How high are bond prices really?

The short answer is very high. However this picture of the US Treasury yield curve highlights just how high prices are and how very very low yields are.

The good news is that the curve is not inverted. However look at the absolute levels. The 3-month is today trading at a level below the Fed Funds rate. It hasn’t even begun to price in the potential for a rate hike in December. The 1-year is pricing in one rate hike by November 2017. The 2-year is suggesting that we will see two and half quarter point hikes by November 2018. These figures are from today suggesting that the rates were even lower before this week’s selloff.

In case you needed evidence of groupthink in the fixed income markets. Here we have it. There is a consensus that the discount rate will remain low indefinitely. There is experiential precedent because investors have been participating successfully in the market for seven years on that basis and yet we know that the situation will end. The elevation of a fiscal spender and tax liberal to the White House with Republican control of both Houses of Congress suggests there is ample room for inflationary policies to dominate in the next four-year administration.

With so much political uncertainty in Europe and the increasing acceptance that quantitative easing does not promote growth there is the very real potential for fiscal stimulus to play a greater role in the Eurozone as well.

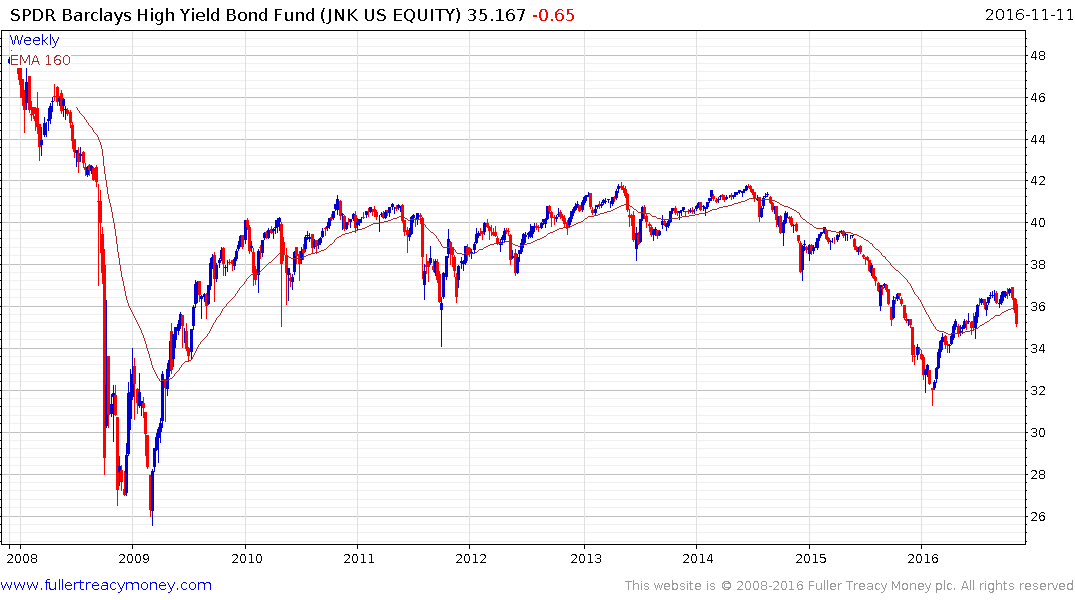

The SPDR High Yield ETF (JNK) has declined to break a progression of higher reaction lows evident since early this year and a sustained move back above the trend mean will be required to question medium-term supply dominance.

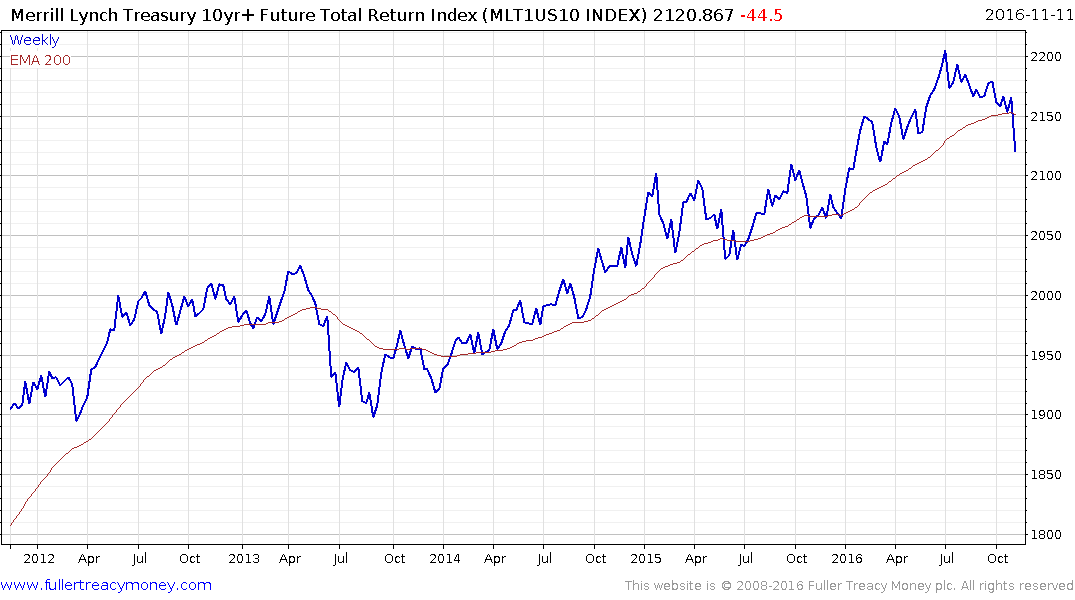

The Merrill Lynch 10-year+ Treasury Futures Total Return Index dropped back below the 200-day MA this week and in a dynamic fashion. This the first time, since the taper tantrum in 2013, the Index has pulled back by this much. In order to mark a clear change of trend, it will need to encounter resistance in the region of the trend mean on the first rebound and sustain the move below it. That would challenge the buy-the-dips strategy which has worked so well for the last 35 years.