How to invest in real estate and pay nothing in capital gains

This article from MarketWatch may be of interest to subscribers. Here is a section:

The Tax Cuts and Jobs Act has created a new tax break that dangles the potential of a 0% capital-gains tax on certain investments in economically distressed areas. But you’ll need to wait 10 years to claim it.

These new investments are funds tied to Qualified Opportunity Zones — approximately 8,000 areas around the country, both urban and rural, that local officials have designated as most in need. Qualified investments can be in real estate — commercial property is an early favourite — as well as small manufacturers and service businesses.

Tax breaks on investments in Qualified Opportunity Zone funds or businesses begin kicking in after five and then again after seven years; but the most generous terms — that 0% rate — are for investments held for at least 10 years.

And

If a taxpayer keeps the investment in the QOZ fund for at least 10 years, the appreciated capital gains on the QOZ fund investment becomes tax-free income when the investment is sold or exchanged. The long-deferred capital-gains taxes owed on the investment rolled into the QOZ will still have been paid once Dec. 31, 2026 rolls around, as illustrated in the previous example.It is only the appreciated value of the QOZ investment that is tax-free, and there is no limit on the amount eligible for this tax break. If the investment in the earlier example was sold for $600,000 after 10 years, no taxes would be owed on $300,000. But deferred capital gains would have been paid on $170,000.

I had heard of this program before but this is the first time I have seen the map of where the qualified opportunity zones are. It represents an interesting way for investors with large potential capital gains liabilities to delay payment while putting the profit to work in a tax efficient manner which could potentially earn enough to absolve the investor of the original capital gains liability.

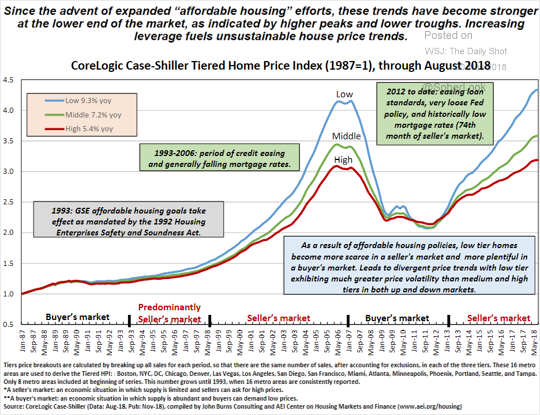

This graphic highlights the fact that low income housing tends to be much more volatile than prime in both bull and bear markets. That suggests the clear opportunity to diversify into housing after the market next peaks for a high beta play on the next expansion.

That also helps to explain the continued interest of private equity firms in the commercial and residential property markets.

Back to top