scope for a recovery when interest rates roll over but it would be rash to expect the themes that drove the bull market from 2009 to predominate over the next decade.

A large options trade supported the Nasdaq-100 in mid-afternoon trading today so it continues to hold the low near the June low. A sustained move above the 200-day MA will be the minimum required to confirm more than short-term steadying.

Back to top