How China Is Losing the World

This article from The Diplomat may be of interest to subscribers. Here is a section:

But to the more attentive, a new counternarrative is also starting to emerge, which stands against this tale of an ever more powerful China that can name its terms and act without restraint or pretense. As more and more people start to know far more about the China model, and to see it manifested in their daily lives, doubts start to grow. The sharp treatment of Taiwan, the actions in Xinjiang, the incredible, pervasive growth of the surveillance state in China and its annexation of almost every aspect of life without any institutional or legal restraint – all these register in some form and shape a little resistance.

In the past, issues about China were once disparate; now they are being linked and form the basis of a critical counternarrative. Suddenly, there is more sympathy for Taiwan, for example. More people in Europe and the United States are starting to be uneasy about the ways in which Confucius Institutes are allowed to operate in Western establishments without similar freedoms for Western equivalents in Chinese ones. They wonder why Chinese can buy, invest, and work so freely in their environments while it is so difficult for foreigners to do the same back in China. They wonder why Chinese lobbyists and activists are able to freely express their ideas in London, Sydney, or Washington, and seek to influence outcomes that matter to them there, when there is precious little space for this sort of activity back in China.

The true talent in a kleptocracy is knowing who to bribe. Afterall there is no point spending the money if the person taking the payment is not in a position to effect the result you wish or is subject to dismissal. Something China is finding out is that in a democracy, politicians who are seen to mortgage the future of the country to a foreign power are less than likely to win the next election.

Malaysia, Sir Lanka and Seychelles have all grown leery of accepting debt financing for infrastructure projects which serve China’s needs. Pakistan’s new prime minister is also finding out just how much China’s bill for building infrastructure is. That has resulted in a reset for the Belt and Road Initiative with Xi offering up $60 billion with no strings attached to African leaders earlier this month.

Chinese 10-year government bond yields have steadied from the 3.5% since July and a sustained move below that level will be required to question supply dominance.

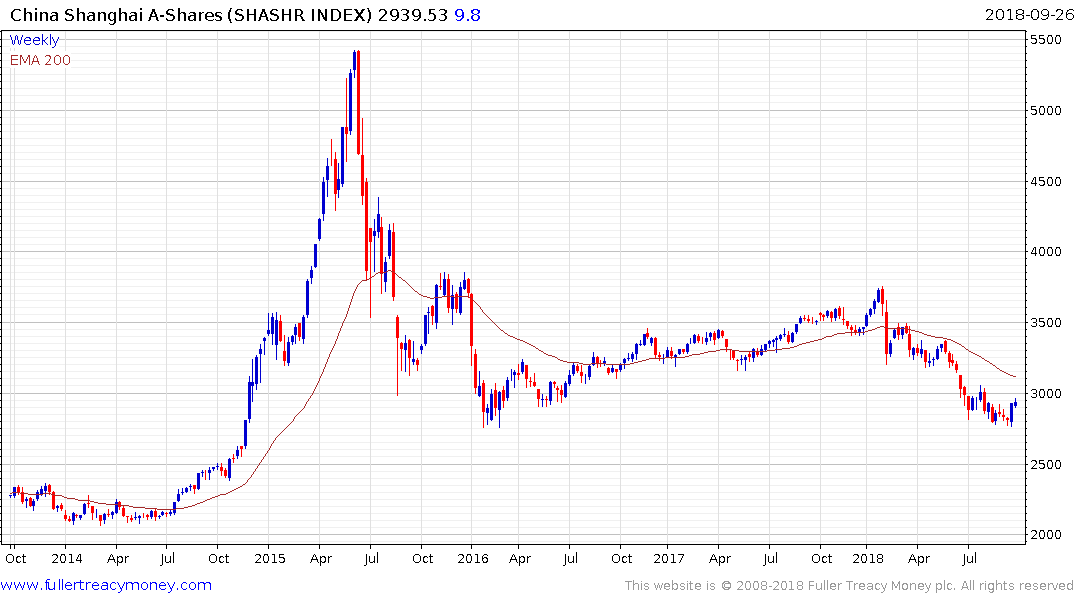

The stock market has stabilised over the last few weeks, led higher by the state-owned banks. The FTSE Xinhua A600 Banks Index is now testing the region of the trend mean and will need hold the sequence of higher reaction lows from the July low will need to hold during any consolidation if recovery is to continue to be given the benefit of the doubt.

The Renminbi continues to hold the August low near 6.93 but there has been a distinct absence of sustained support for the currency suggesting little appetite for more than a token strengthening.

This article from the Wall Street Journal, kindly forwarded by a subscriber, may also be of interest.

Back to top