How an Energy Expert Triggered Vladimir Putin With One Word

This transcript of a podcast with Daniel Yergin may be of interest. Here is a section:

He knew that US shale was a threat to him in two ways. One, because it meant that US natural gas would compete with his natural gas in Europe, and that’s what we’re seeing today. And secondly, this would really augment America’s position in the world and give it a kind of flexibility it didn’t have when it was importing 60% of its oil.

AndThat’s the question that’s really weighing now because in terms of oil, there’s enough crude oil in the world. You have to move it around, but between strategic stocks, between demand being down in China, you can manage that. When you get into products like diesel, it gets harder. And then you’re going to the hardest thing with natural gas, and that is exactly as you go into the winter. So, the big question now is can they fill storage so that they can get through the winter, and, by the way, not only stay warm, but keep industry operating. And I think we can say that Putin made a series of decisions which kind of were irrational -- that his army was really good, that Ukraine wouldn’t be able to resist, that the US had just gone through getting out of Afghanistan and was deeply divided, that Europe was so dependent on his energy that they would say, ‘OK, this is terrible, but life goes on.’ And none of that happened.

But I think he’s still calculating. And he said that ultimately this energy disruption -- and we are in a huge disruption of energy markets -- would be such a big threat to the European economy that the coalition that now exists would fall apart. I think that’s his wager right now. And the Achilles heel is what you pointed to: what happens as Europe goes into the fall and winter. And we’ve had at least one German, very prominent industrialist, who said, ‘This is too dangerous for the European economy. We should negotiate something with Putin.’

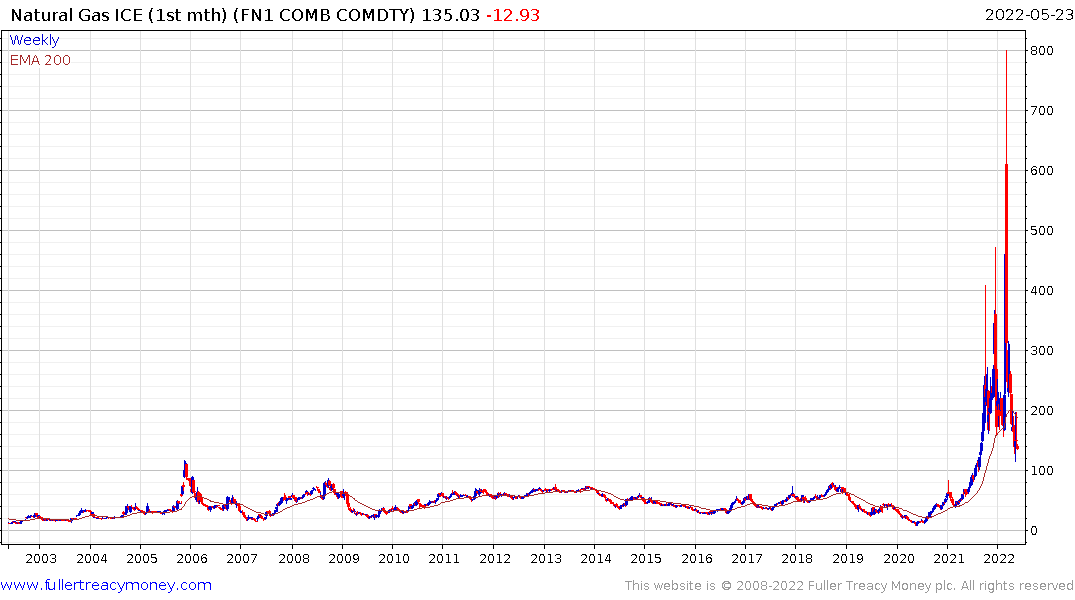

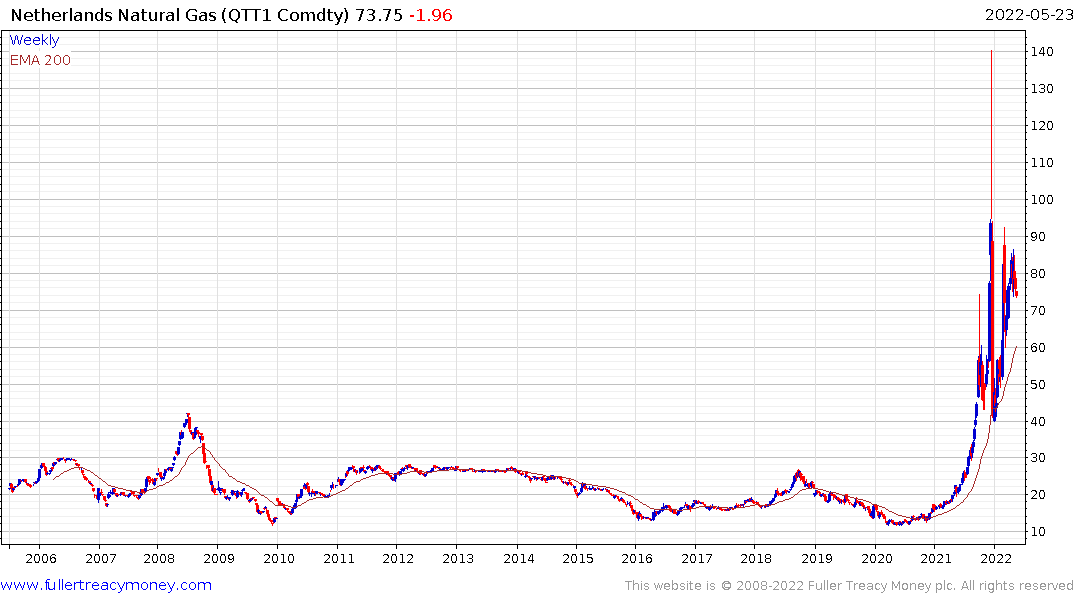

We are in a market lull for European natural gas prices as we head into summer and lower heating demand. The price of European gas (Netherlands) is down from a peak of €140 in December to €74 today. The UK price has been much more volatile and is down from a March high of £800 to £138.

By historical standards these prices are still high and could easily fall further over the summer. The current challenge will be in securing sufficient supply between now and September to ensure adequate inventories for the winter.

Hungary sources most of its energy from Russia so it is obviously very sensitive to anything that would further escalate tensions with Russia, not least admitting Sweden and Finland to NATO. Turkey is also a lot closer to Russia than other NATO members and has equally deep reservations about escalation.

Here is a section from a related Bloomberg article:

“There is infrastructure missing for the west-to-east flows,” said Marco Saalfrank, head of continental Europe merchant trading at Axpo Solutions AG in Baden, Switzerland. “So LNG, in short, is not the only solution to replace Russian gas because of the bottlenecks.”

The price divergence and infrastructure constraints highlight that the European Union’s target to replace as much as third of Russian gas with LNG in the short term won’t be easy.

And

Even if Europe bets big on LNG, the super-chilled fuel has to come from somewhere. New production plants won’t start delivering more supplies before about 2025. Competition for available fuel will remain tight in the next three years, keeping prices high, Axpo said.

“Using all LNG capacity to the max will put a huge strain on the LNG supply,” MET’s Vargha said. “There isn’t enough LNG capacity in the world to avoid demand destruction in a no-Russian-gas scenario.”

Qatar Gas Transport Company (NAKILAT) remains in a consistent uptrend.

Qatar Gas Transport Company (NAKILAT) remains in a consistent uptrend.

Even as the arbitrage between European and US gas narrows, US gas continues to trend higher. A break below $6.50 will be required to question medium-term scope for continued upside.

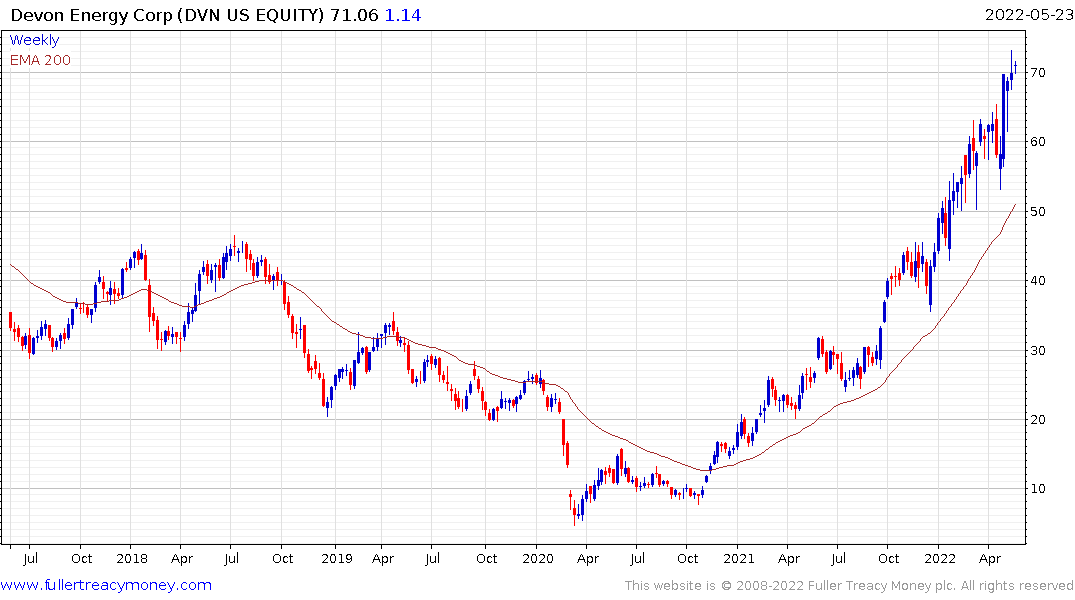

Devon Energy continues to extend its already steep uptrend.

Devon Energy continues to extend its already steep uptrend.

EOG Resources is firming in the region of the upper side of the 10-year range.

EOG Resources is firming in the region of the upper side of the 10-year range.