Palladium Reaches Highest Since 2011 on Russia Supply

This article by Debarati Roy for Bloomberg may be of interest to subscribers. Here is a section:

The U.S. and the European Union have extended the list of prominent Russians subject to sanctions as President Vladimir Putin completed its annexation of Crimea. The supply threat comes as miners haven’t backed back down from a strike that started in January in South Africa, the second-biggest palladium producer. The nations accounted for almost 80 percent of global output last year, London-based Johnson Matthey Plc estimates.

The political restrictions and labor unrest are adding to a tightening supply outlook as demand is set to top production by 783,000 ounces this year, according to Barclays Plc. Concerns that the hostility in Crimea will disrupt raw-materials shipments have boosted prices of commodities from corn to crude oil. Palladium has rallied almost 10 percent this year, the best start to a year since 2010.

“Economic sanctions will cripple supplies, and people are getting very concerned about that,” Mike Dragosits, a senior commodity strategist at TD Securities in Toronto, said in a telephone interview. “The sanctions may only intensify since Putin shows no signs of stepping down.” TD sees the deficit at 1.29 million ounces this year, he said.

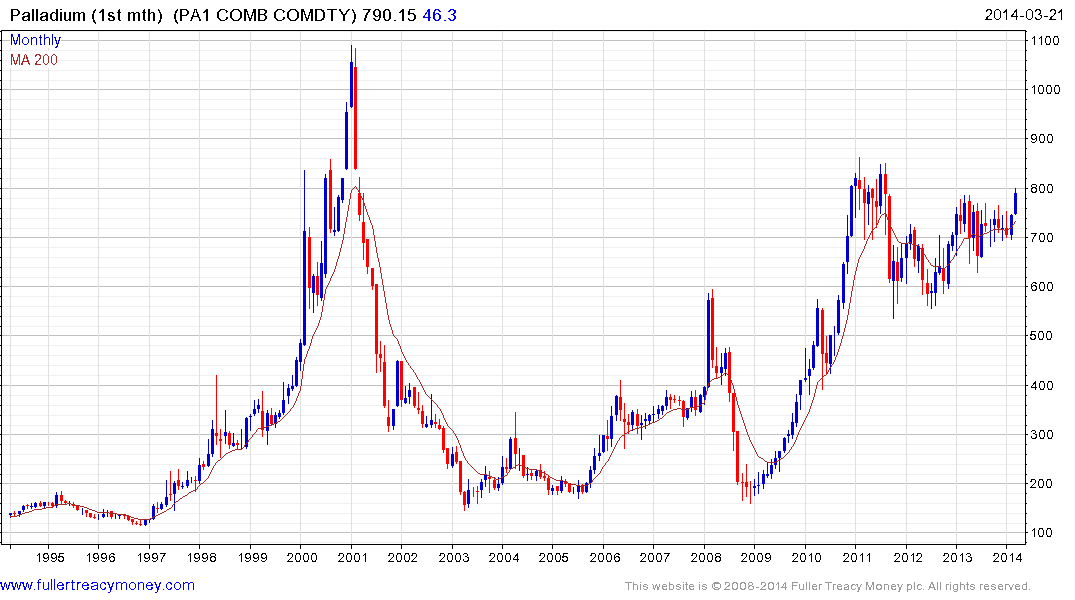

Russia’s voluntary restrictions on palladium supplies in the late 1990s sent prices soaring to levels which have yet to be surpassed. The country’s dominance of the global market has been in place since and any threat to supplies as a result of sanctions will necessarily result in higher prices. The fact that South Africa’s mining sector remains locked in labour disputes suggests it may have difficulty responding in the event of Russian supplies being curtailed.

Palladium rallied to break a progression of lower rally highs two weeks ago. It found support yesterday in the region of $750 and rallied to test the $800 level today. A sustained move below yesterday’s low would be required to begin to question current scope for additional upside.

Back to top