Hong Kong Buys HK$11.697 Billion to Defend Currency Peg System

The Hong Kong Monetary Authority buys HK$11.697 billion ($1.5 billion) to manage the city’s currency peg for Oct. 14 settlement, according to the de facto central bank’s page on Bloomberg.

Aggregate balance will decrease to about HK$106.6 billion on Oct. 14

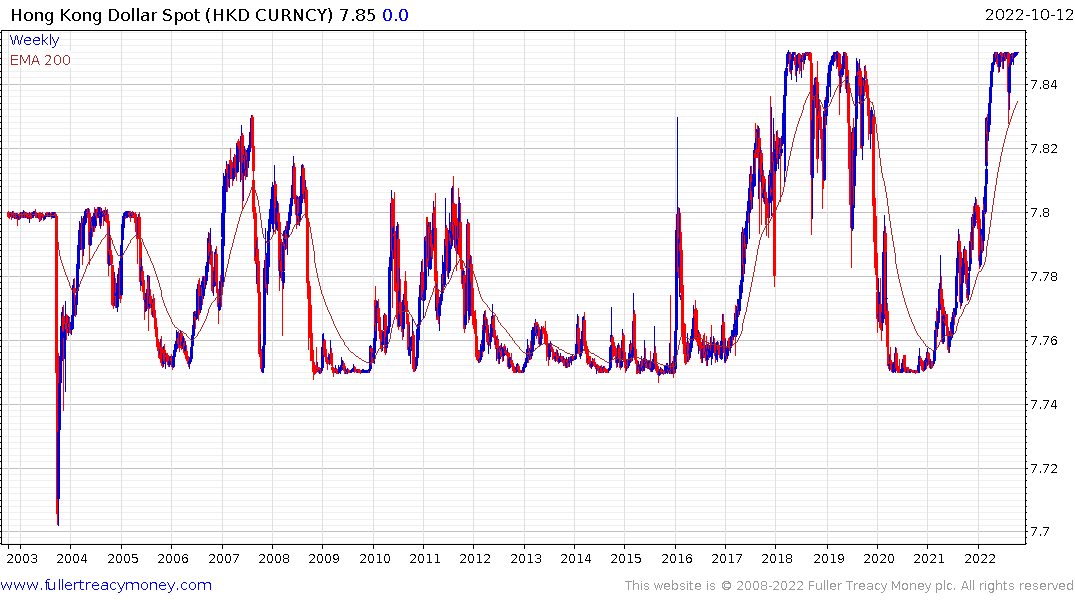

The strength of the Dollar and the Fed’s policy of raising rates has put a lot of pressure on the Hong Kong Monetary Authority to sustain the Hong Kong Dollar’s peg. The rate has been bumping up against the HK7.85 level for much of the last year in a repeat of the 2018/19 weakness.

Interbank liquidity is falling back towards the lows posted in late 2019. At the same time foreign currency reserves have fallen by about $100 billion this year as the cost of defending the peg ratchets up.

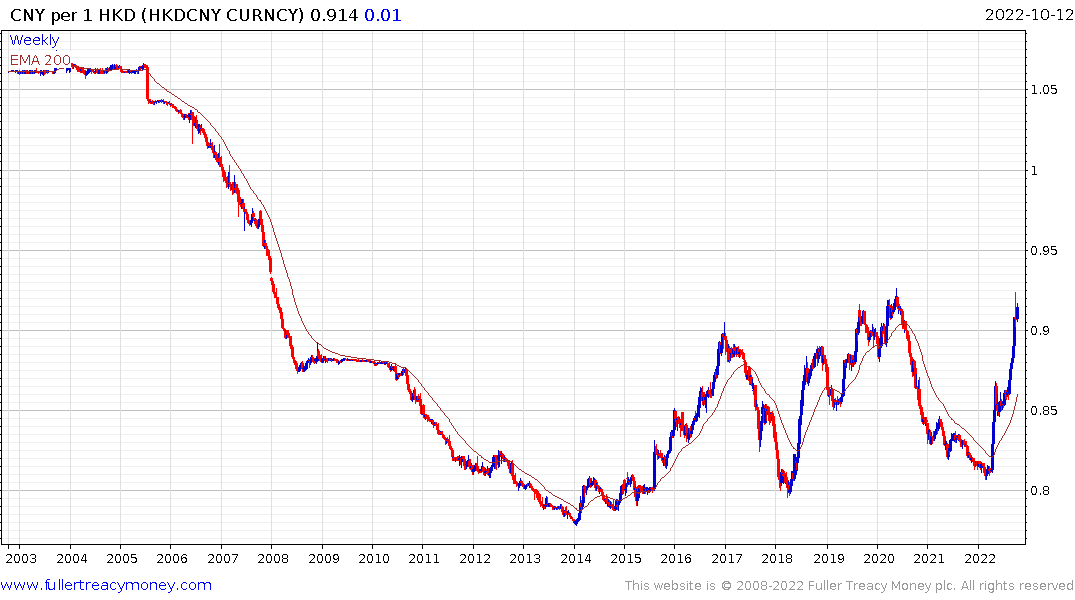

The big fear since the handover has been that China would move to dispense with the one-party, two systems approach. The introduction of the security law was a big step in that direction. Now with property prices deteriorating and the Renminbi/Hong Kong Dollar falling back toward parity, the topic of how long the Hong Kong Dollar will be allowed to exist will come back to the fore.

China is unlikely to force the issue and the HKMA still has $400 billion to defend the Dollar peg. However, in the event of a liquidity crisis, where the peg comes under existential threat and the two currencies are close to parity, it is not inconceivable that China will absorb Hong Kong’s monetary system and redenominate all credits and debits.

Back to top