How resource scarcity is driving the third Industrial Revolution

If you believe as we do that we are in the early stages of a third industrial revolution then this video from McKinsey is well worth spending 11 minutes to watch. Here is a section from the transcript:

What’s important to realize is that the technologies we’re talking about changing in this way are really basic infrastructure technologies. And because of that, they have this spillover benefit for the productivity of the economy as a whole.

When we change the cost of a structure—in housing or an office—that has a knock-on effect on all these industries that use or take advantage of buildings. When we change the economics of the resources required for transportation and for movement of goods, every industry that ships anything anywhere in the world benefits from that.

When we virtualize a process to, instead of physically moving a good, turn it into a service delivered over your phone or over the Internet remotely, that, again, spreads to many, many industries, from elevators to automobiles to mining companies. They’re all now taking advantage of the fact that I can do things remotely. That’s why it’s very exciting. We’re just at the beginning, the inception point, of these new materials and new IT technologies beginning to affect many, many other industrial domains.

The above video helps bring together a number of themes that are likely to help drive productivity growth over the coming decades. This is worth keeping in mind following the sharp pullbacks experienced by a number of technology companies over the last six weeks.

The reality of the accelerating curve of innovation is that industrial processes are being revolutionised. The move to outperformance by heavy industry sectors more than two years ago together with the growth of embedded processors, optics, robotics, 3-D printing etc. represent the seed beds from which major bull markets are developing. The majority of these sectors are still developing so the volatility witnessed in their shares prices of late is perhaps not so surprising but their medium-term to long-term prospects remain positive.

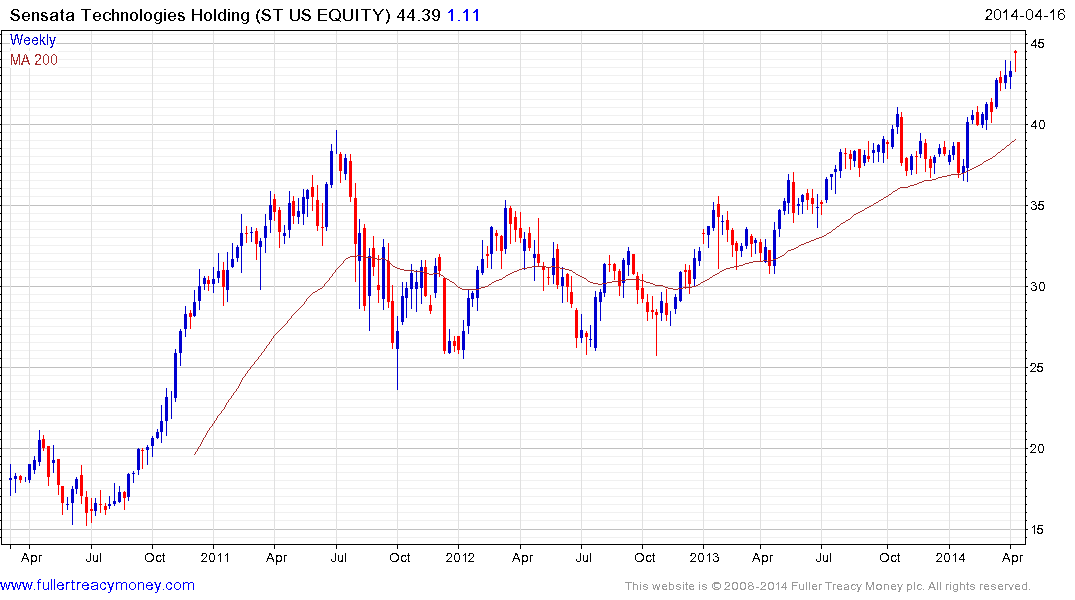

Sensata Technologies IPOed in 2010 and spent much of the time between 2011 and 2013 ranging. The share broke out to new highs in February and a sustained move below $40 would be required to question medium-term scope for additional upside.

This additional article from McKinsey, this time on the solar sector, and also kindly forwarded by a subscriber may also be of interest.