Hong Kong Stocks Jump to 2015 High as Fed, China Energize Bulls

This article by Richard Frost for Bloomberg may be of interest to subscribers. Here is a section:

Hong Kong equities are back at heights unseen since China devalued its currency in August 2015.

A dovish Federal Reserve, China growth optimism and steady mainland inflows combined to fuel a 2.1 percent rally in the Hang Seng Index on Thursday, the biggest advance in almost 10 months. The gain also pushed the gauge firmly above the 24,000 level -- an effective ceiling for the past seven years. China Unicom Hong Kong Ltd. and Link REIT were among the day’s best performers, while Cathay Pacific Airways Ltd. was one of only two decliners after posting a loss on Wednesday.Hong Kong-listed equities are particularly vulnerable to shifts in sentiment toward U.S. monetary policy thanks to a currency peg with the greenback, while the increasing dominance of Chinese companies on the city’s benchmarks means national economic indicators have a powerful pull. With investors relieved the Fed didn’t increase the projected pace of rate hikes and fears of a Chinese hard landing receding, the serially under-performing Hang Seng Index may have room to rally further.

With a pegged currency the Hong Kong market is heavily influenced by Fed policy but that effect is exacerbated by the Renminbi’s relative weakness versus the Dollar which makes Hong Kong a more attractive destination for mainland flows.

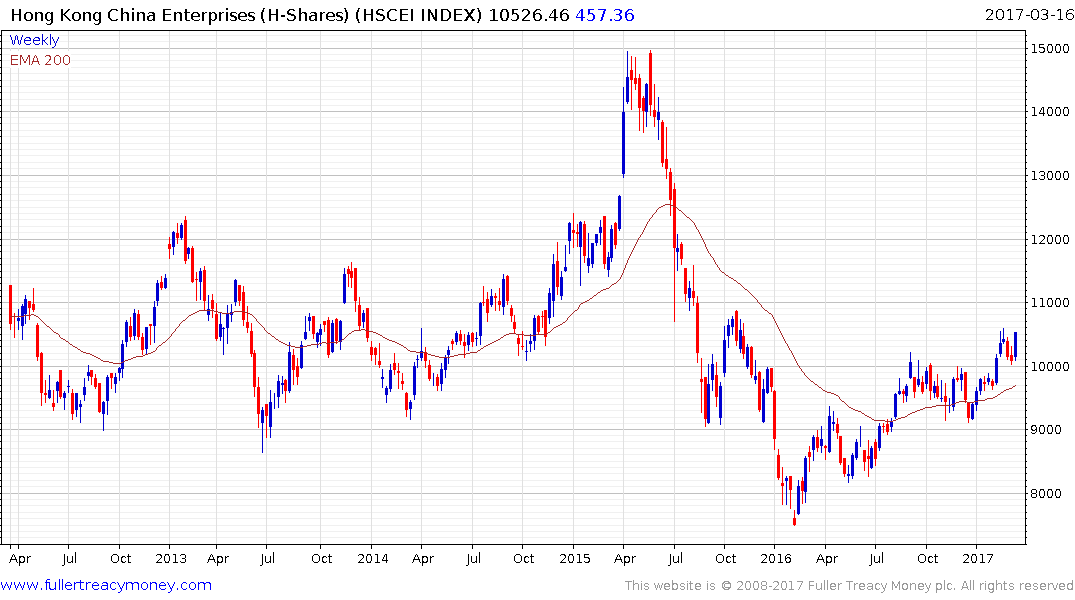

The China Enterprises Index (H-Shares) bounced this week from the psychological 10000 level to hold the yearlong progression of higher reaction lows and a sustained move below that level would be required to question medium-term scope for additional upside.